Key points:

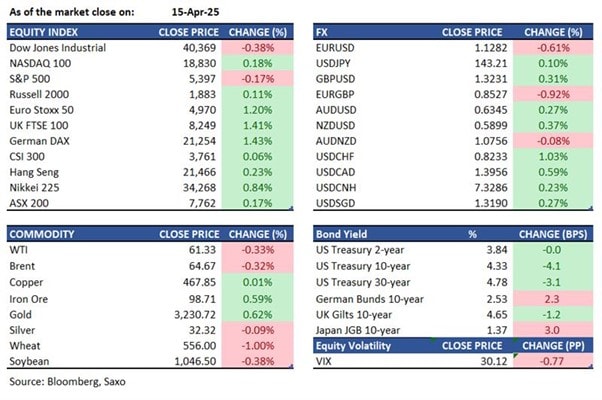

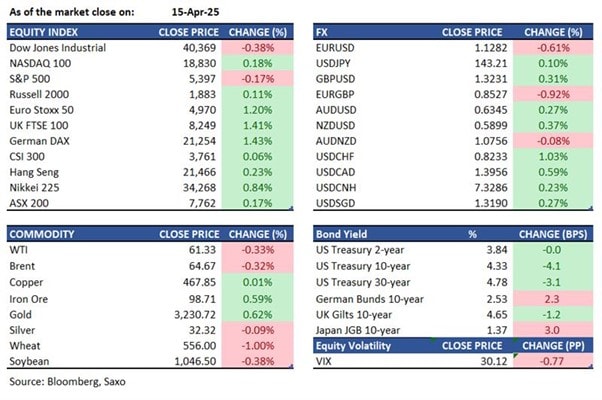

- Macro: China halts Boeing Jet deliveries

- Equities: Nvidia is down 6.3% post market after US blocks H20 chip exports to China

- FX: Dollar Index rose above 100; GBP rose to 1.3230 driven by strong employment data

- Commodities: Gold hit a new record high driven by heightened demand for safe-haven

- Fixed income: Canadian bonds outperformed ahead of the Bank of Canada meeting

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- U.S. reviews pharmaceutical and semiconductor imports before Trump's tariff announcements. Reports indicate China halted Boeing jet deliveries amid the trade war. The White House press secretary said the U.S. is open to a deal, but it's up to China to reach out first. Canada granted temporary six-month relief from counter-tariffs on U.S. goods used in manufacturing, processing, and food packaging.

- Canada's annual inflation rate decreased to 2.3% from February's 2.6%, below expectations of 2.7%. This drop marks the beginning of BoC's predicted inflation normalization after the end of GST and HST breaks last month had increased the rate by 0.6 percentage points.

- Japan's core machinery orders rose 4.3% to ¥894.7 billion, exceeding expectations. This marked a recovery from January's decline, with manufacturing orders up 3% to ¥425.4 billion and non-manufacturing orders up 11.4% to ¥487.3 billion.

- U.S. import prices decreased by 0.1%, contrary to expectations, following a revised 0.2% rise in February. This was the first drop since September 2024, driven by a 2.3% fall in fuel prices. Nonfuel import prices increased by 0.1%, with gains in capital goods, industrial supplies, and foods offsetting declines in consumer goods and vehicles.

- U.S. export prices remained unchanged, following a revised 0.5% rise in February. Agricultural export prices were stable, with soybean price increases balancing declines in wheat and rice. Nonagricultural export prices fell 0.1%, the first drop in six months, as decreases in industrial supplies and foods outweighed gains in capital goods, consumer goods, and vehicles.

Equities:

- US - The three major US stock indices ended mixed on Tuesday amid corporate earnings and tariff concerns. The S&P 500 and Dow Jones fell 0.2% and 0.4%, breaking a two-day winning streak, while the Nasdaq 100 rose nearly 0.2%. President Trump urged China to resume negotiations to ease tariffs, emphasising US consumer demand. Financials provided some relief, with Bank of America up 3.6% and Citigroup gaining 1.7% on strong earnings. Johnson & Johnson dipped 0.5% despite beating estimates, and Boeing fell 2.4% after reports that Beijing instructed Chinese airlines to stop new jet orders. Nvidia fell 5.7% in late trading after it says US is blocking H20 chip exports to China, despite this being compliant with earlier restrictions.

