Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

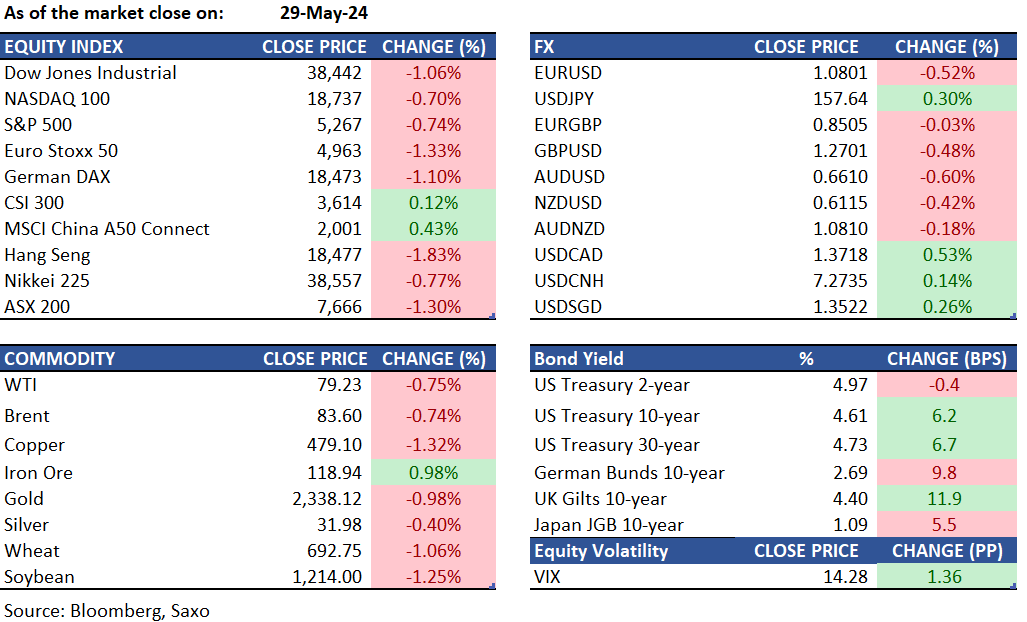

Equities: Asian stocks are set to decline on Thursday following a drop in US bonds and shares, driven by another underwhelming Treasury sale. Futures for equity benchmarks in Sydney, Tokyo, and Hong Kong all point to lower market openings. US share contracts also slipped in early Asian trading, with the S&P 500 closing near session lows, falling below 5,300, and the Nasdaq 100 experiencing its worst day since May 1. US stocks slid to a two-week low on Wednesday, ending a two-day winning streak. Salesforce Inc. witnessed a decline in its shares during extended trading after the software giant's current quarter outlook missed estimates. HP Inc. reported revenue that exceeded expectations, including the first increase in PC sales in two years. Additionally, BHP Group withdrew its bid for Anglo American Plc. In individual stock news, ConocoPhillips agreed to acquire smaller rival Marathon Oil Corp. At about $17b, continuing the oil industry’s trend of major deals. American Airlines Group Inc. shares plunged after the carrier reduced profit and revenue expectations, citing misjudgment of domestic demand leading into the crucial summer travel season.

FX: Risk aversion and higher Treasury yields pushed the dollar higher, with other G10 currencies all in the red. AUDUSD plunged to test the 0.66 handle despite a higher-than-expected inflation suggesting rate cuts from the RBA could be delayed. NZDUSD also down to 0.6110, reversing all of this week’s gains. EURUSD is testing the critical 1.08 level, as likely ECB rate cut draws closer, but EURGBP held up at the 0.85 support once again, a level that has held up since H2 2022. GBPUSD also below 1.27 with stronger dollar and a weaker equity sentiment. USDJPY rose to highs of 157.71 before easing slightly to 157.50 in early Asian trading, and focus today turns to second print of US Q1 GDP and comments from Fed’s Williams. To know more, read our Weekly FX Chartbook.

Commodities: Gold dropped by 0.98% to $2,338 per ounce due to a stronger dollar, higher bond yields, and hawkish comments from a Federal Reserve official. The U.S. dollar rose by 0.4% against other currencies, making gold more expensive for other currency holders. Silver and aluminum prices eased after hitting recent highs, while oil prices slipped to $79.23 per barrel and Brent Crude futures settled at $83.60/bbl, both down around 0.75%. Additionally, U.S. natural gas futures fell by 6% as production increased and recent heat in the southern U.S. was expected to ease by the end of the week.

Fixed income: Today, the big focus is on Treasury yields, with the 10-year yield increasing by over 7 basis points to 4.616%, marking the highest level in about a month. The 30-year yield also rose by 8 basis points to 4.74%, while the shorter-term 20-year note yield saw a more modest increase of around 3 basis points to 4.98%. These gains were extended after a weaker 7-year auction, where the U.S. Treasury sold $44 billion in 7-year notes at a high yield of 4.650%, compared to the previous 4.637% (1.3 basis points tail) when issued. The bid-to-cover ratio was 2.43, with primary dealers taking 17%, direct bidders taking 16.13%, and indirect bidders taking 66.88%.

Macro:

Macro events: Spanish Flash CPI (May), Swiss GDP (Q1), EZ Sentiment Survey (May), US GDP 2nd Estimate (Q1). Speakers: Fed’s Williams

Earnings: Canopy Growth, Kohl’s, Foot Locker, Dollar General, Maxeon, Best Buy, Hormel, Burlington, Birkenstock, Build-a-bear, Costco, Dell, ZScaler, Marvell, MongoDB, Ulta, SentinelOne, NetApp, Veeva, Elastic

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.