Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Earnings: Procter & Gamble, American Express, Schlumberger, Comerica, Fifth Third Bank

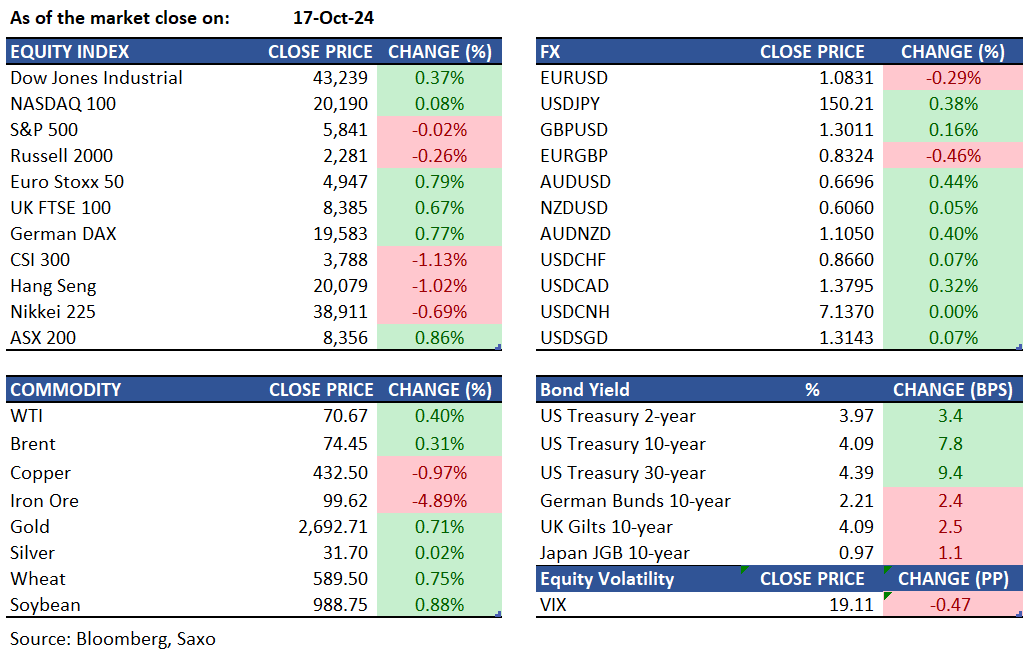

Equities: US stocks traded mostly higher Thursday afternoon, with semiconductor shares driving the gains after strong corporate and economic news. The S&P 500 ended the session flat after briefly touching a new record, the Dow Jones was up over 100 points after hitting all time highs of 43,272, and the Nasdaq 100 rose 0.3%. Nvidia surged 3% to a new record high after its key supplier, Taiwan Semiconductor (TSMC), posted robust Q3 earnings that showed a 54% yoy growth and also raised its revenue outlook. TSMC’s shares spiked 11%, lifting other chipmakers higher like Broadcom (2.6%) and Micron (2.57%). US data continues to outperform with retail sales data for September showing a 0.4% rise vs 0.3% est, which further bolstered sentiment. Additionally, jobless claims came in lower than forecast, reinforcing the view that consumer spending remains resilient. Netflix reported earnings after the close which showed that they beat top and bottom line estimates and they added more than 5 million subscribers in Q3, exceeding expectations of about 4 million.

Fixed income: Treasuries fell after stronger-than-expected September retail sales and upward revisions to August figures, along with a drop in weekly initial jobless claims. Initial losses led by the front end flattened the yield curve, but it ended steeper due to long-end underperformance. Long-end yields rose about 9 basis points, while front-end and belly yields increased by 3 to 7 basis points. The 10-year yield climbed over 7 basis points to 4.09%, just 1 basis point below the day's high. Movement was driven by economic data releases and supported by euro-zone bonds, where investors anticipated larger ECB rate cuts following comments from President Lagarde. German front-end yields declined by about 2 basis points.

Commodities: Gold prices rose by 0.71% to $2,692, reaching new all-time highs earlier in the session. This increase occurred despite gains in yields and the US Dollar. The rise is attributed to uncertainty ahead of the US elections and ongoing tensions in the Middle East, which continue to position gold as a safe-haven asset. Technical indicators also favor buyers. Although economic data was stable this morning, investors anticipate future easing by the Federal Reserve. Meanwhile, November WTI crude futures climbed by 0.40% to $70.67, and Brent crude increased by 0.31% to $74.45. These gains were supported by better-than-expected US economic data and a weekly inventory draw, contrary to the expected build. The improved economic outlook has led investors to lean towards a soft landing rather than a recession for now. Iron ore futures fell below $100 as a Chinese government briefing failed to introduce aggressive property sector policies. Officials announced expanding a 'white list' of real estate projects and increasing bank lending to 4 trillion yuan, but markets were disappointed by the reliance on existing measures.

FX: A Bloomberg index of the dollar rose after strong US consumer spending and labor data led traders to scale back their expectations of interest-rate cuts from the Federal Reserve. The euro declined as European Central Bank officials highlighted growth risks while lowering borrowing costs. EURUSD dropped to a session low of 1.0811 as the ECB cut interest rates for the third time this year, bringing the key deposit rate to 3.25%. The yen weakened past the critical 150 level after US data strengthened the dollar, with USDJPY reaching a session high of 150.30, its highest since August 1, leading G-10 losses. USDCAD reversed Wednesday’s decline, climbing 0.3% to 1.3795. The Australian dollar outperformed after Australia's unemployment rate remained steady, prompting traders to delay their expectations of RBA rate cuts next year.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.