Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Japan’s ruling LDP party leadership election, China Industrial Profits (Aug), German Unemployment (Sep), EZ Consumer Confidence Final (Sep), US PCE (Aug), Uni. of Michigan Final (Sep)

Earnings: No major earnings

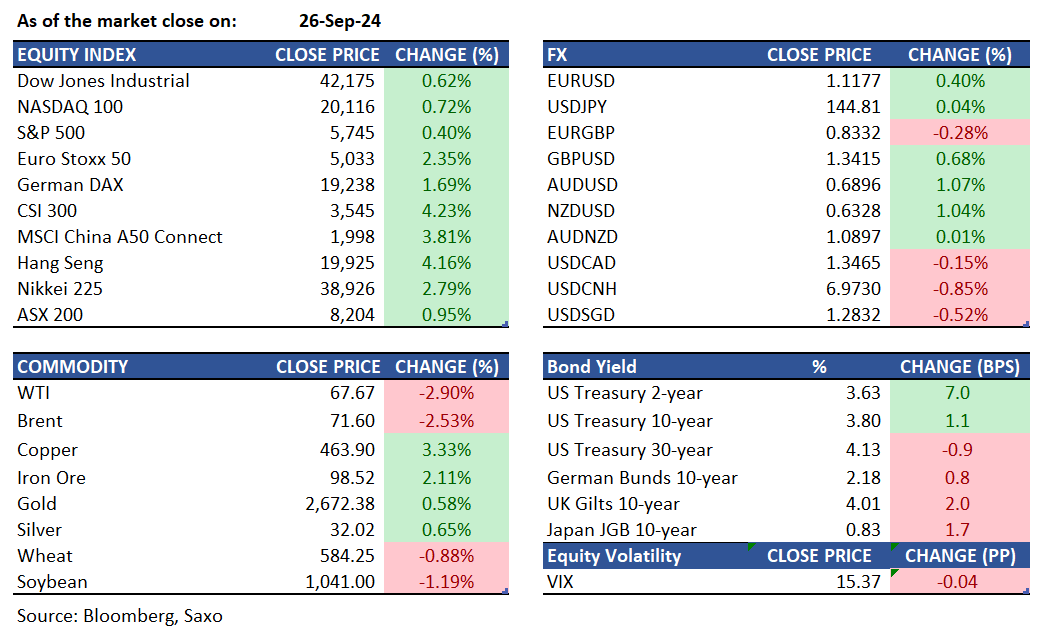

Equities: On Thursday, the S&P 500 rose 0.4% to reach a new record high, while the Nasdaq gained 0.6%, and the Dow Jones added 260 points. Investor sentiment was buoyed by strong corporate earnings and positive economic data. Micron Technology led the charge, surging 14.7% after an optimistic earnings forecast, which sparked gains across the semiconductor sector. Applied Materials climbed 6.2%, and Lam Research advanced 5.4%. The rally was further supported by encouraging economic reports, including weekly jobless claims falling to a four-month low, indicating a strong labor market. Additionally, second-quarter GDP growth was confirmed at a robust 3%. China stimulus continues to boost sentiment with the Golden Dragon Index up 10.8% and KraneShares CSI China Internet ETF up 11.5%. Hang Seng Index was also up 4.1% in Asia session yesterday and Hang Seng futures were up a further 2.7% overnight. For more on how China stimulus measures can impact markets, read this article.

Fixed income: The Treasuries curve flattened significantly as long-end yields declined and 2-year yields rose by 6 basis points from Wednesday's close, reflecting a reduced Fed rate cut premium in overnight swaps. Losses intensified ahead of the 7-year note auction, which concluded strongly, trading 0.7 basis points through the when-issued yield. Treasury yields were up to 6 basis points higher at the front end, with the 2s10s spread flattening by 6 basis points on the day. The US 10-year yield hovered around 3.785%, nearly unchanged, as the curve pivoted around this sector. The 2s10s spread saw its most significant flattening in over a month, dropping to as low as 16.2 basis points late in the session. Additionally, the amount of reserves in the banking system, a key factor for the Federal Reserve's balance sheet reduction, fell to its lowest level since April 2023.

Commodities: Gold rose by 0.57% to settle at $2,672, supported by China's stimulus commentary. It remains a strong uncorrelated hedge for equity portfolios, bolstered by central bank buying, though it may face profit-taking as momentum appears stretched. Silver extended its strong momentum to reach $32.5 per ounce in late September, its highest in 12 years, driven by expectations of incoming rate cuts by the Federal Reserve. WTI crude futures declined overnight and failed to rally despite positive China stimulus news and favorable economic data. The November contract fell by 2.9% to $67.67, while Brent dropped by 2.53% to $71.60. A Financial Times report suggested that Saudi Arabia might abandon its $100 per barrel target and increase production to regain market share, likely driving the price decline despite attempts by bulls to counter the story. Copper futures rose by 3.33% to $463.90, hovering close to over two-month highs on reports that top consumer China will be rolling out more stimulus measures to support the economy.

FX: The US dollar pared much of its gains as risk-on returned due to the optimism on China’s stimulus measures. The Chinese yuan was back below the 7-handle against the US dollar while the Australian dollar and kiwi dollar outperformed as commodity currencies remain in the spotlight amid optimism that China’s demand could return. High-beat British pound also rose higher. The Swiss franc also defied any pressures given the SNB rate cut was well-expected and there was also an odd chance of a 50bps cut. The only G10 currency that ended lower against the US dollar was the Japanese yen, but losses have been constrained ahead of the LDP elections due today and US PCE out later. The euro and Canadian dollar also underperformed.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.