Quarterly Outlook

Upending the global order at blinding speed

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Employment Trends, US NY Fed Inflation Expectations (Jun)

Earnings: TheGreenBrier

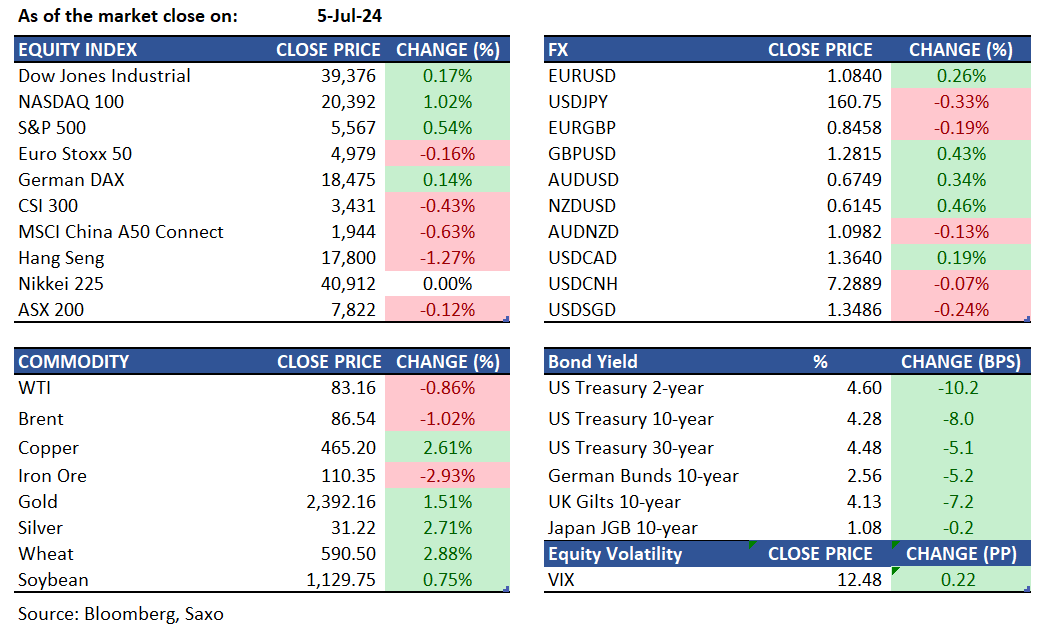

Equities: In June, Nonfarm payrolls rose by 206,000, exceeding the 190,000 estimate, while May and April were revised down. Private payrolls increased by 136,000, below expectations, and manufacturing jobs fell by 8,000. The unemployment rate rose to 4.1%. Average hourly earnings grew 3.9% YoY and 0.3% MoM. Interest-rate futures showed a 72% probability of a September rate cut, with increasing chances for a December cut. Gold prices hit one-month highs as the U.S. dollar fell to three-week lows following mixed jobs data. TSLA's rally extended to +24.5% after delivery data. Crypto stocks slumped as Bitcoin fell over 6% to below $55,000, with concerns about creditors selling returned tokens and weakening short-term correlation with stocks.

Fixed income: Australian and New Zealand bonds advanced following a rally in U.S. Treasuries triggered by the latest jobs report. Market participants are now keenly awaiting the opening of French bond futures, as a left-wing coalition seems poised to secure the most seats in France’s legislative election. Australia’s 10-year bond yields slid by 4 basis points to 4.36%, while the U.S. 10-year Treasury yields dropped 8 basis points to 4.28% on Friday. The yield curve steepened, leading gains in the front and belly sections, with investors pricing in two additional 25 basis point rate cuts into this year's swaps market. Meanwhile, Japan’s 10-year yield fell 1 basis point to 1.07% on Friday. Japanese investors also increased their holdings of U.S. sovereign bonds significantly—the largest amount since March 2023—according to the Asian nation's latest balance-of-payments data released on Monday.

Commodities: Gold climbed to $2,392 per ounce on Friday, close to its record high of $2,450 from May, driven by US jobs data that bolstered expectations of Federal Reserve rate cuts. Silver rose 2.7% to $31.2 per ounce in July, its highest since May. Brent crude futures fell 1% to $86.54 per barrel on Friday due to a potential Gaza ceasefire, despite strong summer fuel demand and possible hurricane-related supply disruptions. However, oil prices saw a fourth consecutive weekly gain, up 3%, supported by a significant 12.2 million barrel drop in US crude inventories, far exceeding the expected 680K barrel decrease. Hurricane Beryl, a Category 2 storm, also raised supply concerns after causing fatalities and damage in the Caribbean.

FX: The US dollar ended last week about 1% lower, sending all the other major currencies higher. This comes on the back of increasing scope for the Fed to cut rates as the US jobs data surprised to the downside. The biggest gainer was the British pound with UK election results providing the market with some stability before focus turns to Bank of England’s rate cuts. The euro also ended last week higher but saw some downside pressures at the Monday open amid continued volatility from the French elections where markets braced for a hung parliament as the left wing saw a surprise surge in the 2nd round elections over the weekend.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.