Key points:

- Macro: Trump plans to impose tariffs on pharmaceuticals in near future

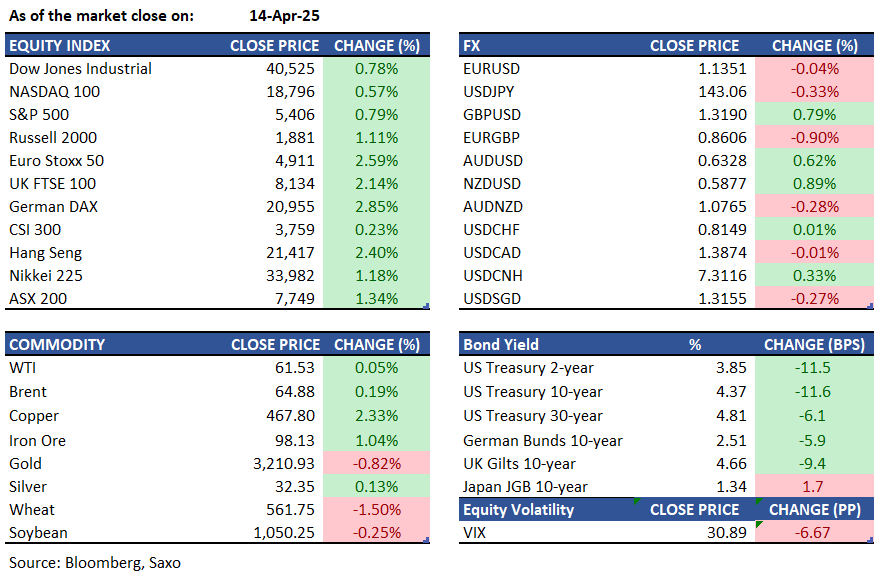

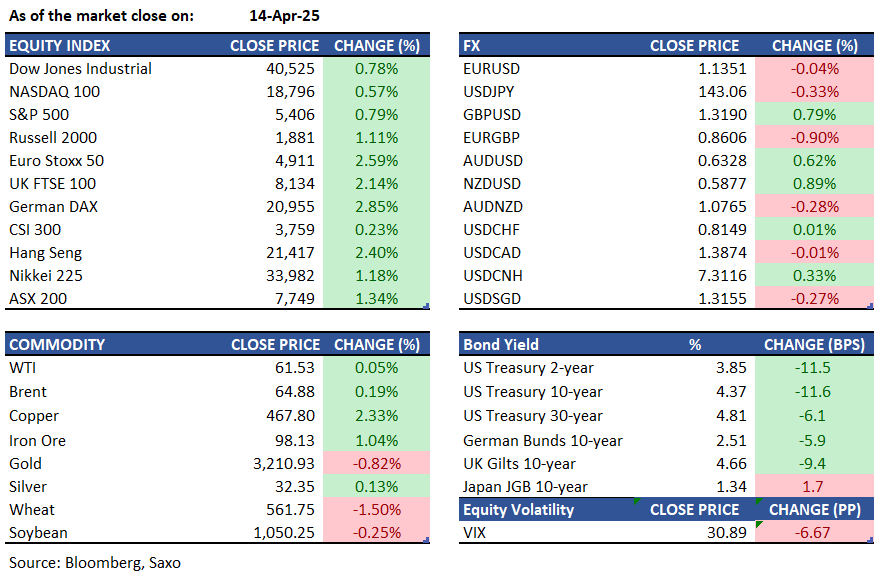

- Equities: Apple gained 2.2% on temporary tariff relief. S&P 500 recovered 0.79%

- FX: US dollar index closes below 100

- Commodities: Copper extends rally as market condition calms

- Fixed income: Treasuries sharply rebounded, ending a five-day selloff

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- US President Trump announced plans to impose tariffs on imported pharmaceuticals soon, highlighting that the US does not produce its own drugs. He also reiterated that the EU is taking advantage of the US and emphasized that the EU needs to negotiate, which they are attempting to do.

- UK retail sales rose by 0.9% in March 2025, exceeding the 0.5% forecast. Unseasonably warm weather and Mother's Day boosted spending on gardening, DIY, food, and health products. Food sales grew by 1.6%, while non-food sales increased by 0.6%.

- US consumer inflation expectations for the next year rose to 3.6% in March 2025, up from 3.1% in February. Expectations increased for food, medical care, and rent, but decreased for gas, college education, and home prices. Three-year expectations stayed at 3%, while five-year expectations dropped to 2.9%.

- China's exports rose 12.4% year-on-year to USD 313.9 billion in March 2025, surpassing the 4.4% forecast and up from 2.3% in January–February. This marks the fastest growth since last October, likely due to frontloading before new U.S. tariffs. First-quarter exports increased 5.8% year-on-year to USD 853.7 billion.

