Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Japanese Services PPI (May), Canada CPI (May), US Consumer Confidence (Jun)

Earnings: Carnival, TD Synnex, Airship, FedEx, Progress

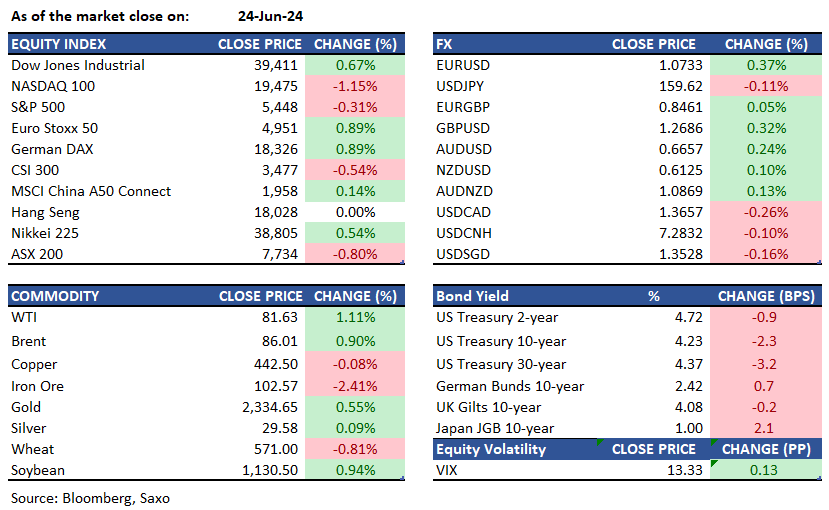

Equities: Stocks ended lower last night after a week of record highs driven by large cap tech stocks. Semiconductor giants like NVDA, AVGO, and ARM have been falling for the third straight day, impacting indices. Despite this, NYSE breadth was positive, with most sectors higher, particularly energy and financials, which are at a one-month high. Banks climbed after regulators announced the results of the annual stress test. Upcoming potential catalysts including the Fed bank stress tests, Q1-final GDP data, the Trump/Biden Presidential debate, and PCE/core PCE inflation data. Energy stocks were the market leaders, while technology stocks saw profit taking after reaching record highs last week.

Fixed income: US 10-year Treasury note remained stable at around 4.26% as the last week of June began. Traders are anticipating key PCE inflation data and comments from several Fed officials to gauge the monetary policy outlook. The upcoming presidential debate between Joe Biden and Donald Trump is also drawing attention. Economic data from last week showed mixed results, with faster manufacturing and services activity growth but elevated initial unemployment claims and disappointing retail sales, housing starts, and building permits. The likelihood of a 25bps Fed rate cut by September is currently at 66%, and traders are still expecting two interest rate cuts this year.

Commodities: Gold prices increased by $13.20, or 0.57%, to reach $2,344.40 per ounce, as the dollar index (DXY) retreated after five consecutive weeks of gains, dropping by 0.3% to 105.55. In the energy market, Brent Crude futures settled at $86.01 per barrel, marking a 0.9% increase of 77 cents, while WTI crude oil settled at $81.63 per barrel, rising by $0.90, or 1.11%. This rise reflects the ongoing upward trend in energy prices as the summer driving season reaches its peak.

FX: The dollar slipped lower at the start of a new week, erasing last week’s gains likely due to month-end/quarter-end selling as portfolios are rebalanced. EURUSD gained strength despite the weakness in German Ifo and climbed to 1.0740. ECB's Villeroy attempted to alleviate some of the growing fears of the French snap election, saying the French Bank's liquidity and capital are very solid and neither have been affected by market moves due to political uncertainty. GBPUSD also rose towards 1.27 but could not break above that level. Intervention threat in the Japanese yen continued to unnerve investors, and a sharp drop in USDJPY to 158.80 was seen before NY open, but this was erased swiftly and pair continued to trade above 159.60. USDCAD was lower at 1.3660 ahead of Canada’s inflation release today.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)