Key points:

- Macro: President Xi met with private companies including Alibaba and Meituan

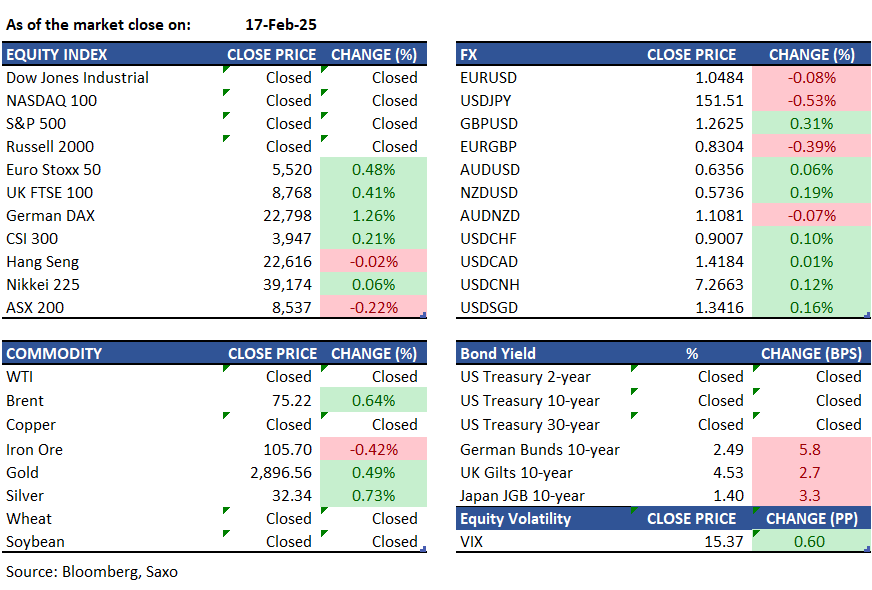

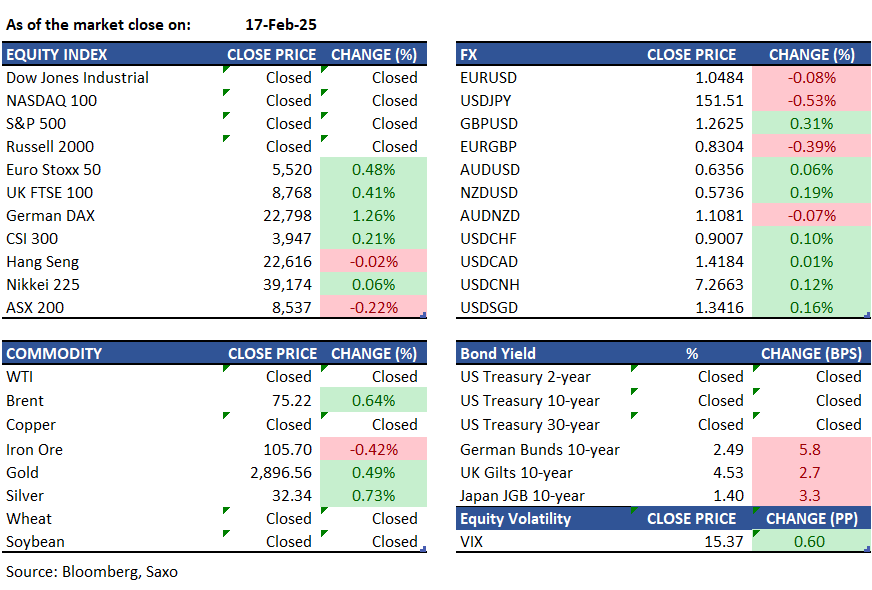

- Equities: DAX hits record high, boosted by defense stocks and spending

- FX: JPY strengthened after strong GDP figures, trading below 152 against USD

- Commodities: Gold rises to reclaim the $2,900 level

- Fixed income: Australia's yield curve bull-steepened before RBA

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

Macro:

- President Xi Jinping held a meeting with private companies, including Alibaba, Meituan, Xiaomi Corp, and BYD Co, urging entrepreneurs to stay competitive and confident in China’s future. This meeting by Xi himself sends a strong signal on China’s commitment to boost the economy. Meanwhile, investors kept an eye on Reuters reports suggesting that Beijing is hopeful the European Commission will reach a "political decision" concerning the bloc's anti-subsidy investigation into Chinese electric vehicles.

