Key points:

- Macro: Trump announces temporary exemption for tech devices

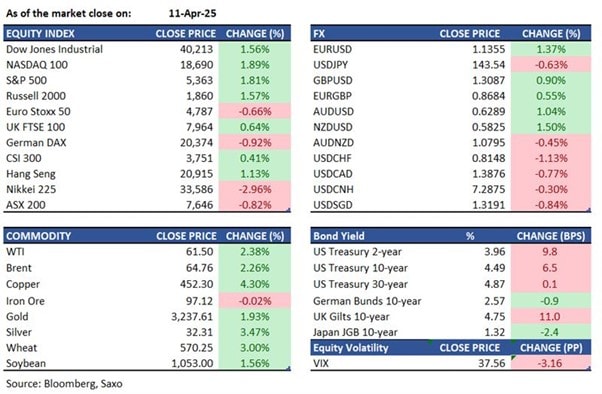

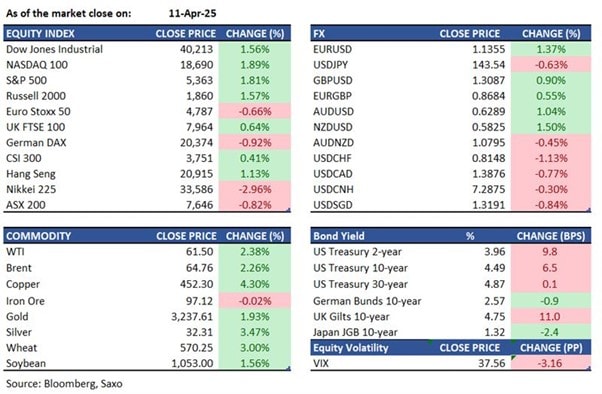

- Equities: S&P 500 rose 1.8% on Friday; US futures up on Trump’s temporary exemption.

- FX: Dollar index fell below 100; JPY strengthened below 143; EUR rose above 1.1350

- Commodities: Copper inventories on the Shanghai Futures Exchange saw a record five-year drop.

- Fixed income: 10-year Treasury yield saw its largest weekly rise in over 20 years

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- The Trump administration announced a temporary exemption for smartphones, computers, and tech items from the new reciprocal tariffs on Chinese imports. However, President Trump stated China remains subjected to the 20% Fentanyl Tariffs and they will soon announce sector specific tariffs on semiconductors.

- Chinese banks issued CNY 3640 billion in new yuan loans, significantly exceeding February's CNY 1010 billion and surpassing forecasts of CNY 3000 billion. The People's Bank of China does not offer monthly breakdowns. Additionally, the money supply increased by 7.4% year-on-year in March, slightly above February and market predictions of a 7.3% rise.

- US PPI (MoM) fell by 0.4%, the first drop since October 2023, below forecasts of a 0.3% rise. Goods prices decreased by 0.9%, mainly due to an 11% plunge in gasoline, with declines in chicken eggs, beef, vegetables, diesel, and jet fuel. Services costs fell by 0.2%, led by a 1.3% drop in machinery and vehicle wholesaling.

- US consumer sentiment dropped to 50.8, the lowest since June 2022, from 57 in March, missing the 54.5 forecast. This marks the fourth monthly decline, with sentiment down over 30% since December 2024 amid trade war concerns. Consumers noted worsening expectations for business conditions, finances, incomes, inflation, and labour markets, signalling recession risks.

Equities:

- US - US stocks surged on Friday, ending a volatile week positively due to hopes for a US-China trade deal. The S&P 500 rose by 1.8%, the Nasdaq 100 by 1.89%, and the Dow by 618 points. The University of Michigan reported consumer sentiment at its lowest since 2022, with inflation expectations at a peak since 1981. Earnings season began with mixed results: Wells Fargo fell 1%, Morgan Stanley rose 1.4%, and JPMorgan jumped 4% with record revenue. US stock futures rose on Monday as investors absorbed recent trade updates, including the Trump administration's late Friday announcement of a temporary exemption for smartphones, computers, and other tech products from new tariffs on Chinese imports.

