Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Introduction

Salesforce is a leading global customer relationship management (CRM) platform, renowned for transforming the way businesses connect with customers. By leveraging cloud technology, Salesforce provides solutions across sales, service, marketing, and commerce sectors, enabling organizations to streamline operations, enhance engagement, and drive business growth efficiently.

Earnings consensus

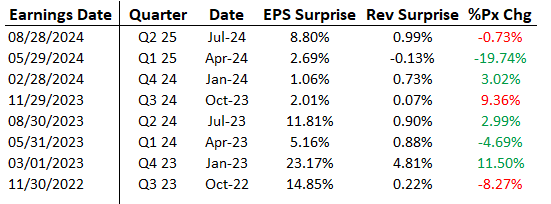

Salesforce is expected to report on the 3rd Dec 2024, with quarterly earnings expected at $2.44 per share, marking an 81% increase from the previous year. Revenues are projected to reach $9.35 billion, a 7.2% rise compared to the same quarter last year. Table below shows past earnings and the subsequent market reaction:

Source: Bloomberg

Price Action

Salesforce reached a high of $348.86 on 12th November and is showing signs of consolidation as it tried to break the $350 resistance twice in the past month. Despite this, the overall trend remains bullish. Year-to-date, CRM has risen from about $260 at the start of 2024 to $348.86, making an approximate 34% return.

Options Activity

As of 2nd Dec 2024, there is substantial open interest in call options at the 340 and 350 strike levels, which are near the all-time high of $348.86 and the psychological resistance point of $350. This could imply a bullish sentiment with traders betting on a positive outcome. If you are already long Salesforce, selling call options at the $350 strike with 6th Dec expiry gives you a premium of $4.80 per share, which is the equivalent annual yield of ($4.80/$329.74) x (365/4) = 133%. If you sell calls, you might experience two scenarios:

1) If Salesforce’s price stays above the strike price of $350 at expiry, the option will expire in-the-money, and the investor is obligated to sell 100 shares at $350.

2) If Salesforce’s price stays below the strike price of $350 at expiry, the option will expire worthless, and the investor gets to keep the premium with no additional obligations.

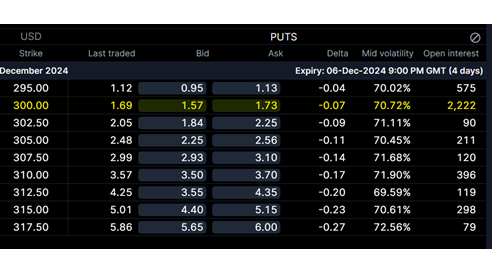

On the contrary, selling cash secured puts at $300 (significant open interest) gives you a premium of $1.57 per share, which is the equivalent annual yield of ($1.57/$329.74) x (365/4) = 43.4%. If you sell cash secured puts, you might experience two scenarios:

1) If Salesforce’s price stays above the strike price of $300 at expiry, the option will expire worthless, and the investor gets to keep the premium with no additional obligations.

2) If Salesforce’s price falls below the strike price of $300 at expiry, the investor is obligated to buy 100 shares at $300. The investor still gets to keep the option premium and owns the stock at a price that they were comfortable buying at.

Salesforce Call Options Expiry 6th December 2024