Quarterly Outlook

Macro Outlook: The US rate cut cycle has begun

Peter Garnry

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Japan/Australia/Eurozone/UK/US Flash PMIs, BoC Policy Decision, German GfK

Earnings: AT&T, Ford, IBM, Thermo Fisher Scientific, Waste Management

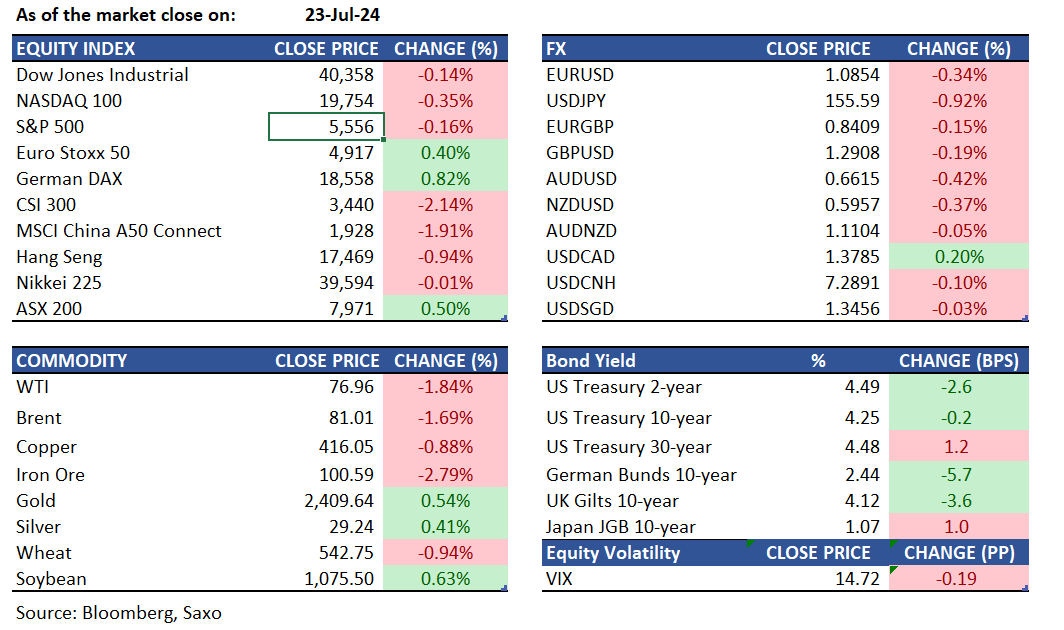

Equities: U.S. stocks ended the session flat with mixed earnings from key names. SAP shares jumped 7.2% on strong results, boosting software stocks, while SPOT rallied 12% on its results and subscriber numbers. GM posted solid results, but shares reversed lower after reaching 52-week highs. Tesla reported profits that missed estimates for the fourth straight quarter, resulting in a 7.8% fall post-market. Alphabet's earnings topped estimates, but the stock fell 2% after hours. Economic data continues to be soft, with existing home sales for June falling -5.4% M/M and a larger negative reading from the Richmond Fed for July.

Fixed income: Treasuries ended Tuesday with mixed results, as the yield curve steepened following robust demand for the $69 billion 2-year note auction. Investors secured a combined 91% of the auction, the highest since 2003, while primary dealers received a record low of 9%. The 2s10s curve inversion eased to about -24 basis points, nearing the least-inverted levels of the year. The Treasury is set to auction $30 billion in two-year floating-rate notes and $70 billion in five-year debt on Wednesday. Meanwhile, Japan’s Ministry of Finance will auction ¥700 billion in March 2064 bonds via a tap sale. Futures of Japan’s 10-year notes fell 10 ticks to 142.8, while the benchmark 10-year yield remained steady at 1.06%.

Commodities: Brent crude fell 1.7% to $81, and WTI dropped 1.8% to $76.96, hitting their lowest levels in over a month due to renewed Israel-Hamas ceasefire talks and demand concerns. Despite a 3-week decline in US crude inventories, summer gasoline demand remains weak. Investors await API's oil inventory estimates and official US data. The upcoming OPEC+ meeting on August 1 is not expected to change output policies. Gold price continued to decline yesterday but has stabilized in early trading this morning, closing back above $2400. Silver prices dropped below $29, approaching their lowest levels since mid-May due to a weakened demand outlook in China, the leading consumer, which affected investor sentiment. Copper declined to around $4.15, marking their lowest point since early April amid worries over demand from China, the largest consumer.

FX: The US dollar was higher on Tuesday across most major currencies, but fell against the Japanese yen. The yen has seen broad strength as US yields continue to fall in the run up to the Fed meeting next week where Chair Powell could acknowledge the progress on bringing inflation back towards the target and potentially open the door to a September rate cut. Meanwhile, expectation for the Bank of Japan to hike rates again next week is also underpinning and pushing Japanese yields higher. Activity currencies such as the Norwegian krone, New Zealand dollar and the Australian dollar, meanwhile, continue to weaken with commodity prices on a decline and equities also seemingly losing momentum. Canadian dollar will be on watch today with Bank of Canada meeting on tap, and recent decline in the Loonie could mean that further weakness would need a rate cut and dovish language along with it.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.