Key points:

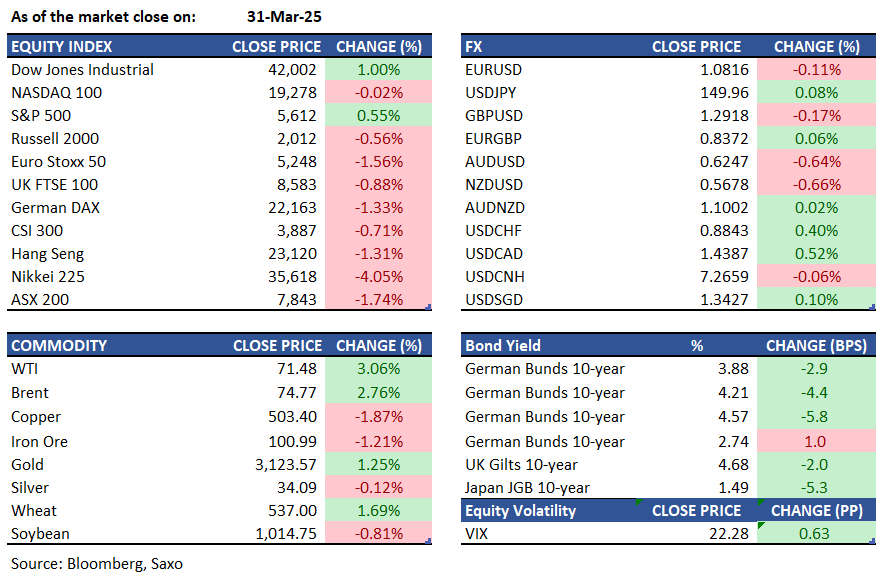

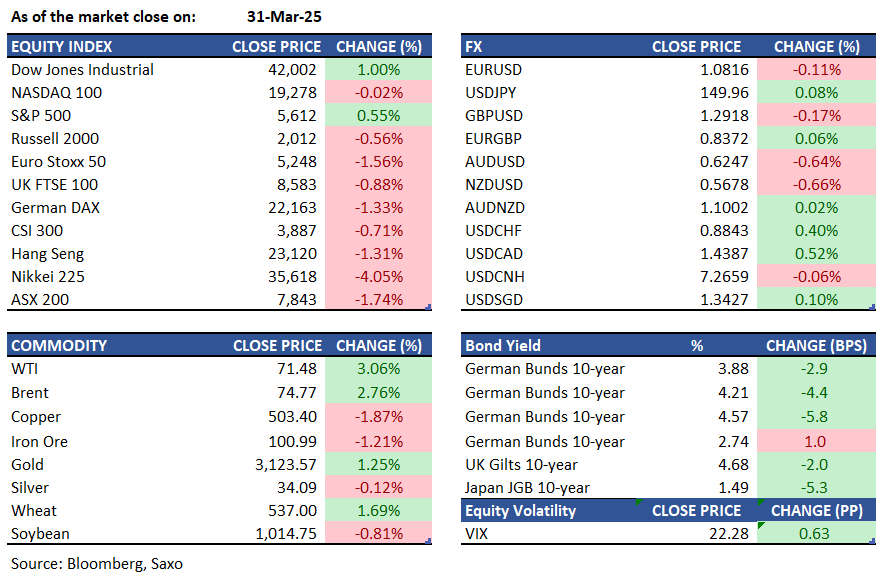

- Macro: Trump threatens tariffs against Iran and Russian Oil

- Equities: S&P 500 gained 0.55% but tech stocks were under pressure

- FX: AUDUSD under selling pressure ahead of RBA rate decision

- Commodities: Oil rallied after Trump suggested limiting Russian crude

- Fixed income: Two-year TIPS breakeven hit 3.36%, highest since March 2023

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- President Trump is pushing for significant tariffs, with threats against Iran and secondary tariffs on Russian oil. The White House Press Secretary stated the tariffs aim to end unfair trade practices, targeting countries treating the US unfairly. Trump is considering multiple tariff plans ahead of Liberation day tomorrow. Fed officials recommend assessing tariff impacts before policy changes, while strong Chicago PMI data improved market sentiment.

- The Bank of Japan's index for large manufacturers fell to 12 in early 2025, its lowest in a year, amid U.S. tariff concerns. Confidence dropped notably among textile, petroleum and coal, iron and steel, basic materials, and pulp and paper producers.

- Japan's unemployment rate dropped to 2.4% in February 2025, defying expectations. Unemployment decreased by 60,000 to 1.68 million, employment fell by 110,000 to 68.16 million, the labour force reduced by 150,000 to 69.86 million, and non-labour force numbers rose by 100,000 to 39.91 million.

