Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

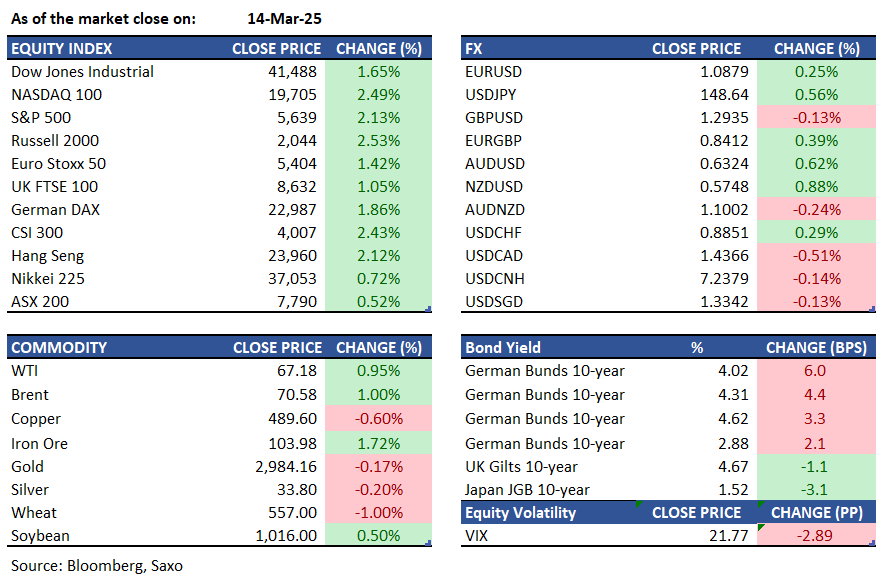

Macro:

Equities:

Earnings this week:

FX:

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.