Quarterly Outlook

Upending the global order at blinding speed

John J. Hardy

Global Head of Macro Strategy

Earnings Preview

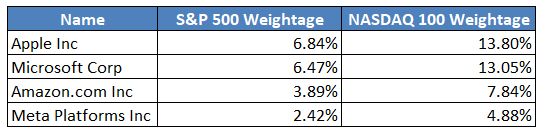

This week will feature earnings reports from Microsoft, Apple, Amazon, and Meta, potentially marking the most significant week of this earnings season. As of 29th July 2024, these four companies make up nearly 20% of the S&P 500 and 40% of the NASDAQ 100 Index.

Significant movements in their stock prices could impact major indexes, especially after last week's earnings from Tesla and Alphabet caused tech stocks to plummet, leading to a sector correction and the S&P 500's worst day since December 2022. Any weakness in this week's major tech earnings could exacerbate the issues that emerged last week. These results could either reinforce or challenge the prevailing concerns about spending on artificial intelligence (AI) that have recently impacted market sentiment. On the other hand, any strength in the big tech earnings could help mend the cracks that began to show last week.

Earnings Date

Price Action

Last week, the S&P 500 Index dropped by 1.5% and the Nasdaq 100 Index decreased by 3.8%, whereas both indexes closed nearly unchanged yesterday. At present, there is substantial open interest in the 2-month S&P 500 (SPX) call and put options at the 5450-strike price level, which coincides with the first key support level of 5447 in the index. The sell off in the Nasdaq 100 has been more significant, having declined 8.2% from the highs with the first support at 18,875. Among the 4 single stocks, Apple presents the most interesting chart pattern, forming a top and reversal pattern with support at $206.5. Kim Cramer, our technical strategist, has provided a more detailed explanation in this video.

Trade Inspiration

If earnings exceed expectations— S&P 500, Nasdaq, and individual stocks like Apple, Microsoft, Amazon, and Meta might surge. You can ride the positive momentum by going long on index futures like E-mini S&P 500 and E-mini Nasdaq 100, or by investing in ETFs that track US indices. Furthermore, Saxo strategists have created a basket of AI software stocks that could benefit from this positive momentum in tech names. Refer here for more details.

If earnings miss expectations - these indices and stocks could face downward pressure. In such a scenario, you might consider hedging your positions by exploring selling opportunities in index futures like E-mini S&P 500 and E-mini Nasdaq 100. In addition, if you believe that the long-term potential of these single stocks, you can gradually add to positions through the selling of cash secured puts or buying the stocks outright.