Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

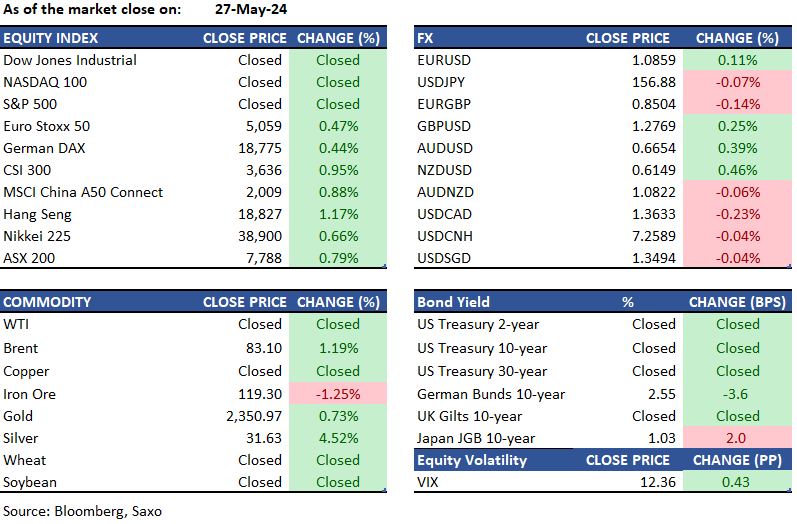

Equities: US and UK stock markets are closed on Monday for Memorial Day. On Monday, Hong Kong stocks surged 1.17% to 18,827, bouncing back from the index's largest weekly drop since January. The upswing was driven by news that profits for industrial companies in China increased by 4 percent in April compared to the previous month. The Nikkei 225 share average rose by 0.66% to end at 38,900, while the broader Topix increased by 0.87%vclosing at 2,766. Ongoing concerns about the Bank of Japan's bond purchases and potential rate hikes were in focus as Governor Kazuo Ueda and Deputy Shinichi Uchida spoke, leading to higher government yields. Financial and insurance stocks rose, with chip-related shares also gaining after strong performances by their US counterparts following Nvidia's earnings report last week.

FX: Risk sentiment remained upbeat, pushing the US dollar lower in a quiet session. Unsurprisingly, gains were led by the risk-sensitive commodity currencies and GBP, while JPY and CHF underperformed. NZDUSD surged to 0.6150 while AUDUSD tested a break of 0.6660, helped by a recovery in the yuan after PBOC’s firmer fixing. USDCNH reversed from Friday’s highs of 7.2632 and traded below 7.26. GBPUSD moved above the 76.4% fibo retracement, unfazed by election news, and was last seen at 1.2770. Next target likely to be the 1.28 handle. USDJPY traded just below 157 with AUDJPY inching above 104.40 and GBPJPY breaking above 200. EURUSD was choppy on ECB Lane’s comments who tried to balance out rate cut expectations beyond June, but remains around 1.0860 ahead of the well-anticipated June rate cut. To read more on our FX views, go to our Weekly FX Chartbook published every Monday.

Commodities: Oil increased as tensions escalated in the Middle East following the death of an Egyptian soldier in a clash with Israeli troops. WTI rose by approximately 1% from Friday's close to near $79 a barrel, while Brent traded close to $83. Egypt's military confirmed the death at the Rafah crossing into Gaza, potentially heightening tensions with Israel. Meanwhile, Gold surpassed $2,350 per ounce and Silver surged by 4.5% to above $31 on Monday, rebounding from the previous session's two-week low of $2,330 per ounce. These gains were supported by safe-haven demand as markets continued to evaluate the Fed's policy outlook, with both metals set to maintain significant gains for the month of May. Wheat reached a 43-week high of 717.25 USd/Bu. Over the past 4 weeks, it has surged by 17.47%, and in the last 12 months, it has risen by 15.83%

Fixed income: Following an extended weekend, cash trading for U.S. Treasuries reopens with market participants keenly anticipating insights from Federal Reserve officials, which could provide indications of the timing for anticipated interest rate reductions. Both Japan and Australia are poised to conduct bond auctions in the near term. The yield on the 2-year U.S. Treasury note marginally declined by a basis point to 4.94%, while the yield on the 10-year note remained unchanged at 4.46%. A roster of Federal Reserve speakers is scheduled for today, with Cleveland Fed President Loretta Mester and Fed Governor Michelle Bowman set to address an audience at a Bank of Japan event. Additionally, Minneapolis Fed President Neel Kashkari is slated to deliver remarks in London. In a separate engagement, Fed Governor Lisa Cook and San Francisco Fed President Mary Daly are expected to participate in a panel discussion focusing on artificial intelligence and its economic implications.

In Japan, the yield on the benchmark 10-year government bond hit a peak of 1.025% on Monday, marking its highest level since April 2012. Bank of Japan Governor Kazuo Ueda, along with Deputy Governor Shinichi Uchida, signaled a potential for a gradual uptick in interest rates, as the nation moves away from a long-standing deflationary baseline of zero percent.

Macro:

Macro events: Canada PPI (Apr), US Consumer Confidence (May), ECB Inflation Expectations (Apr), Australia Retail Sales (Apr). Speakers: Fed’s Mester, Bowman, Kashkari, Cook, Daly

Earnings: Scotiabank, Futu, Danaos, Diana Shipping, Hello Group, Ice Cure, Nanox, Elbit Systems, Biolinerx, Golar LNG, Cava, Digital Turbine, Box, Heico, Joyy, Ooma, Cosan

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.