Key points:

- Macro: USTR reports staggered reciprocal trade negotiations with 18 partners

- Equities: Tesla rose 9.8% on regulations; BYD's Q1 profit surged 100.4% YoY

- FX: Leveraged funds increased yen bets to their highest since November 2020

- Commodities: Oil is seeing its sharpest monthly fall since 2022

- Fixed income: The yield curve flattened as short-term yields lagged

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- The USTR's office has reportedly developed a framework for staggered reciprocal trade negotiations with 18 partners, set to occur over the next two months until the US's July 8th deadline, as per the WSJ.

- The University of Michigan's US consumer sentiment rose to 52.2 in April 2025 from 50.8, but fell for the fourth month to its lowest since July 2022, amid concerns over trade policy and inflation risks.

- China's industrial profits increased by 0.8% to CNY 1,509.36 billion in Q1 2025, recovering from a 0.3% decline, thanks to Beijing's stimulus. Foreign-invested and Hong Kong, Macao, and Taiwan enterprises' profits rose 2.8%, joint-stock enterprises 0.1%, while private sector profits fell 0.3%, less than the previous 9.0% drop.

- Canada's retail sales increased by 0.7% in March 2025 to C$69.4 billion, after a 0.4% drop in February. Sales fell in four of nine subsectors, led by a 2.6% decrease at motor vehicle and parts dealers.

- UK retail sales rose by 0.4% in March 2025, contrary to forecasts of a 0.4% decline, after a revised 0.7% increase in February. Non-food store sales grew by 1.7%, the highest since March 2022, with clothing stores up 3.7%, boosted by favourable weather.

Equities:

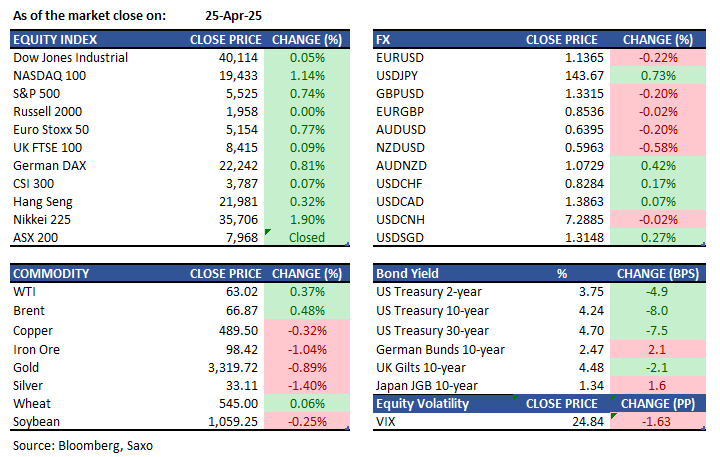

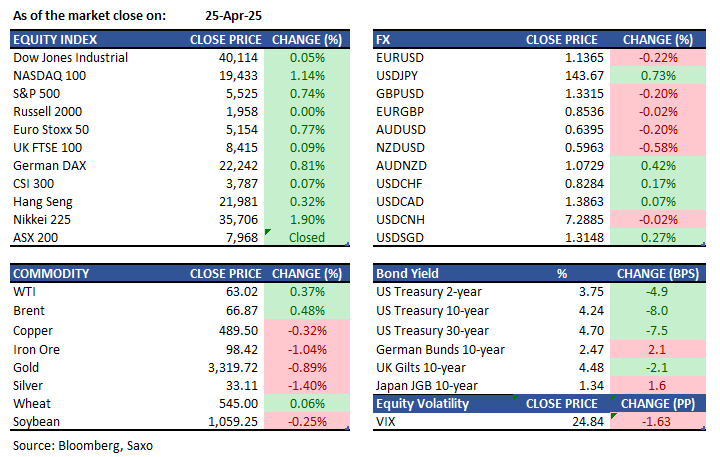

- US - US equities rose on Friday for the fourth straight session, driven by Big Tech's performance, while President Trump's tariff comments maintained trade tensions. The S&P 500 gained 0.7%, Nasdaq 100 rose 1.1%, and Dow added 20 points. Trump's mention of 50% tariffs as a "total victory" created uncertainty, with Beijing disputing ongoing talks, countering optimism from exemptions on some US goods by China. Alphabet shares were up 1.5% after exceeding earnings expectations, introducing a dividend, and announcing a $70 billion stock buyback. Tesla jumped 9.8% following new self-driving car regulations. Intel dropped 7% due to weak guidance, and T-Mobile fell 11% on poor subscriber growth.

