Key points:

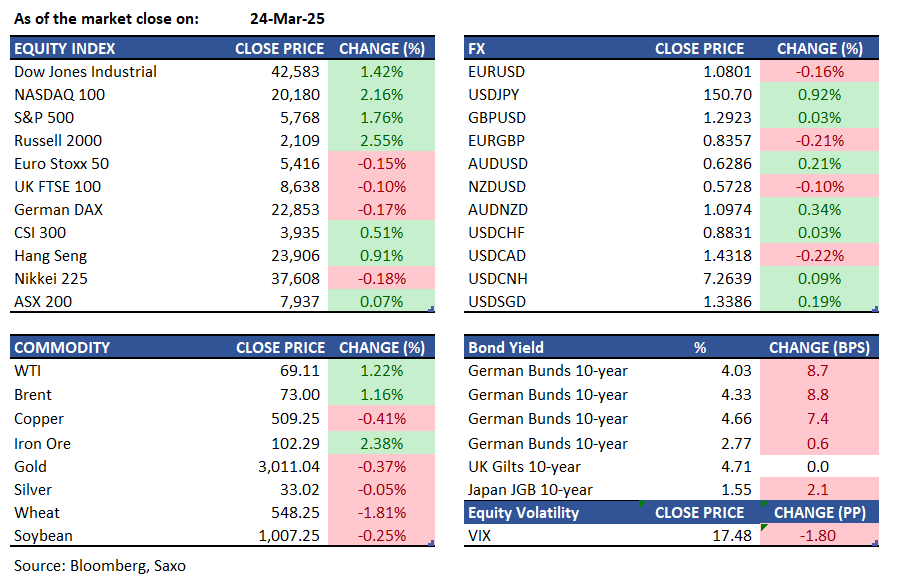

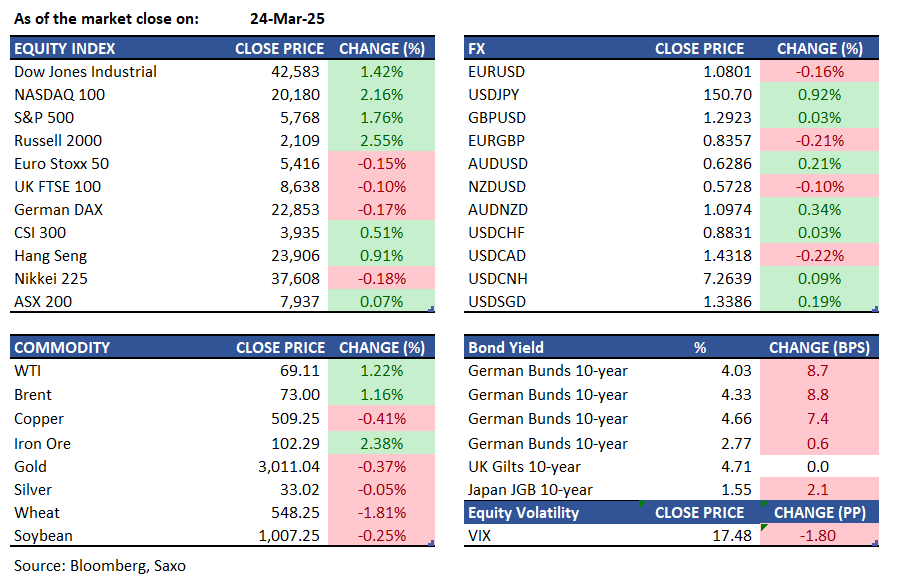

- Macro: Trump imposed a 25% tariff on countries buying Venezuelan oil or gas

- Equities: Tesla is up 11.9% after recent declines; BYD sales exceed $100b, above Tesla

- FX: USD strengthened with March's Services PMI surge; TRY fell amid political unrest

- Commodities: Gold stays above $3,000; Oil rose on Trump's Venezuelan crude sanctions threat

- Fixed income: Treasuries dropped after Trump hinted at tariff relief

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- President Trump imposed a 25% tariff on countries buying Venezuelan oil or gas and extended Chevron's deadline to exit Venezuela, easing pressure after a prior 30-day wind-down order due to Maduro's lack of progress on reforms.

- The Chicago Fed National Activity Index increased to 0.18 in February 2025 from -0.08 in January, signalling economic growth. Production indicators contributed +0.19, up from +0.02. Sales, orders, and inventories improved to -0.01 from -0.04, while personal consumption and housing rose to -0.01 from -0.14.

- The S&P Global US Manufacturing PMI fell to 49.8 in March 2025 from 52.7 in February, below the expected 51.8, but the Services PMI came in much better at 54.3 vs 50.8 est. Output decreased after February's sharp rise, with fewer boosts from tariffs and nearly stalled new orders growth.