- EU - European stock markets closed lower after reversing early gains, ending a turbulent week marked by US-China trade tensions that raised fears of a global recession and led to a shift away from US assets. The STOXX 50 dropped 0.6%, and the STOXX 600 fell 0.2%. China imposed 125% tariffs on US goods following Trump's increase to 145% on Chinese imports while the EU paused its retaliatory tariffs for 90 days to encourage dialogue. Novartis shares rose 2.5% after announcing a $23 billion US investment, while Stellantis fell 3.8% due to a 9% drop in first-quarter vehicle shipments.

- HK - The Hang Seng rose 233 points, or 1.1%, to 20,915 on Friday, recovering from morning losses as US futures surged following President Trump’s comments that trade talks were "very close," sparking optimism about China's return to negotiations. The index marked its fourth consecutive positive close, supported by Beijing's efforts to stabilise financial markets, including stock purchases by state entities and share buybacks by listed companies. Gains were widespread, led by tech, financial, and consumer sectors, with chipmakers outperforming—Hua Hong Semiconductor jumped 14%, while SMIC and Horizon Robotics rose over 7% and 12.8%

Earnings this week:

Monday: Goldman Sachs, M&T Bank, FirstBank, Pinnacle Financial Partners, Skillsof

Tuesday: Bank of America, Citi, Johnson & Johnson, PNC, Albertsons Companie

Wednesday: ASML, Alcoa, US Bancorp, Abbott, Progressiv

Thursday: TSMC, UnitedHealth Group, Huntington Bancshares, American Express, Regions Financia

Friday: D.R. Horton, Ally Financial, Hooker Furniture, Fifth Third Bank, Texas Capital Bank

FX:

- USD fell below 100.00 due to China's tariffs increase to 125% on US imports, causing a lack of confidence in US assets. It later rebounded. The US Producer Price Index was lower than expected, and the University of Michigan's April report showed disappointing metrics with rising inflation expectations.

- NZD was the leading performer among the G10 currencies, trading above 0.5850.

- GBP saw a modest rise to above 1.30 level following stronger-than-expected UK growth data for February, although this was short-lived due to recent developments.

- CHF traded near 0.8160, SNB spokesperson did not comment on the CHF's strength or any potential actions.

- EUR rose to above 1.1360. ECB President Lagarde stated they are prepared to use available tools to ensure price stability and mentioned she would not disclose any Fed intervention to support US Treasuries, emphasising that the ECB does not target specific FX rates.

- CAD rose to a five-month high, nearing $1.39, due to significant weakness in the US dollar as investors moved away from US assets amid recession and high inflation concerns.

- JPY surpassed 144 against USD, reaching a six-month high, as concerns over the US economy led to widespread dollar weakness and increased demand for safe-haven assets.

- Major economic data: China Balance of Trade, Japan Industrial Production, Fed Speech

Commodities:

- Oil steadied above a four-year low, with Brent near $65 and WTI above $61, as traders considered US trade war moves and talks with Tehran. Trump paused duties on electronics but hinted at future tariffs.

- Copper inventories on the Shanghai Futures Exchange fell by nearly 43,000 tons this week, the largest drop in five years, as manufacturers and traders bought heavily in futures markets due to collapsing prices.

- Gold dipped from its record high and fell up to 0.8%, after rising over 6% last week to above $3,245 an ounce for the first time.

Fixed income:

- The Treasury curve's front end saw yields rise nearly 10 basis points, while the long end closed nearly unchanged, reversing Thursday's steepening. Large 10-year futures sales amid volatility worsened early losses. Yields rose as the longer-term Treasury selloff eased, with 30-year yields experiencing one of the largest weekly jumps since the 1980s. The 10-year yield's weekly rise is the largest since 2001.

For a global look at markets – go to Inspiration.