HK Stock

6.98%

| VIP | Platinum | Classic |

| Saxo Offer Interest Rate* + 1.99% | Saxo Offer Interest Rate* + 2.99% | Saxo Offer Interest Rate* + 3.99% |

We offer three levels of pricing depending on your account tier.

| Exchange | VIP | Platinum | Classic |

| 0.005 USD/share (Min. USD 3) | 0.0065 USD/share (Min. USD 3) | 0.008 USD/share (Min. USD 3) | |

| 0.005 USD/share (Min. USD 3) | 0.0065 USD/share (Min. USD 3) | 0.008 USD/share (Min. USD 3) | |

| 0.08% (Min. HKD 18) | 0.06% (Min. HKD 18) | 0.05% (Min. HKD 18) |

• On SaxoTraderGo: You can request Margin Lending on your account via the trading platform. Simply go to ‘Contact Support’, then ‘Request margin lending on my account’.

• On SaxoInvestor: You can request Margin Lending on your account by clicking the “Request margin lending on my account” banner on the main Markets page on the platform.

When a trade is funded by a loan you will be charged a margin lending interest on the loaned amount.

The loan interest is payable from the day that the share purchase is settled. Loan interest will continue until the settlement day for the share sale.

The loan amount is calculated daily based on the net cash balance on each margin lending account (in different currencies) and charged on a monthly basis.

You can find the Margin Lending Interest Costs under Trading Conditions > Trading rates for a given instrument. Furthermore, you will be able to find a breakdown of the charges to your account in the Margin Lending Interest Details report available within the platform.

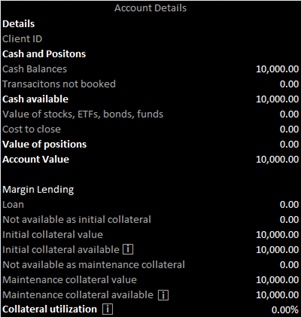

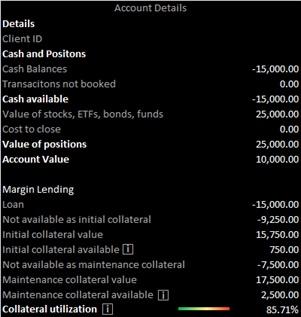

Imagine you deposited USD 10,000 on your Margin Lending account and plan to buy 1,000 shares in the US listed Stock ABC, priced at USD 25/share.

Stock ABC has a risk rating 1, with an initial collateral value of 63% and maintenance collateral value of 70% (haircut = 30%). This means you’ll need to put up 37% of the transaction value as collateral (cash or positions) to open the position. This will give you an effective leverage of up to 2.70x your capital at the time of opening.

After the trade, your net cash balance will change from USD 10,000 to minus USD 15,000, since you have now borrowed USD 15,000 to finance the position value of USD 25,000.

After the trade you will have utilised 86% of your account’s maintenance collateral value. That means you’ll have USD 750 left as unused initial collateral to open new positions worth up to USD 2,027 (assuming a risk rating 1 stock with 63% initial collateral value).

| Pre Trade | Post Trade | ||

|  | ||

| Position details - Stock ABC | Position details - Stock ABC | ||

| # shares | - | # shares | 1,000.00 |

| Share Price | - | Share Price (USD) | 25.00 |

| Market Value | - | Market Value (USD) | 25,000.00 |

| Risk Rating | - | Risk Rating | 1.00 |

| Initial Collateral Value (%) | - | Initial Collateral Value (%) | 63% |

| Maintenance Collateral Value (%) | - | Maintenance Collateral Value (%) | 70% |

| Haircut (Maintenance Margin Req., %) | - | Haircut (Maintenance Margin Req., %) | 30% |

Please note that the above example does not take transactional costs (commissions etc) and financing costs (interest) when holding the position overnight into account.

For more FAQ, please click here.