Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: RBNZ Interest Rate Decision

Earnings: Thera, Manu, WD40, PriceSmart, Azz, E2Open

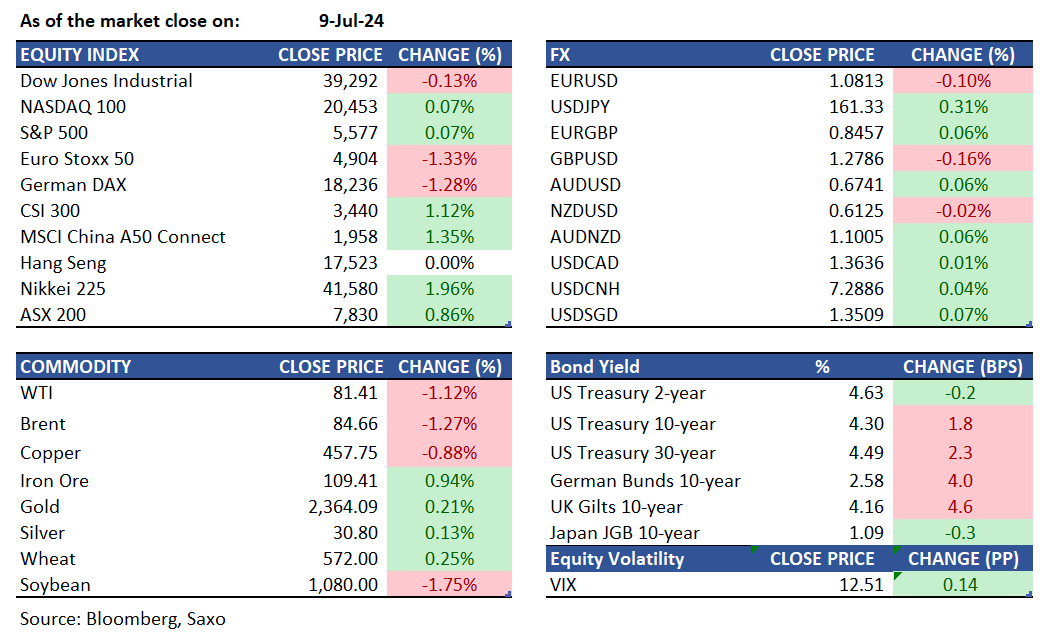

Equities: Fed Chair Jerome Powell's testimony before the Senate Banking Committee offered no major headlines or signals on rate cut timing, yet many economists are more confident about a September reduction. Powell noted the U.S. is no longer an overheated economy, with a cooling job market similar to pre-pandemic levels. S&P and Nasdaq hit all-time highs, while financials and large-cap tech stocks gained ahead of CPI data and upcoming bank earnings. Key 52-week highs included AAPL, AMAT, COST, CROW, GOOGL, LLY and WMT.

Fixed income: Treasuries finished Tuesday higher from the belly to the long end, rebounding from session lows during Fed Chair Powell’s testimony, where he stressed the need for more data indicating cooling inflation. Robust demand for the 3-year auction helped stabilize the market and bolstered curve-steepening ahead of the 10- and 30-year reopening. Long-end yields increased by over 2 basis points, while short maturities remained steady, with the 10-year yield closing at approximately 4.30%.

Commodities: Brent crude futures declined by 1.3% to $84.66 per barrel, marking the third consecutive session of losses, as Gulf Coast production and refining infrastructure largely escaped significant damage from Tropical Storm Beryl. Gold prices trades around $2,360 per ounce, amid ongoing market speculation about the Federal Reserve's potential rate cuts in the coming quarters. Copper futures also dropped below $4.6 per pound, retreating from the one-month high of $4.65 on July 5th, as uncertainty about manufacturing demand in China persisted.

FX: EURUSD dipped to $1.082 from $1.084 due to a stronger dollar after Federal Reserve Chair Jerome Powell's testimony, where he emphasized no rate cuts until inflation nears 2%. In Europe, the ECB is expected to cut rates this year as inflation eased to 2.5% in June, though core inflation stayed at 2.9%. Politically, France's hung parliament reduced concerns about radical policies. NZDUSD rose above $0.61, recovering from a low of $0.606 on July 1st, due to weak US economic data. The Reserve Bank of New Zealand (RBNZ) is expected to keep rates high for an extended period and maintain the official cash rate at 5.5% in its July meeting. Second-quarter inflation data is also anticipated later in the month.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.