Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: RBA Announcement, EZ Final CPI (May), German ZEW Survey (Jun), US Retail Sales (May), Japanese Trade Balance (May)

Earnings: America’s Car-Mart, Cognyte, Patterson, kb Home.

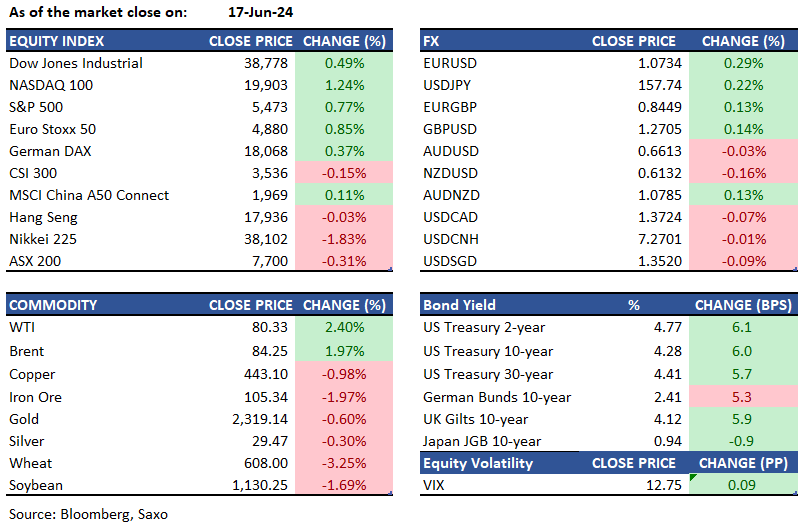

Equities: U.S. stocks continue to reach new record highs as technology leaders drive gains, propelling the S&P 500 index and Nasdaq Comp to fresh record highs on Monday. This marks the sixth consecutive record for the Nasdaq. Meanwhile, the S&P 500 utilities sector (XLU) has fallen to a six-week low. Tech stocks have been performing exceptionally well for over a year, with the SOX semi-index rising 34% year-to-date, following a 40% jump in 2023. Apple and Microsoft saw increases of 2% and 1.3% respectively, while Tesla surged by 5.3%. On the other hand, Nvidia experienced a 0.6% decrease following reports indicating that the chipmaker is expected to have a weighting of more than 20% in the rebalance of its tech ETF.

Fixed income: The US 10-year Treasury yield rose to 4.27%, remaining near its lowest level since March. Traders are waiting for more information to assess the economic and monetary policy outlook. This week, several Fed policymakers will speak, providing further insight into the Fed's interest rate intentions for the rest of the year. Minneapolis Fed President Kashkari suggested that it is likely the Fed will cut interest rates once this year, possibly towards the end of the year. Last week, the Fed kept the funds rate unchanged at 5.25%-5.5% as expected, but projected a single 25bps rate cut this year, down from previous forecasts of three cuts. Currently, there is a 67% chance of a rate cut in September. The U.S. Treasury is set to issue $70 billion in 13-week bills, $70 billion in 26-week bills, and $60 billion in 42-day cash management bills. Mortgage rates were lower in the latest week, with the average 30-year fixed mortgage rate at 6.95% and the 15-year fixed mortgage rate at 6.17%.

Commodities: Oil surged which is driven by optimism about increased demand during the summer driving season, despite mixed economic indicators from China. Retail sales in China benefited from holiday boosts, while oil prices saw their first weekly gain in four weeks, supported by expectations of dwindling inventories and ongoing OPEC+ supply cuts. Silver prices remained near $29 per ounce, as a weaker industrial outlook offset support from major central banks. Chinese government support for solar panels led to overcapacity, prompting industry groups to call for reduced investment and limiting the outlook for silver input buying by manufacturers. Aluminum dropped below $2,500 per tonne in June, reflecting weak demand and strong supply. Heavy rainfall in China's Yunnan province increased hydropower availability, leading to record-high aluminum output in May despite Rio Tinto's force majeure declaration on alumina shipments.

FX: The upbeat risk sentiment kept a lid on the US dollar on Monday, and gains were led by euro while Japanese yen was the weakest. Looking ahead, eyes will be on Tuesday for US retail sales and remarks from Fed's Barkin, Collins, Kugler, Logan, Musalem, and Goolsbee. EURUSD climbed higher to 1.0740 from lows of 1.0668 last week amid French election jitters with ECB sources postulating the Bank is in no rush to discuss a French bond rescue. GBPUSD was also back above 1.27 ahead of Bank of England rate decision on Thursday. Today’s focus is on the RBA rate decision, and AUDUSD remains supported at 50-day moving average as it wobbles around 0.66. USDJPY remains capped below 158 on intervention risks.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.