- EU - European stocks rose sharply on Tuesday, building on the previous session's gains, as hopes of a US pause on auto tariffs boosted key sectors. The Eurozone's STOXX 50 increased by 1.2%, and the STOXX 600 climbed 1.6%. Investor sentiment improved following President Trump's comments about considering temporary tariff exemptions for imported vehicles and parts to allow automakers more time to expand US production. This optimism extended to companies in the auto sector, with Stellantis surging 6.5%, and Volkswagen and BMW each gaining 3%. Santander and UniCredit also rose over 3%, leading gains in the banking sector. However, LVMH fell over 7% after reporting disappointing first-quarter revenues.HK - The Hang Seng rose 49 points, or 0.23%, to 21,466 on Tuesday, marking its sixth consecutive gain and maintaining a two-month high. U.S. tariff exclusions on electronics bolstered sentiment, easing concerns over President Trump's tariffs on China. Caution prevailed ahead of key Chinese economic data due Wednesday, including Q1 GDP, industrial production, retail sales, and the jobless rate. Financial and consumer stocks in Hong Kong rose modestly, while property shares remained subdued. Notable gainers included H World Group, Laopu Old, Pop Mart Intl., and Mixue Group.

Earnings this week:

Wednesday - ASML, Alcoa, US Bancorp, Abbott, Progressive

Thursday - TSMC, Netflix, UnitedHealth Group, Huntington Bancshares, American Express, Regions Financial

Friday - D.R. Horton, Ally Financial, Hooker Furniture, Fifth Third Bank, Texas Capital Bank

FX:

- USD strengthened with DXY trading above 100 level, ending a three-day losing streak, aided by weaker EUR, CHF, and CAD. The White House considered over 15 trade deals, but EU-US tariff talks stalled. US-China tensions rose as China halted Boeing deliveries. Mixed data showed cooling import prices, flat exports, and improved NY Fed manufacturing.

- EUR fell below 1.13 against the USD amid pessimism over EU-US trade talks and mixed data, including weak German ZEW figures.

- GBP advanced, reclaiming the 1.32 level, driven by stronger-than-expected UK employment data.

- JPY slightly weakened to 143.20 against the USD but gains in USDJPY were limited due to a subdued risk mood and softer US yields.

- Canada will provide a six-month tariff relief on certain US imports. Weaker March CPI pushed USDCAD to 1.3970. Analysts anticipate the BoC will keep rates at 2.75% during its April meeting on Wednesday.

- AUD rose towards $0.635, achieving its fifth straight session of gains, driven by enhanced global risk appetite.

Major economic data: China GDP Growth Rate, China Industrial Production, China Retail Sales, UK Inflation Rate, US Retail Sales, Canada BoC Interest Rate Decision, Canada BoC Monetary Policy Report, US Fed Chair Powell Speech

Commodities:

- Oil steadied after a slight drop, with Brent below $65 and WTI near $61, as surplus concerns and trade tensions weighed on demand. The IEA cut consumption forecasts, noting supply should exceed demand.

- Industrial metals stabilised as investors assessed Trump's tariff actions. Copper fell below $9,200 a ton, nickel rose 1.6%, and aluminium was steady. Trump suggested pausing auto tariffs, raising negotiation hopes.

- Gold hit a record high as Trump administration probes threatened to expand the trade war, boosting demand for safe havens. Bullion rose above $3,248, surpassing Monday's peak.

Fixed income:

- Treasuries rose with yields near daily lows and up to 6bp richer. Canadian bonds outperformed ahead of the Bank of Canada meeting, driven by soft CPI data. Swap spreads widened after positive bank regulation comments from Deputy Treasury Secretary Michael Faulkender. Front-end Canadian rates were boosted, with the 2-year sector trading almost 4bp richer than Treasuries.

For a global look at markets – go to Inspiration.