- Germany's inflation dropped to 2.2% in March 2025, the lowest since November 2024, driven by slower services inflation at 3.4% and a larger decrease in energy costs at 2.8%. Food inflation rose to 2.9%, while core inflation, excluding food and energy, fell to 2.5%, the lowest since June 2021.

Equities:

- US - On Monday, the S&P 500 gained 0.5%, and the Dow increased by 417 points, starting the week positively. However, the Nasdaq 100 fell 0.2% as investors grappled with economic growth worries and worsening trade tensions. Market anxiety grew after Trump announced broader tariffs, including a 25% tax on non-U.S. cars beginning 2 April, including a potential secondary tariff on the buyers of Russian crude. Defensive stocks performed well, with Coca-Cola and Walmart rising 1.8% and 3.1%. In contrast, tech stocks experienced selling pressure, with Nvidia and Microsoft dipping 1.2% and 0.9%. Automakers had mixed results; Tesla dropped 1.7% while GM and Ford rose 0.7% and 3.1% respectively.

- EU - The STOXX 50 dropped over 1.5% to a two-month low of 5,240, and the STOXX 600 fell 1.5% to 534, amid trade war developments and key inflation data releases. The basic resources index hit its lowest since December 2020, with banks, chemicals, and construction materials also experiencing declines. US President Trump announced that forthcoming reciprocal tariffs would apply to all nations, rather than just a select group with notable trade imbalances, and he reportedly pushed his advisors to adopt a more aggressive tariff strategy.

- HK - Hong Kong stocks fell over 1% to close at 23,120 on Monday, continuing losses for a second session across sectors. Investor sentiment remained weak ahead of US reciprocal tariffs set for Wednesday. Despite upbeat Chinese PMI data showing factory activity at a one-year high and service growth at a three-month high, support was lacking. CK Hutchison dropped over 3% after criticism from Chinese media over its port sale near the Panama Canal to BlackRock. Other significant decliners included Sands China (-5%), Lenovo (-3.5%), Xiaomi (-3.6%), SMI (-4%), and BYD (-3.4%). Conversely, PetroChina gained over 2%, reporting a profit record. China Construction Bank (+2.7%), China Mobile (+1.3%), and Citic (+1.4%) posted gains. The index gained 0.8% for March and surged 15% for the quarter.

Earnings this week:

Monday: Gorilla, Nanox, Workhorse, FTC Solar, BiolineRx.

Tuesday: Evaxion, nCino, Sportsman's Warehouse, Rekor, CytoSorbents.

Wednesday: BlackBerry, RH, UniFirst, Penguin Solutions, Bassett.

Thursday: Conagra, Guess, Lamb Weston, MSC, Lifecore Biomedical.

Friday: Acuity Brands, Lindsay Corporation, RenovoRx, Simulations Plus, FranklinCovey.

FX:

- USD strengthened amid anticipation of 'Liberation Day.' The White House stated Trump's tariffs aim to end unfair trade practices. Fed officials suggested waiting to assess tariff impacts, while strong Chicago PMI data improved risk sentiment. Trump considers various tariff plans.

- EUR slightly weakened due to mixed German data, with Retail Sales exceeding forecasts but CPI slowing, as the bloc anticipates US tariffs.

- GBP briefly fell below 1.29 before recovering, amid UK PM Starmer's spokesperson's comments on expected impacts from US tariffs and ongoing US economic deal talks.

- JPY lost some recent gains, with USDJPY rebounding from below 148 to near 150. Overnight, the BoJ reduced its planned purchases of super-long bonds in its quarterly schedule.

- AUD fell to 0.6220, and NZD to 0.5850. RBNZ's Quigley stated the Governor appointment process will start soon, taking six to nine months. The RBA is expected to keep rates at 4.10%, per a Reuters poll.

- Major economic data: China Caixin Manufacturing PMI, RBA Interest Rate Decision, UK Mortgage Lending, UK Boe Consumer Credit, Germany Inflation Rate, US Chicago PMI, US Dallas Fed Manufacturing Index

Commodities:

- Oil prices steadied after Monday's surge, as Trump hinted at limiting Russian crude. WTI rose above $71, while Brent closed below $75. The US plans measures on Wednesday, called “Liberation Day.”

- Gold stayed near its record high amid volatility and trade war fears before Trump's tariff announcement. Bullion was stable at $3,127.92 per ounce. Gold gained nearly 20% this year, marking its best quarter since 1986.

Fixed income:

- Treasury yields were lower after recovering from tariff-related declines. SOFR options showed positions for Fed rate cuts, including 100 basis points of easing this year. The two-year TIPS breakeven inflation rate rose to 3.36%, its highest since March 2023.

For a global look at markets – go to Inspiration.