Equities:

- US - US stocks increased on Monday following a volatile week, as investors welcomed temporary tariff exemptions. The S&P 500 and Dow Jones rose nearly 0.8%, and the Nasdaq 100 gained 0.6%. An early rally was sparked by a pause on new tariffs for tech items, although President Trump later clarified these items remain under the existing 20% Fentanyl Tariffs. Apple and Dell shares rose by 2.2% and 4%, respectively. Automakers saw gains after Trump indicated possible relief from the 25% auto tariffs, allowing more time to shift production to the US. Ford, GM, Stellantis, and Rivian rose 3% to 6%, while Tesla edged higher, and Toyota and Honda added over 1%. Goldman Sachs climbed 1.9% following strong quarterly earnings.

- EU - European stocks surged on Monday after President Trump temporarily paused tariffs on computers and consumer electronics. The STOXX 50 rose 2.4% to 4,901, and the STOXX 600 increased 2.6% to 499.5. The pause affects the baseline 10% tariff on all countries, but a 20% tariff on Chinese goods remains. Trump stated baseline tariffs on phones, computers, and electronics will still apply, with semiconductor tariff details coming soon. Banks and insurers led gains, with BNP Paribas, UniCredit, Santander, and Munich Re rising between 4% and 6.5%. LVMH added 1% ahead of its revenue announcement.

- HK - The Hang Seng rose 503 points, or 2.4%, to 21,417 on Monday, achieving its highest close in two months and marking its second consecutive session of gains. Broad-based buying, especially in the tech sector, boosted sentiment after the Trump administration granted tariff exclusions on tech goods, mostly imported from China. Optimism was further supported by Beijing's measures to stabilise domestic markets, including placing a cap on daily net sales by hedge funds and major retail investors at CNY 50 million. China's trade surplus surged in March, with exports rising sharply and imports declining. PICC Property and Casualty climbed 2.7% on positive earnings forecasts. Notable gainers included Hong Kong Exchanges & Clearing (6.9%), Pop Mart Intl. (5.6%), AIA Group (4.2%), and Geely Auto (3.9%).

Earnings this week:

Tuesday - Bank of America, Citi, Johnson & Johnson, PNC, Albertsons Companies

Wednesday - ASML, Alcoa, US Bancorp, Abbott, Progressive

Thursday - TSMC, Netflix, UnitedHealth Group, Huntington Bancshares, American Express, Regions Financial

Friday - D.R. Horton, Ally Financial, Hooker Furniture, Fifth Third Bank, Texas Capital Bank

FX:

- USD started the week with volatile trading, DXY dropping below 100 after the Trump administration announced exemptions on smartphones and electronics. Trump later clarified these items face 20% fentanyl-related tariffs.

- EUR slightly weakened after failing to maintain a brief rise to the 1.14 level, while EU Trade Commissioner Sefcovic is in Washington for talks, aiming for a fair deal with zero-for-zero tariffs on industrial goods.

- GBP strengthened, testing the 1.32 level against the dollar before encountering resistance, with participants awaiting UK earnings and jobs data.

- JPY saw mixed price action, strengthening as USDJPY retreated from a brief test of the 144 level. BoJ Governor Ueda highlighted increased global and Japanese economic uncertainty due to US tariff policy, which may exert downward pressure on both economies.

- CHF weakened with USDCHF rising to above 0.8260 from 0.8120, without a clear reason. Swiss Sight Deposits for the week ending April 11 increased, with domestic banks at 438.374 billion and total deposits at 446.94 billion.

- NZD rose to $0.584, its highest since last December, due to a weaker US dollar and improved risk appetite. AUD strengthened to $0.63, boosted by Trump's tariff exemptions on key technology products.

- Major economic data: AU RBA Meeting Minutes, UK Unemployment Rate, Eurozone Economics Sentiment, Canada Inflation Rate, US Import and Export

Commodities:

- Oil prices increased, with Brent above $65 and WTI near $62, as traders watched US trade war developments and potential easing on Iranian crude.

- Gold remained near its record high at $3,211 an ounce amid US tariff plans, after peaking above $3,245.

- Copper rose 0.4% to $9,187 a ton on the London Metal Exchange after Trump exempted some products from tariffs, improving market sentiment. Nickel gained 1.5%, while aluminium fell.

Fixed income:

- Treasuries rebounded sharply, ending a five-day selloff with yields near session lows, especially in intermediate sectors. Treasuries outperformed swaps, reflecting calmer market conditions. Treasury Secretary Scott Bessent dismissed rumours of foreign nations selling US Treasuries and stated his department can address market dislocation if necessary.

For a global look at markets – go to Inspiration.