Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

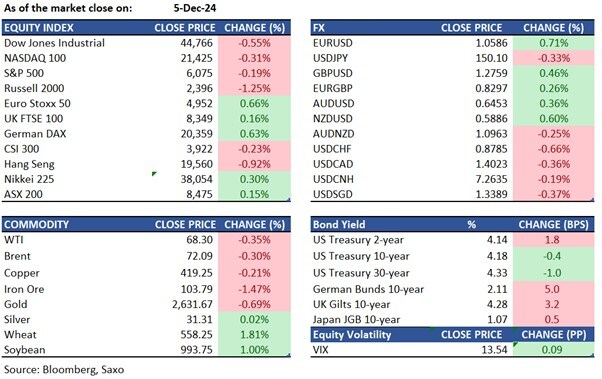

The data will be used to help shape expectations for the December FOMC meeting, where the vast majority of analysts expect a 25bps rate cut, while money market pricing is assigning 70% probability of a rate cut. Governor Waller has said that he favours a 25bps rate cut in December, and while some other members have hinted at caution at the pace of easing – that is more a 2025 story. Mary Daly speaks after the NFP release and her comments could be key to shape up December Fed expectations, but a 300k+ headline print may be needed to dissuade the Fed from cutting rates this month. For a trader’s preview of the NFP, read this article.

Equities:

FX:

Commodities: WTI crude stayed near $68 per barrel as OPEC+ maintained Q1 2025 production levels, planning gradual increases until September 2026. U.S. data showed a large stockpile drop but record production. Gold fell below $2,630 per ounce due to rising Treasury yields. Silver held above $31 per ounce on Fed rate cut bets. Copper traded around $4.14 per pound, amid speculation of Beijing stimulus measures.

Fixed income:

For a global look at markets – go to Inspiration.