Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: BoE Announcement, PBoC LPR Announcement, SNB Announcement & Press Conference, Norges Bank Announcement & Press Conference, German Producer Prices (May), US Philly Fed Survey (Jun)

Earnings: Aurora, Accenture, Kroger, Jabil, Winnebago, Smith & Wesson, Algoma, Tsakos Energy Navigation, Commercial Metals Co, Silvaco Group

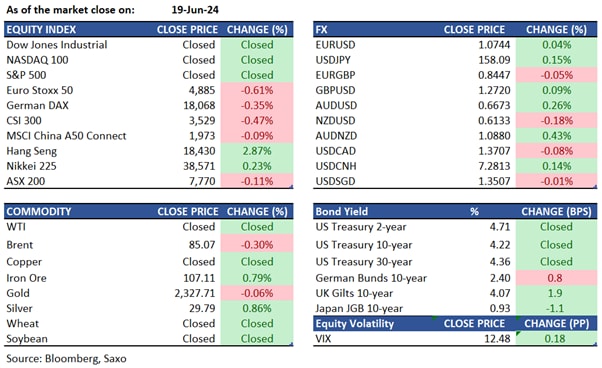

Equities: US market was closed for the Juneteenth holiday. The Hang Seng Index saw a significant 2.9% surge, the strongest one-day rise since mid-March, driven by strong gains across all sectors. The tech index climbed 3.7% due to optimism in AI, with Nvidia emerging as the world’s most valuable firm. Additionally, consumers, financials, and property sectors experienced notable increases after the head of a Chinese central bank expressed the intention to flexibly use various policy tools, including interest rates and RRR. European stocks closed lower on Wednesday due to ongoing political uncertainty, with the Stoxx 50 dropping by 0.6% and the pan-European Stoxx 600 easing by 0.2%. The European Commission's reprimands to several countries for wider-than-allowed fiscal deficits led to underperformance in their markets. ASML and the healthcare sector experienced losses, while gains for British mining giants helped the Stoxx 600 outperform its Eurozone counterparts.

Fixed income: Markets are almost fully pricing in that the Bank of England will maintain its current interest rates despite having inflation dropping to the 2% target for the first time in almost 3 years. The decision to hold rates comes after the steady increase in rates since 2021 to fight inflation. CPI fell to 2% in May, marking the first-time inflation has met BoE’s target since July 2021. The CBI (Confederation of British Industry (CBI) expects a cautious rate cut in August after these developments.

Commodities: Oil prices held steady around 7 weeks high due to escalating conflict in Eastern Europe and the Middle East, which raised supply concerns. Additionally, robust global demand growth forecasts and reaffirmed production quotas from key OPEC+ members supported oil prices. However, US crude inventories unexpectedly increased by 2.264 million barrels last week, contrary to forecasts for a draw. Gold traded around $2,330 per ounce on Wednesday as weaker US retail sales data raised expectations of Federal Reserve rate cuts. Additionally, central banks plan to increase their gold reserves due to economic and political uncertainty, despite high prices. Copper rose to $4.55 per pound, bouncing back from a two-month low, as markets considered uncertain ore availability alongside weak demand from major consumers.

FX: The US dollar traded sideways in a quiet session overnight with US markets closed for the Juneteenth holiday. AUDUSD continued to rise and was above 0.6670 and AUDNZD also pushed above 1.0880 to test the 50-day moving average at 1.0885. NZ’s Q1 GDP report out this morning showed that the economy exited recession with 0.2% growth, but gains in NZDUSD to 0.6140+ did not stick. Meetings for Bank of England and Swiss National Bank could be key for FX markets today. GBPUSD continues to hold on to its gains above 1.27 while USDCHF trades just below 0.8850. Any hints of dovishness may weaken sterling or franc respectively, especially against AUD where the RBA has kept a rate hike on the table this week.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.