Key points:

- Macro: Trump is set to announce "reciprocal tariffs" on April 2

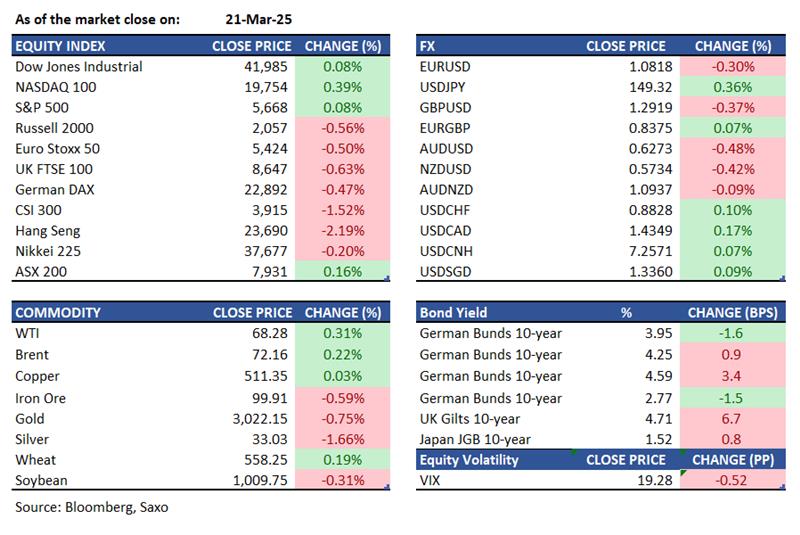

- Equities: US futures rose Monday; Asia markets opened mostly lower Monday

- FX: G10 currencies weakened, except NOK and SEK

- Commodities: Kostas Bintas expects copper prices to rise

- Fixed income: Treasuries curve twist steepens

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- France wants the EU to use its anti-coercion instrument against the US if Trump uses tariffs to unfairly pressure the bloc. This instrument allows retaliatory measures like trade restrictions and control over investments. The European Commission is not currently considering it, and discussions await the US tariffs announcement on April 2.

- President Trump is set to announce "reciprocal tariffs" on April 2., targeting countries with tariffs on US goods, excluding some. They will take effect immediately, potentially straining ties with allies, but no sector-specific tariffs are planned. The scope is narrower than initially planned, with some countries exempt and existing metal tariffs possibly not cumulative.

- Chinese Premier Li Qiang says China is ready for "unexpected shocks" as Trump plans more tariffs. Li urges market openness and resource-sharing amid rising instability. He pledged interest rate cuts and support to ensure economic stability.

- Canadian PM Mark Carney set an election for April 28, with a close race between Liberals and Conservatives. The campaign focuses on Trump's tariffs and annexation threats, uniting Canadians. Carney and Conservative leader Pierre Poilievre both promise tax cuts but differ on economic and US relations.

Equities:

- US - Equities closed positively on Friday as Trump hinted at tariff "flexibility," and megacap stocks recovered. The session was volatile due to "quadruple witching." The S&P 500 rose 0.1%, the Dow gained 31 points, and the Nasdaq increased by 0.5%. Market pressure persisted from poor earnings forecasts; FedEx fell 6.4% and Nike dropped 5.5%. For the week, the S&P 500 was slightly up, the Dow rose 0.7%, and the Nasdaq was mostly flat.

- EU- DAX closed slightly lower on Friday, its third consecutive loss and second week of declines. Siemens fell nearly 2%, and other major stocks dropped over 2%. German lawmakers approved borrowing reforms for defense spending, leading Deutsche Bank to revise forecasts: Germany's GDP growth is expected at 1.5% in 2026 and 2.0% in 2027, with the 2025 forecast reduced from 0.5% to 0.3% due to global challenges.

- HK - HSI fell 2.2% to 23,690 on Friday, its second consecutive decline. It dropped 1.1% for the week due to tech stock profit-taking and caution before Chinese earnings. Semiconductor Manufacturing hit a one-month low, down 7.1%, while Kuaishou Tech, Alibaba, and Tencent also declined. Consumer, property, and financial stocks retreated as China's plan to boost consumption lacked details. BYD expected to report over $100 billion in revenue, surpassing Tesla. It delivered 4.27 million units in 2024, leading domestically, and its exports rose 72% to over 417,000 vehicles last year.

Earnings this week:

Monday: Intuitive Machines, Oklo, Lucid Diagnostics, KB Home, Dragonfly Energy, BYD

Tuesday: Canadian Solar, GameStop, McCormick, SurgePays, Worthington Industries

Wednesday: Dollar Tree, MicroVision, Chewy, Target Hospitality, Jinko Solar

Thursday: Bitfarms, Lululemon, Winnebago, TD SYNNEX, Braze

Friday: LpA, Katapult, Super League, zSpace, LiqTech

FX:

- Dollar Index (DXY) rallied for three days, closing above 104, possibly due to unwinding short positions ahead of April 2nd tariffs. Fed members, including Waller, discussed reserve levels and policy uncertainty. President Trump urged US plant construction to avoid tariffs. Upcoming data includes Durable Goods and GDP growth.

- G10 currencies generally weakened due to USD strength, although NOK and SEK gained. SEK, the best-performing G10 currency this year, is expected by Rabobank to recover further against USD, EUR, and NZD.

- In Europe, the Bundesrat passed the debt reform bill and a EUR 500 billion fund. EURUSD closed around 1.0820, with downside DMAs approaching. Antipodean currencies continued underperforming as sentiment in China eased overnight.

- GBP dipped below 1.29, as pressure mounts on UK Chancellor Reeves ahead of the spring statement. February's PSNB Ex-Bank exceeded expectations. With no tax hikes expected, spending cuts are anticipated. The UK may reduce its digital services tax to avoid a trade war with the US.

- CAD was largely unaffected by retail sales dropping -0.6%, with ex-autos rising 0.2%. USDCAD trades near 1.342. PM Carney cancelled the capital gains tax increase.

- USDJPY stayed steady despite strong Japanese inflation data, with BoJ expecting 33bps tightening by year-end.

- Major economic data: Eurozone HCOB Manufacturing PMI Flash, UK S&P Global Manufacuring PMI Flash, US S&P Global Composite PMI Flash

Commodities:

- Oil prices stayed steady as traders considered new US tariffs and increased OPEC+ supply. Brent traded above $72, with WTI near $68.

- Gold steadied after declines, buoyed by economic and geopolitical risks despite targeted US tariffs. Trading near $3,022 an ounce, Trump's tariffs are expected to be less severe, with exemptions and no sector-specific barriers, aides say.

- Kostas Bintas expects copper prices to rise by a third as the US draws large amounts, leaving China short. Tariffs push traders to send copper to the US, where prices are $1,400 a ton higher. Mercuria estimates 500,000 tons are heading to the US, reducing Chinese stocks.

Fixed income:

- Treasuries curve twist steepened with the 7-year yield nearly unchanged, while the long end became cheaper by 3.5 basis points, pushing the 5s30s spread to its widest since September. Fed Governor Waller's comments and a firming Fed cut premium supported the widening of Treasuries spreads. A bear steepening in gilts added support, as UK 30-year yields increased by 9 basis points to 5.31%, following data on the UK's growing budget deficit.

For a global look at markets – go to Inspiration.