Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Introduction

NVIDIA is a global leader in technology, renowned for its groundbreaking work in graphics processing units (GPUs). The company drives innovation in gaming, artificial intelligence, and machine learning, and plays a pivotal role in advancing autonomous vehicles and enhancing computational performance worldwide.

Earnings consensus

Nvidia is expected to report quarterly earnings of $0.74 per share, marking an 85% increase from the previous year. Revenues are projected to reach $32.81 billion, an 81.1% rise compared to the same quarter last year.

Price action/ Key levels

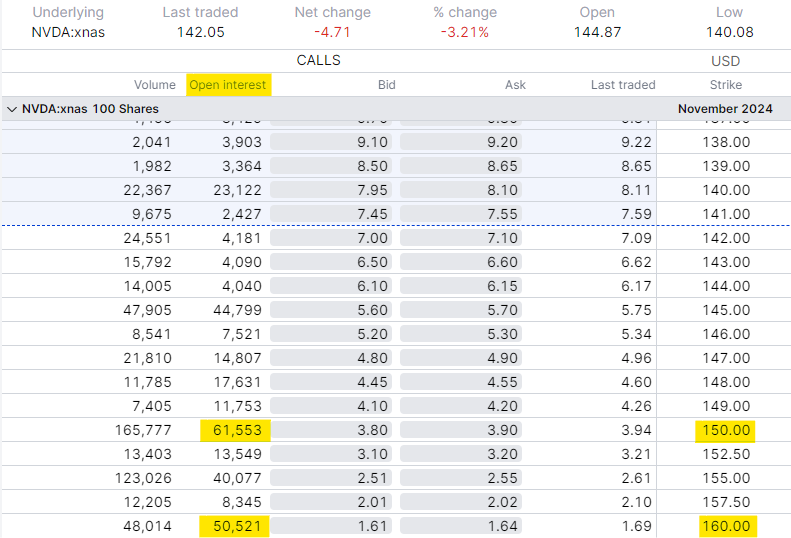

Nvidia traded to a new all-time high of $149.77 on the 8th of November and the year-to-date return for the stock has been approximately 200%. There is significant open interest for call options at $150 and $160, approximately 60k and 50k respectively. Max pain for options traders is $140, which coincides with the last swing high and is thus a key technical level. Next support levels we can watch for are $132.11 and $115.14, which are the two previous swing lows.

Nvidia Call Options Expiry 22nd November 2024

Market Catalyst – How will the stock move post earnings?

The bar for the stock to rise is quite high given the amount of optimism priced into Nvidia and the chip sector over the past year. In addition to earnings and revenue surpassing estimates, the market is also looking for strong earnings guidance for the year ahead.

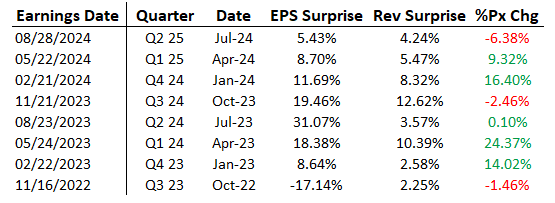

Nvidia has beaten earnings expectations for 7 straight quarters and beaten revenue expectations for 8. From the table below, we see that the market has high expectations for Nvidia and even in quarters where revenue and earnings beat, the stock could still be down on the day.

Based on historical data, it appears that Nvidia must at least exceed estimates for its stock to finish the day with a gain. Otherwise, the likelihood of the stock declining is quite high.

To express your view on the stock, please click here for a list of option trading strategies. For more advanced volatility trader, look here instead.

Source: Bloomberg