Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Australia RBA Meeting Minutes, NAB Business confidence Sept, China National Development and Reform Commission Briefing, Canada Balance of Trade

Earnings: Pepsico, Accolade, Saratoga

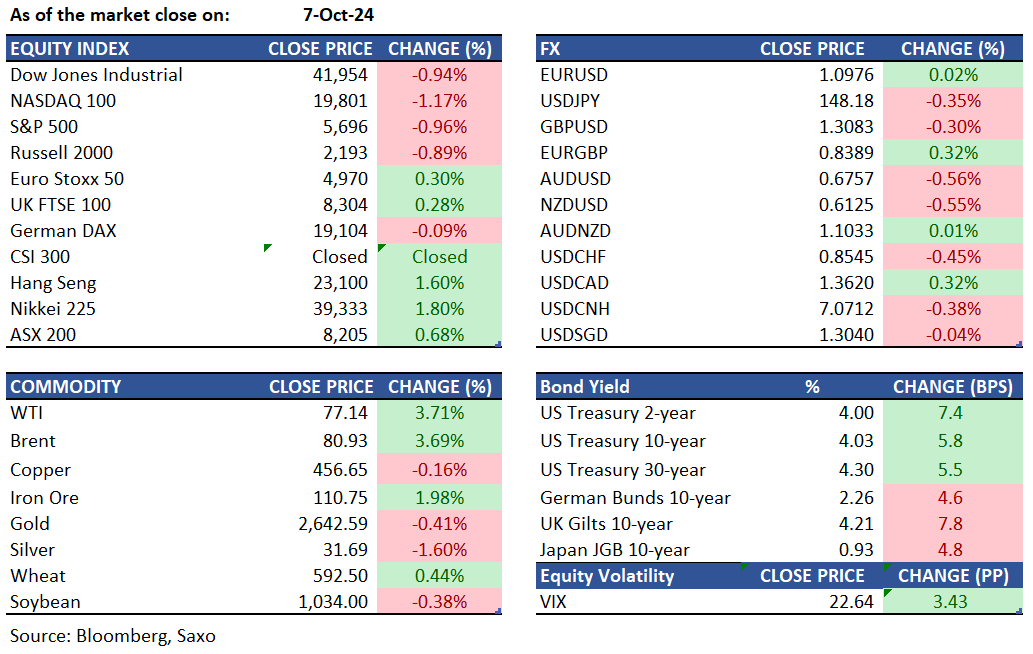

Equities: The S&P 500 and Nasdaq fell by 1% and 1.2%, respectively, while the Dow Jones dropped 398 points. Benchmark 10-year Treasury yields rose above 4% for the first time since August, as a strong jobs report led investors to adjust their expectations for Federal Reserve rate cuts. The probability of a 0.50% rate cut in November has decreased, with an 84% chance of a smaller 0.25% cut. Key inflation data and earnings reports from major banks like JPMorgan, Wells Fargo, and Bank of New York Mellon are anticipated this week. Utilities, communication services, and consumer discretionary sectors declined, while the energy sector gained. Among tech giants, Apple (-2.2%), Microsoft (-1.6%), Alphabet (-2.4%), Amazon (-3%), and Meta (-1.9%) fell, whereas Nvidia (+2.5%) rose. The Hang Seng surged 1.6% to 23,100 on Monday, its highest since early 2022, with gains across all sectors. Investors increased positions ahead of China's stock market reopening on Tuesday after a week-long break. Goldman Sachs upgraded its outlook on Chinese stocks to overweight, predicting a 15%-20% rise if Beijing implements promised policy measures. China is expected to hold a media briefing Tuesday to discuss economic stimulus.

Fixed income: The front end of the Treasuries curve led losses, extending Friday's post-payrolls decline as traders adjusted their expectations for the Federal Reserve's policy. By session's end, around 20 basis points of rate cuts were priced into the November meeting, down from 24 basis points on Friday. The curve flattened but ended above session lows, with significant activity in SOFR futures and options. Treasury yields were up to 8 basis points higher at the front end and about 5 basis points higher at the long end. The 2s10s spread tightened to around 2 basis points, having dropped to minus 1.2 basis points earlier. U.S. 10-year yields ended at 4.025%, up 5.5 basis points after briefly exceeding 4.03%. Gilts underperformed, with 10-year UK yields closing nearly 8 basis points higher. Buyers preferred the six-month bill auction over the three-month offering as traders continued to adjust for expected Fed rate cuts in 2024 following a strong jobs report. Japanese funds bought a record amount of U.S. sovereign bonds in August, according to Japan's Ministry of Finance data released.

Commodities: WTI and Brent crude oil futures both surged by 3.7%, reaching $77.14 and $80.93 respectively, marking a six-week high after a 9.1% gain last week. This increase is attributed to escalating tensions in the Middle East, with investors closely monitoring Israel's potential response to an Iranian missile attack. Concerns about a broader regional conflict are heightened as Israel continues its military actions in Gaza and Lebanon. Despite this, President Biden has advised against striking Iran’s oil fields, suggesting alternative measures. Iran's oil production, currently near full capacity, faces potential risks. Meanwhile, gold prices dipped by 0.4% to $2,642, and silver prices fell by 1.6% to $31.69. Wheat futures rose to $5.9 per bushel as investors considered the impact of adverse weather conditions in Russia against a backdrop of declining demand.

FX: USD stalled near a seven-week high on Monday as investors reconsidered their positions after strong U.S. jobs data and rising Middle East tensions. The September jobs report showed significant payroll growth, a lower unemployment rate, and solid wage increases, leading markets to expect a 25-basis point (bps) rate cut by the Federal Reserve in November instead of 50 bps. The CME's FedWatch tool now indicates an 85% chance of a quarter-point cut, up from 47% a week ago. Against the Japanese yen, the dollar weakened after Japan's top currency diplomat warned against speculative moves, causing the USD/JPY to fall 0.49% to 147.98. The dollar index, measuring the greenback against six currencies recorded a weekly gain of over 2%, its largest in two years. Meanwhile, NZD/USD fell to around $0.615 ahead of the Reserve Bank of New Zealand’s policy meeting, where a second interest rate cut this year is expected. In August, the RBNZ surprised markets by cutting its cash rate by 25 bps to 5.25%, nearly a year earlier than forecast. Investors now fully expect a 50bps reduction. The Kiwi remains under pressure due to the strong U.S. dollar, buoyed by stronger-than-expected U.S. payroll data.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.