Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Japan Inflation rate, Fed Williams Speech

Earnings: American Express, SLB, Badger Meter, Autoliv, Fifth Third Bank, Halliburton

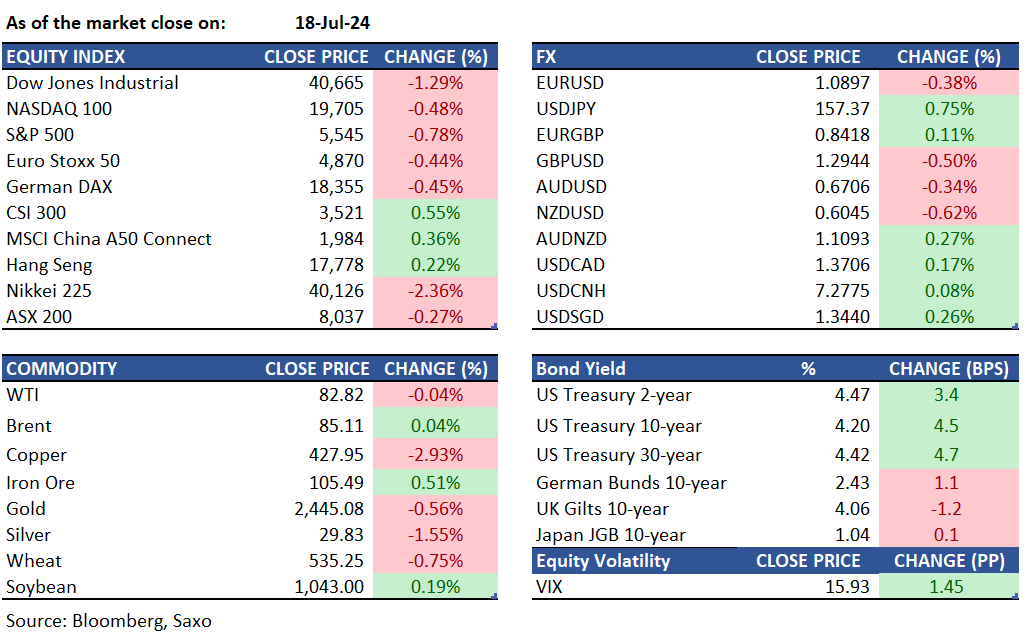

Equities: The Dow Jones Industrial Average reached a new record high of 41,376 before retreating to close down over 1%, ending a 6-day winning streak. The Smallcap Russell 2000 hit a 1-year high but fell over 2% below 2,200 at the close. The S&P and Nasdaq saw their first consecutive daily declines since June. Utilities, Homebuilders, and Energy sectors strengthened amid anticipated Fed rate cuts. Netflix traded flat in the post-market after reporting Q2 earnings that beat both top and bottom lines, adding 8 million-plus subscribers in Q2 that smashed expectations of 4.9 million. TSMC also traded flat in the US after reporting revenue and earnings that beat expectations, with revenue gaining 40% from a year ago.

Fixed income: Treasury yields climbed by 3 to 4 basis points across the curve on Thursday, closing near session highs achieved in the final hour of trading. The move, which lacked a clear catalyst aside from a stronger US dollar, reversed an earlier decline to session lows following higher-than-expected jobless claims. The 10-year yield settled around 4.20%, with curve spreads largely unchanged. In May, total foreign holdings of US Treasuries surged by $89.6 billion to a record $8.13 trillion, despite slight reductions in holdings by China and Japan.

Commodities: Gold prices fell 0.56% to $2,445 per ounce, recovering from earlier lows of $2,304.60 per ounce. This is also down from the recent all-time high of $2,448.40 per ounce. Silver price declined 1.55% and closed below $30 per ounce. Copper prices fell 2.9% to below $4.3 due to profit-taking after a speculation-driven rally pushed the market to a two-year high. Despite this, LME copper has still gained 9% this month. In the oil market, brent crude futures hovered around $85 per barrel on Thursday following a 1.6% increase the previous day. EIA data revealed that U.S. crude stocks decreased by 4.87 million barrels, reaching their lowest level since February and significantly exceeding the forecasted drop of 0.8 million barrels.

FX: A gauge of dollar strength rose for the first time in three days as Treasury yields edged higher and the market found its footing after Wednesday's selloff. The euro continued its slide after the European Central Bank kept interest rates steady and indicated that the September meeting is "wide open." EURUSD dropped 0.3%, trading near a session low of 1.0899, extending losses post-ECB meeting. GBPUSD fell 0.5% to a session low of 1.2948, following data showing UK wages grew at the slowest pace in nearly two years, in line with economists' expectations. The yen weakened from its strongest level in almost six weeks, as a recent sharp rally in Japan’s currency led local businesses to buy the greenback. AUDUSD declined 0.3%, trading near the day's low of 0.6705; earlier, it had risen as much as 0.2% after a report showed a faster-than-expected increase in jobs.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.