Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Republican Convention, Eurogroup Meeting, Chinese GDP (Q2), Industrial Output/Retail Sales (Jun), Swiss PPI (Jun), US NY Fed Manufacturing (Jul), EZ Industrial Production (Jun); China's Third Plenum (15-18th July)

Earnings: Goldman Sachs, BlackRock, Guaranty, FirstBank, CrossFirst, Servis1st

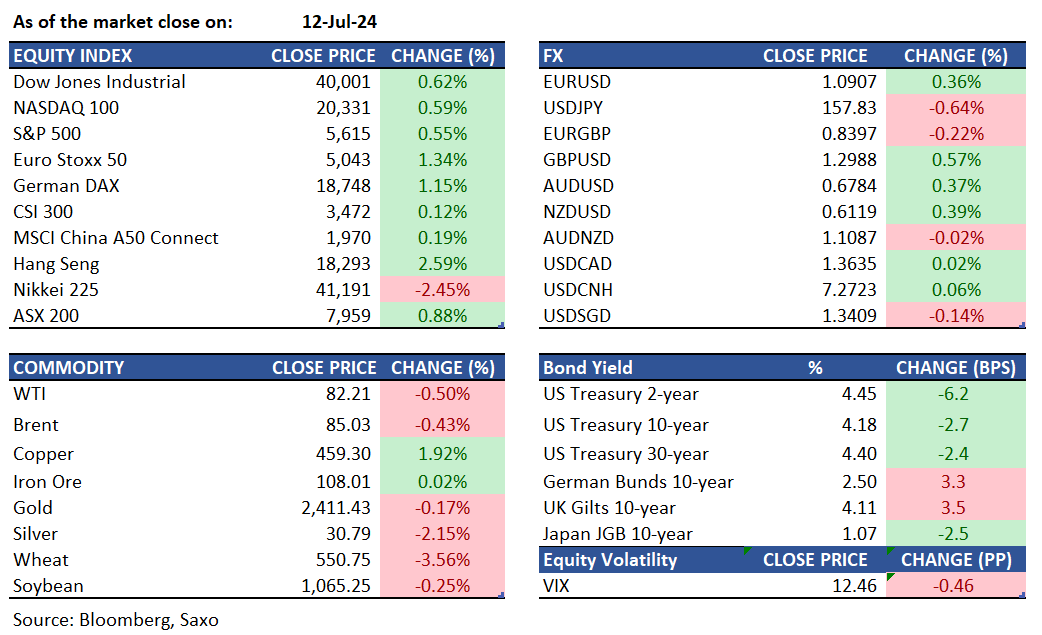

Equities: Equity markets demonstrated strong resilience on Friday, erasing most of Thursday's losses and closing the week higher. The Russell 2000 Smallcap Index, benefiting significantly from Thursday's tech selloff with a 3.5% rise, continued its upward trajectory, ending the week with a 5% gain. The S&P 500 and Nasdaq also showed sustained strength as investors capitalized on the brief decline in large-cap tech stocks. Geopolitical developments, particularly the attack on President Trump, may prompt safe-haven flows in Asian markets. Early indications show the USD slightly higher, while S&P 500 futures remain flat.

Fixed income: Treasuries advanced in the US afternoon session, reversing initial declines following the June PPI data. US 10-year note futures closed near the day's highs, while the yield curve steepened due to front-end gains, reinforcing expectations for at least two rate cuts this year. Increased activity in October fed funds futures indicated a potential half-point rate cut in September. Additionally, Treasury futures volumes surged 13% above the 20-day average, with 2-year notes trading 45% above typical levels.

Commodities: WTI crude oil futures declined by 0.5%, to close at $82.21 per barrel, ending a two-day winning streak and marking a 1.14% decrease for the week. Brent Crude futures also fell, settling at $85.03 per barrel, down 0.43%. Natural gas saw a late-week rebound, finishing up 0.43% for the week at $2.329. Gold prices slipped by 0.17% to $2,420.70 and silver price declined 2.15% to $30.79, achieving their third consecutive weekly gain as investor confidence grew regarding the U.S. Federal Reserve's potential interest rate cuts. Rice fell to a 12-month low of $14.57 per cwt. Over the past 4 weeks, it has declined by 21.32%.

FX: The US dollar opened higher following the assassination attempt on former President Donald Trump over the weekend as markets have increased the probability of a second Trump presidency. FX market liquidity was thin with Japan on holiday, but Mexican peso opened lower while the euro and Aussie slipped along with Chinese yuan amid risks of higher tariffs. China’s third plenum kicks off today, and focus would be on any reform announcements. The Swedish krona remained an underperformer in G10 as softer Sweden inflation supported the case for three rate cuts that Riksbank has guided for. British pound remained strong after hawkish BOE comments last week and UK CPI will be on the radar this week.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.