Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US & Canada Holiday (Labor Day), EZ & UK Final Manufacturing PMIs (Aug), Chinese Caixin Manufacturing PMI Final (Aug)

Earnings: N/A

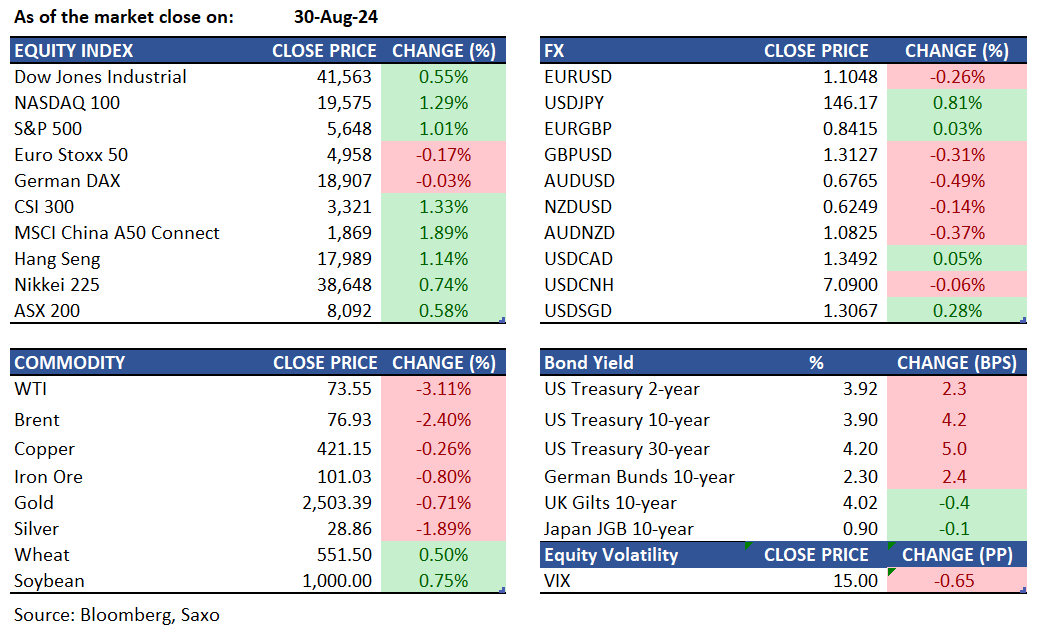

Equities: US stocks concluded August on a high note, with the S&P 500 up by 1%, the Nasdaq 100 increasing by 1.3%, and the Dow Jones setting a new record by adding 228 points. Investors evaluated crucial inflation data from the Personal Consumption Expenditures (PCE) price index, which rose by 0.2% month-on-month and 2.5% year-on-year, aligning with expectations and fueling optimism for potential Fed rate cuts. Dell Technologies saw a 4.3% boost after surpassing Q2 earnings forecasts, while Intel jumped 9.5% amid restructuring news despite a significant yearly decline. Conversely, Super Micro Computer declined by 2.5%, marking its worst month on record. Overall, the S&P 500 gained 3.9%, the Nasdaq rose by 4.1%, and the Dow increased by 2% for the month.

Fixed income: Treasuries fell on Friday, particularly during the US afternoon, as the market anticipated a significant influx of new corporate bonds next week. They hit session lows due to heavy futures trading, with month-end index rebalancing. Most yields reached their highest levels for the week. Corporate bond dealers are forecasting approximately $125 billion in new supply for September, with a large portion expected in the first three sessions following Monday’s Labor Day holiday. Yields had risen by 3 to 6 basis points, approaching session highs, with the yield curve steepening. The 2s10s and 5s30s spreads neared their widest points of the year, with the 10-year yield around 3.91%, up from a low of 3.77% on Monday. Treasury futures hit new session lows on very heavy volume, coinciding with the rebalancing of many bond indexes for month-end. Long-end tenors led the movement, further steepening the yield curve. Asset managers covered net long positions in both 10-year note futures and ultra 10-year note futures at a record pace in the week leading up to August 27, according to Commodity Futures Trading Commission data. Hedge funds took the opposite stance, aggressively covering short positions during a reporting week that included Friday’s Jackson Hole speech by Fed Chair Powell.

Commodities: Gold prices fell by 0.71% to $2,503 following the PCE data release. Despite a high greed level of 78/100 on the Gold Fear and Greed Index, the trading day was unfavorable. However, gold reached a new high on August 20th and ended the month with a 2% gain. Silver also declined by 1.89% to $28.86.WTI crude futures dropped after OPEC+ confirmed plans to increase production by 180,000 barrels per day starting in October, despite the loss of Libyan output. Concerns over China's demand and excess supply led to a 3.11% decline to $73.55. Brent crude similarly fell by 1.43% to $78.80.

FX: The US dollar recovered last week after heavy selling in the last few weeks, despite PCE data giving room to the Federal Reserve to cut rates this month. Market, however, still remains undecided about the magnitude of the rate cut as the strong growth narrative continues to hold up. This week’s labor market data – from JOLTs to ISM surveys and jobless claims, but most importantly the August jobs report – could provide further insights. If cooling in the labor market remains orderly, market may be forced to remove excessive easing expectations from this year, pushing the US dollar higher. The euro was an underperformer last week, with inflation coming in softer and ECB speakers also hinting at further rate cuts. The New Zealand dollar led the gains and Canadian dollar also moved higher as short covering likely extended further following a strong GDP report. The Australian dollar was relatively weaker and will have its eyes on RBA Governor speeches this week. The Japanese yen weakened and is extending its losses in early Asian session.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.