- EU - European stocks continued their rally into a fourth session on Friday, with the STOXX 50 up 0.8% and STOXX 600 increasing by 0.3%. Traders were encouraged by suggestions of a U.S.-China tariff truce, despite China's denials and U.S. concessions. Reports suggested China might suspend its 125% tariff on some U.S. imports, while President Trump stated trade talks were progressing well. Both indices achieved a second consecutive week of gains, with the STOXX 50 up 4.4% and STOXX 600 up 2.5%. In earnings news, Safran shares surged 4.2% after exceeding first-quarter revenue expectations and expressing confidence in meeting full-year targets, excluding tariff effects.

- HK - Hang Seng Index rose 0.3% to 21,981 on Friday, recovering from previous declines due to Wall Street's rally and positive sentiment from PBoC's loose monetary policy. Reports of potential tariff exemptions on U.S. goods by Beijing also lifted the mood. For the week, the index gained 2.7%, driven by optimism over Beijing's reduced foreign investment restrictions. Gains were led by tech, consumer, and property stocks, with Baidu up 2.3% after launching its Ernie 4.5 Turbo AI model. BYD's Q1 profit surged 100.4% year-on-year, the fastest in two years, as it led a smart EV price war. Net profit hit 9.2 billion yuan ($1.26 billion), within the forecasted range of 8.5 to 10 billion yuan.

Earnings this week:

Monday: Domino’s Pizza, Yum! Brands, McDonald’s

Tuesday: Coca-Cola, Starbucks, Booking, Royal Caribbean, Norwegian Cruise, Spotify, Visa, UPS, Mondelez

Wednesday: Microsoft, Meta, Robinhood, Qualcomm, eBay

Thursday: Apple, Amazon, Block, CVS, Mastercard, Hershey

Friday: Exxon, Chevron

FX:

- On Friday, the dollar strengthened against all G10 currencies amid optimism over easing trade tensions. The yen was among the weakest performers. The Bloomberg Dollar Spot Index rose by 0.4%, gaining 0.1% for the week after three weeks of declines, supported by month-end factors. The US dollar index is set for its worst performance in the first 100 days of a presidency since Nixon.

- USDJPY increased 0.7% to 143.63, with leveraged funds most positive on the yen since November 2020, and asset managers most bullish since 2006.

- USDCAD held steady at 1.3860 ahead of Canada's election.

- EURUSD fell 0.2% to 1.1363 as ECB's Robert Holzmann suggested US tariffs may impact euro zone prices. Traders priced in a 25bp cut in June.

- USDCHF rose 0.1% to 0.8277, while GBPUSD decreased 0.2% to 1.3322.

- Major economic data: UK CBI Distributive Trades, US Dallas Fed Manufacturing Index, Canada Wholesale Sales MoM Preliminary, ECB Guindos Speech

Commodities:

- Oil prices rose, with Brent above $67 and WTI near $63. Traders are monitoring China's economic plans and Iran's geopolitical events. Oil faces its largest monthly decline since 2022 due to the US-led trade war and increased OPEC+ output.

- Gold has outperformed other assets this month amid Trump's tariff war, with SPDR Gold Shares ETF options hitting a record 1.3 million contracts. Despite low hedging costs and high volatility, Barclays advises selling June calls to buy puts, expecting a price decline.

Fixed income:

- Treasuries rose as stocks pared gains after Trump stated that US tariffs on China would remain unless Beijing makes substantial concessions. Treasury yields fell by 3 to 5 basis points, closing near the day's lows, with the 10-year yield at approximately 4.265%, close to the weekly low after reaching 4.43% on Tuesday. The 2s10s spread flattened as front-end yields lagged slightly.

For a global look at markets – go to Inspiration.