Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

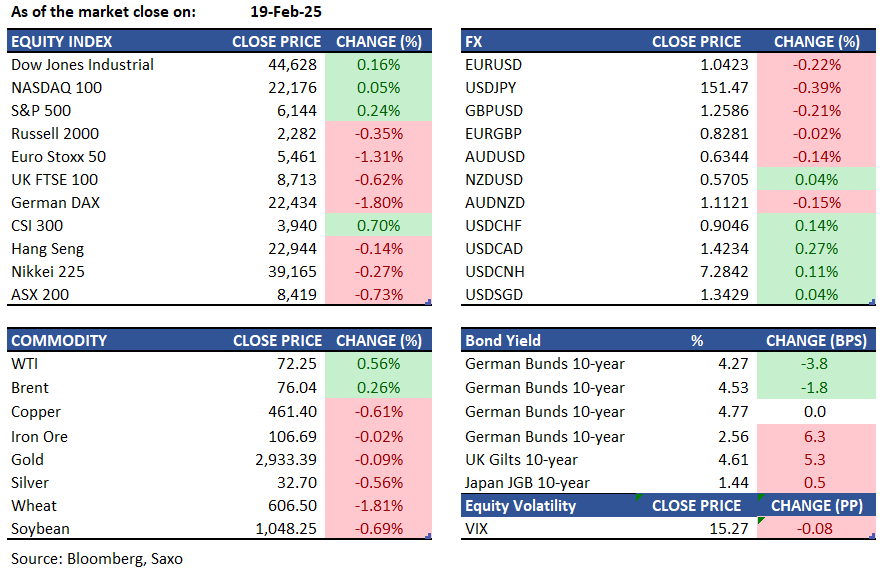

Macro:

Equities:

Earnings this week:

Thursday: Alibaba, Walmart, Unity, Wayfair, Newmont, Rivian, BLock

Friday: Mercado Libre, Booking Holdings, Texas Roadhouse

FX:

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.

Equity outlook: The high cost of global fragmentation for US portfolios

Commodity Outlook: Commodities rally despite global uncertainty