Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

------------------------------------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

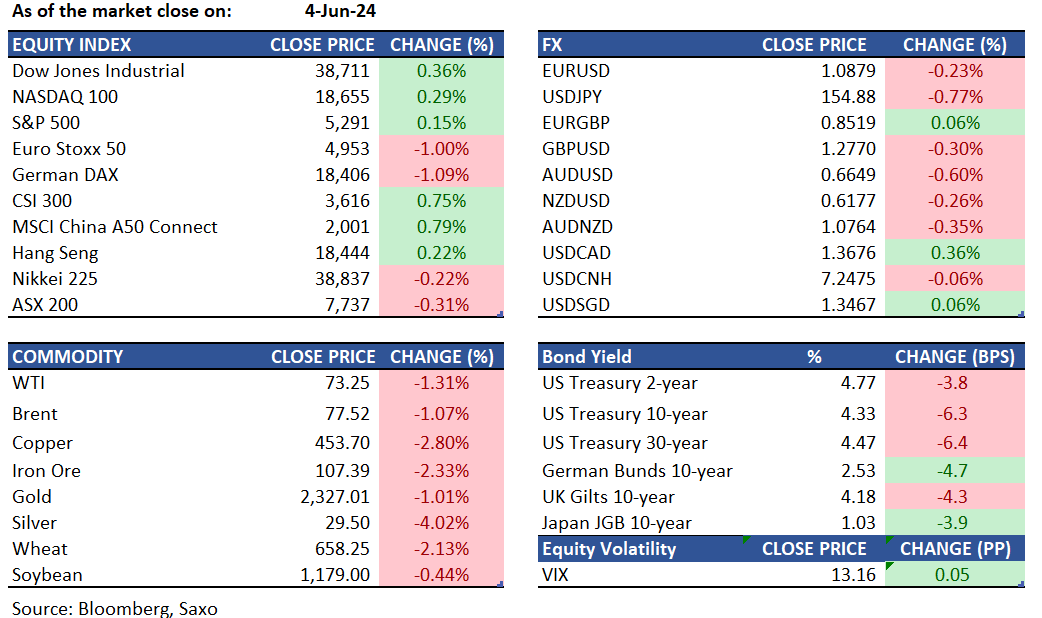

Equities: Amidst a backdrop of economic uncertainty, U.S. stocks traded with some intraday volatility, initially selling off due to a drop in job openings to three-year lows, signaling deceleration in the labor sector. The market managed to pare these losses as the day progressed, rallying sharply in the late afternoon, mirroring the prior session’s pattern. Surprisingly, equity markets did not react much to a significant two-day decline in Treasury yields, with the 10-year yield falling by approximately 20 basis points to 4.3%. Market expectation for an interest rate cut in September have risen to about 65%, up from less than 50% last week, following a report indicating a weakening manufacturing sector. For the second consecutive day, oil firms led the declines in the S&P, with oil prices falling to their lowest point in four months to $73.25 and negatively affecting the stock values of companies like Exxon, Chevron, and ConocoPhillips. Meanwhile, the Russell 2000 Index which represents smaller companies fell over 1%.

FX: The US dollar traded mixed on Tuesday, gaining some strength initially but reversing back lower after the soft JOLTS data. Lower yields saw haven currencies outperform. USDJPY slid below 155 with reports of BOJ considering tapering its bond buying at the June meeting next week. Pair however rose back above 155 this morning even as Japan’s labor cash earnings came in higher than expected at 2.1% YoY suggesting wage pressures may be picking up. USDCHF down to 0.89 and EURCHF has slid below 0.97 even as Swiss core CPI came in unchanged as against expectations of a slight pickup suggesting SNB’s June 20 meeting options remain open. AUDUSD around 0.6650 very much in focus with Q1 GDP out today expected to show a stark softness. EURUSD back below 1.09 and GBP below 1.28, but not too far from these key levels.

Commodities: Oil prices continued to decline as concerns about increased supply and weak U.S. economic data unsettled traders. Silver prices fell below $30 per ounce from an 11-year high of $32 due to evaluations of interest rate policies by major central banks and the impact of US tariffs on Chinese imports of solar cells. Strong domestic demand in China and anticipated interest rate cuts by major central banks limited the decline. Copper futures fell due to low demand, particularly from China, and ample supply. Prices remained 15% higher year-to-date, driven by expectations of potential shortages and the metal's role in electrification and infrastructure projects. Natural gas prices fell after an outage at a Norwegian offshore platform disrupted gas exports to the UK. The outage, which has been extended by two days, caused a 4% surge in gas prices in Europe and a 5% rise in the UK.

Fixed income: Bond market sentiment is shifting toward a dovish stance, with investors increasingly betting on the Federal Reserve to slash interest rates sooner, as evidenced by a robust Treasury rally. The yield on the 10-year U.S. Treasury note has dropped sharply, falling over 30 basis points in just a few sessions, reaching depths not plumbed since mid-May, amid signs that inflation may be stabilizing and economic indicators like manufacturing and consumer spending are weakening. The pullback in yields deepened following a surprising decline in U.S. job vacancies, with the 10-year yield sinking as low as 4.31% today. This downward trend in yields has led to a significant technical milestone, with the 10-year closing beneath its 200-day moving average for the first time in several weeks.

In Japan, the 10-year bond yield edged down by 2 basis points, and JGB futures climbed 21 ticks to 143.37, buoyed by robust demand at the latest 10-year debt auction—a marked improvement from the prior offering. Meanwhile, in Australia, the yield on 10-year government bonds decreased by 6 basis points, paralleled by a 7 basis point drop in the yield of New Zealand's equivalent maturity bonds.

Macro:

Macro events: BoC Announcement, Australia Real GDP (Q1), China Final Caixin Services & Composite PMI (May), EZ/UK/US Final Services & Composite PMIs (May), US ADP National Employment (May), ISM Services PMI (May)

Earnings: Dollar Tree, Ollie’s, UNFI, Hibbett, Land’s End, Campbell’s, Thor, Douyu.com, Global Blue, REV, Lululemon, Chargepoint, Victoria’s Secret, Five Below, Greif, SemTech, Sprinklr, Couchbase, Smartsheet, ReNew

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)