- Eurozone's trade surplus decreased to €15.5 billion from €16.4 billion the previous year, surpassing market expectations of €14.4 billion. Imports grew by 3.8% year-over-year to €211 billion, while exports saw a more modest increase of 3.1% to €226.5 billion. For the entire European Union, the trade surplus expanded slightly to €16.3 billion from €16.1 billion.

- Japan's economy experienced a modest growth of only 0.1% in 2024, marking a significant slowdown from the 1.5% increase seen the previous year. This represents the slowest growth rate since 2020, attributed to rising challenges such as natural disasters, the depreciation of the yen, and uncertainties in global trade.

Equities:

- US - Stock markets were closed for Presidents' Day, but equity futures experienced slight gains during the limited trading hours.

- HK – HSI closed nearly flat at 22,616 on Monday, after an early 1.5% surge. Gains in property and financial stocks offset losses in tech and consumer sectors. Traders took profits from a tech rally, awaiting policy signals from President Xi's meeting with firms like Alibaba and Xiaomi.

- EU - European stocks climbed on Monday, with the STOXX 50 and STOXX 600 up 0.5% to new highs, driven by rising defense stocks on expected European defense spending. European leaders met in Paris over Russia's Ukraine invasion, as US-Russia talks are planned in Saudi Arabia, with uncertainties about Ukraine's participation. DAX index rose 1.3% to a record high of 22,797.

Earnings this week

Tuesday: Baidu, Arista, Oxy, Devon, Toll Brothers

Wednesday: Etsy, SolarEdge, Garmin, Wix, Fiverr

Thursday: Alibaba, Walmart, Unity, Wayfair, Newmont

Friday: Mercado Libre, Rivian, Block, Booking Holdings, Texas Roadhouse

FX:

- USD remained stable, showing mixed results against major currencies, with minimal US news due to participants being away. Comments from Fed officials Bowman and Harker had little impact, as attention turns to the upcoming FOMC minutes midweek.

- EUR slightly weakened against the USD after failing to maintain the 1.05 level, following an emergency summit on Ukraine in Paris.

- GBP gained strength, with GBPUSD rising above 1.26, as UK PM Starmer prepares to meet US President Trump next week.

- JPY outperformed, trading around 151.00 against the USD, boosted by strong recent GDP data.

- Major economic data: AU RBA interest rate decision, UK unemployment rate, CA Inflation rate. GE ZEW Economic Sentiment Index

Commodities:

- Oil steadied as OPEC+ considered delaying output increases following Ukrainian drone attacks on a Russian station. WTI was near $71, and Brent topped $75. The Ukrainian strike also slowed Kazakhstan's pipeline exports.

- Gold futures edged higher in light trading, up 0.4% to $2,912.20 per troy ounce. Prices rebounded from Friday's sharp selloff, bolstered by a softer U.S. dollar and ongoing safe-haven demand amid uncertainty over President Trump's tariff policies.

Fixed income:

- Treasury futures fell as cash trading prepared to resume post-holiday. Australia's yield curve bull-steepened ahead of the Reserve Bank's decision, with the 3-year note yield down 3 bps to 3.85%, anticipating the first rate cut in four years. Japanese 10-year bond futures decreased by 20 ticks, and the Ministry of Finance plans a ¥1 trillion bond auction. Bunds eased a bear steepening move, underperforming euro-area peers and gilts, amid talks of potential joint EU bond sales following US officials' remarks on limited support.

For a global look at markets – go to Inspiration.