- In March 2025, the HCOB Eurozone Manufacturing PMI rose to 48.7, the highest in 26 months, from 47.6, exceeding forecasts. Manufacturing expanded for the first time in two years. The Composite PMI increased to 50.4 from 50.2, below expectations. Manufacturing grew, service growth slowed, new orders declined, employment stabilised, inflation rates hit lows, and business confidence was at its lowest since November.

Equities:

- US - US stocks surged on Monday amid optimism that the Trump administration might adopt a more targeted tariff approach, easing trade war fears. The S&P 500 rose 1.8% to a two-week high, the Nasdaq 100 gained 2.1%, and the Dow Jones increased by 597 points. Tech stocks led the rally, with Nvidia up 3.1%, AMD rising 7%, and Tesla jumping 11.9% after recent declines. Amazon climbed 3.6%, and Alphabet advanced 2.1%. Reports suggested sector-specific tariffs might be excluded from the April 2 rollout, though final decisions are pending. Investors welcomed this potential policy shift following market volatility due to recession fears. Preliminary PMIs showed strong services growth, while manufacturing contracted, with rising input costs from tariffs.

- EU - The DAX closed slightly down at 22,853 on Monday, reversing early gains as traders assessed European business data and US tariff developments. Reports suggested US tariffs might be more targeted, but President Trump announced duties on autos, aluminium, and pharmaceuticals. Germany's private sector saw its fastest growth in ten months, with manufacturing production rising for the first time in nearly two years. Bayer dropped 6.9% after a $2.1 billion Roundup case verdict, while Beiersdorf and Vonovia also faced losses. Infineon Technologies and Deutsche Bank were top gainers, rising 3.3% and 2.6%, respectively.

- HK – HSI rose 0.9% to 23,905, driven by strong US futures gains after Trump hinted at tariff flexibility. Fed Chair Powell eased concerns, while Premier Li Qiang pledged proactive policies. PBoC plans rate cuts, and Morgan Stanley raised China's GDP forecast. BYD's sales exceeded US$100 billion last year, surpassing Tesla's revenue, as the Chinese automaker impressed consumers with its electric and hybrid cars featuring advanced technology. BYD reported a 29% revenue increase to 777 billion yuan, surpassing estimates. Net income rose 34% to 40.3 billion yuan, beating analyst expectations.

Earnings this week:

Tuesday: Canadian Solar, GameStop, McCormick, SurgePays, Worthington Industries

Wednesday: Dollar Tree, MicroVision, Chewy, Target Hospitality, Jinko Solar

Thursday: Bitfarms, Lululemon, Winnebago, TD SYNNEX, Braze

Friday: LpA, Katapult, Super League, zSpace, LiqTech

FX:

- USD rose as March's unexpected Services PMI surge offset manufacturing contraction. Trump plans new tariffs on autos, lumber, and chips, with potential exemptions for some countries. Additionally, he announced a 25% tariff on Venezuelan oil and gas imports, affecting countries purchasing from Venezuela.

- G10 currencies showed mixed performance amid USD strength. CAD, NOK and SEK gained ahead of Trump's potential tariff break announcement. Subsequently, existing G10 gains increased, with AUD and GBP turning positive from flat, while NZD, EUR, and CHF reduced losses.

- EUR fell below 1.08 level due to dollar strength and looming tariff threats, with mixed Eurozone PMI data.

- GBP fluctuated, settling just above 1.29, as BoE Governor Bailey's remarks had minimal impact, with traders anticipating the Spring Statement and CPI data.

- JPY weakened, causing USDJPY to rise above 150.00, driven by strong dollar, higher US yields, and increased risk appetite.

- TRY hit record lows, trading above 37 against USD, amid political turmoil. Istanbul's mayor, Ekrem Imamoglu, Erdogan's rival, was jailed on corruption charges, likely disqualifying him from elections, causing protests and asset sell-offs. Turkey's central bank raised rates by 200 basis points to 46% to stabilise markets.

- Major economic data: Germany Ifo Business Climate, UK CBI Distributive Trades, US New Home Sales, US CB Consumer Confidence, US Fed Speech

Commodities:

- Gold stabilised after three days of losses, trading near $3,010 an ounce. Trump announced tariffs on auto imports.

- Oil gained as Trump threatened sanctions on Venezuelan crude buyers, raising supply concerns. WTI topped $69 a barrel, with Brent at $73. A 25% tariff effective April 2 could restrict supply for refiners in China, India, Spain, and the US.

Fixed income:

- Treasuries fell, extending overnight losses after Trump hinted at tariff relief for many countries. This was intensified by block futures trading and corporate issuance, with 16 firms raising nearly $25 billion. Yields rose by 6 to 9 basis points across the curve, with 2s10s and 5s30s spreads tightening. US 10-year yields ended at 4.325%, up 8 basis points from Friday's close.

For a global look at markets – go to Inspiration.