Outrageous Predictions

Carry trade unwind brings USD/JPY to 100 and Japan’s next asset bubble

Charu Chanana

Chief Investment Strategist

Chief Investment Strategist

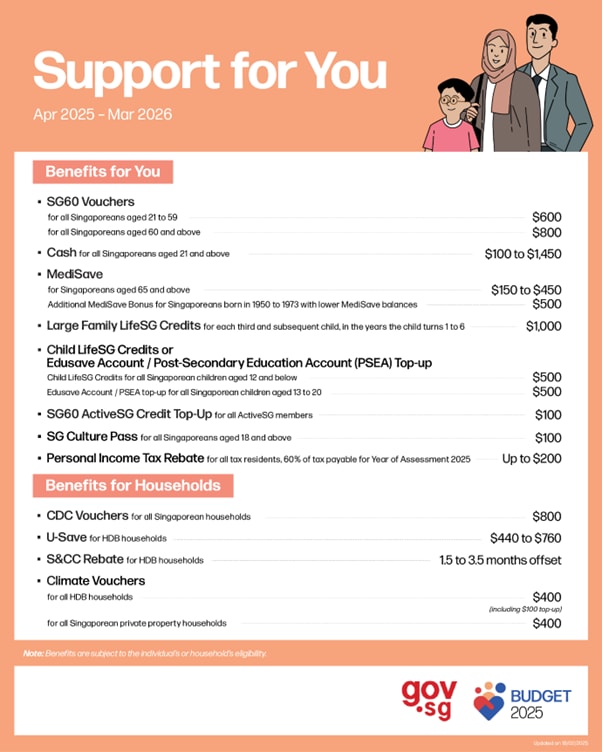

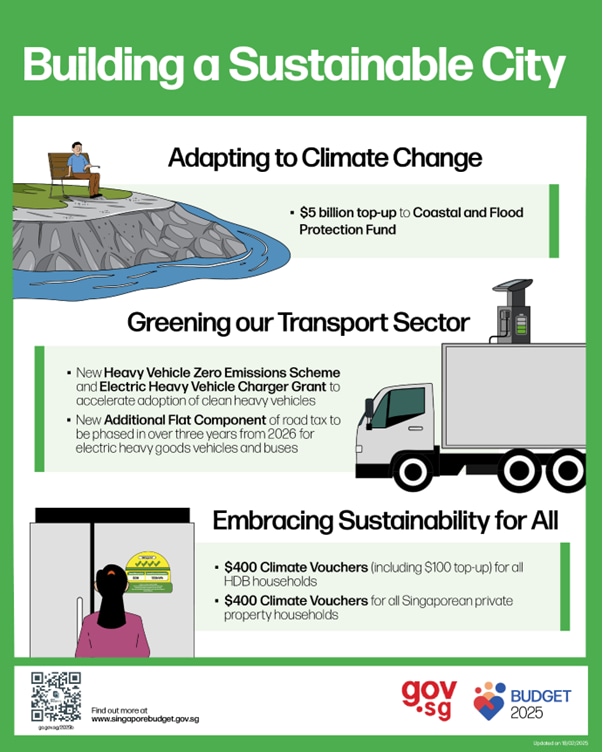

The latest budget delivers a mix of support measures, business incentives, and strategic investments in AI, semiconductors, nuclear energy, and infrastructure, creating opportunities for long-term investors. Here’s what stands out for buy-and-hold investors:

Relevant Stocks:

Relevant Stocks:

Relevant Stocks:

Relevant Stocks:

Relevant Stocks & ETFs:

While Singapore’s Budget 2025 is packed with growth initiatives and sector tailwinds, investors should remain cautious about global economic uncertainty, high interest rates, and execution risks in AI, green energy, and infrastructure investments. Short-term consumer spending boosts may fade, and regional trade headwinds could impact key industries like semiconductors and exports. A well-diversified portfolio remains essential to navigate both opportunities and uncertainties in the evolving market landscape.