Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Biden/Trump debate on CNN, Riksbank Announcement, China Industrial Profits YTD (May), EZ Sentiment Survey (Jun), US GDP Final (Q1), US Jobless Claims (Jun 22)

Earnings: Walgreens Boots Allianc, McCormick, AcuityBrands, SimplyGood, Apogee, Lindsay, Nike, Accolate, American Outdoor Brands, Pinstripes

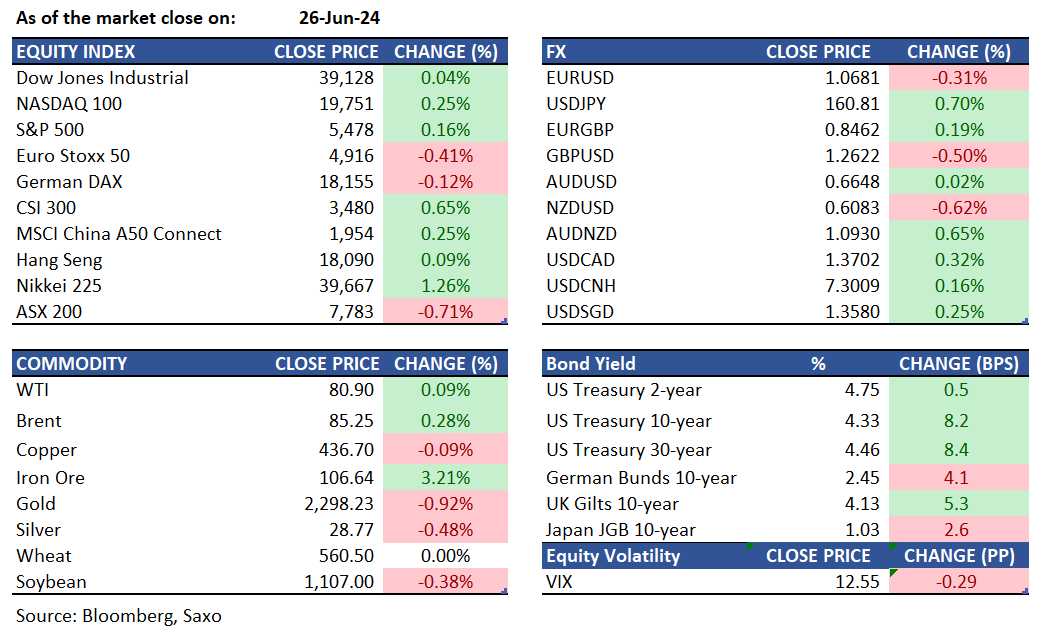

Equities: U.S. equities exhibited mixed performance, though underlying market fundamentals displayed weakness, with 10 out of 11 S&P sectors declining. A few large-cap, heavily weighted index stocks contributed to a stronger market appearance. Amazon (AMZN) shares reached a record high, hitting a $2 trillion market cap and lifting the Consumer Discretionary (XLY) sector alongside significant gains in Tesla (TSLA), which rose 4.8%. Apple (AAPL) also remained a positive contributor to major indices, gaining 2%. Post-market, Micron experienced an 8% decline following earnings, as their quarterly forecast fell short of investor expectations.

Fixed income: Treasuries extended losses in the US afternoon session, despite a 5-year auction that stopped through the WI level. Investors are now focused on Thursday’s 7-year auction, GDP data, and Friday’s PCE print. Initial weakness was linked to widening swap spreads and continued yen losses. The decline began in the Asian session, triggered by a significant selloff in Australian bonds following hotter-than-expected CPI data. BlackRock's $54 billion iShares 20+ Year Treasury Bond ETF (TLT) saw record inflows of $2.7 billion on Monday, its largest since 2002, as investors adjust expectations for Federal Reserve rate cuts. This brings its total inflows to $4.4 billion for the year, despite a nearly 3% loss.

Commodities: Oil prices edged lower on Wednesday after the EIA reported an unexpected rise in US crude stockpiles, sparking concerns about declining demand. US crude inventories increased by 3.591 million barrels last week, defying expectations of a 3 million barrel drop. Copper futures stayed below $4.4 per pound, their lowest since mid-April, due to uncertain global demand and rising inventories. Recent PMI reports indicate a bleak manufacturing outlook in major economies, worsened by slowing industrial demand in China. Despite an anticipated seasonal decrease, Chinese copper inventories remained high in June, driven by robust domestic production from scrap. This has kept Shanghai bonded warehouse delivery prices at a discount to the LME for over a month.

FX: The US dollar rose to its highest in eight weeks due to higher US yields and month/quarter-end buying, with market focus shifting to the upcoming US presidential debate on CNN. Despite this, AUDUSD resisted the strong dollar pressure, closing nearly unchanged and as the best G10 performer after a surprising May CPI left room for another RBA rate hike. AUD strength is expected to be more pronounced on crosses, with AUDUSD needing a weaker USD to sustain a rally past 0.67. AUDJPY reached record highs at 106.97 and AUDNZD rose above 1.09. USDJPY hit fresh 30+ year highs at 160.87 despite intervention threats. EUR faced pressure ahead of the French elections and from dovish ECB comments, while GBPUSD slipped below its 100-day moving average. The Chinese yuan is in focus as USDCNH rose to 7.30 for the first time since November 2023, impacted by USD strength and JPY weakness.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.