Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

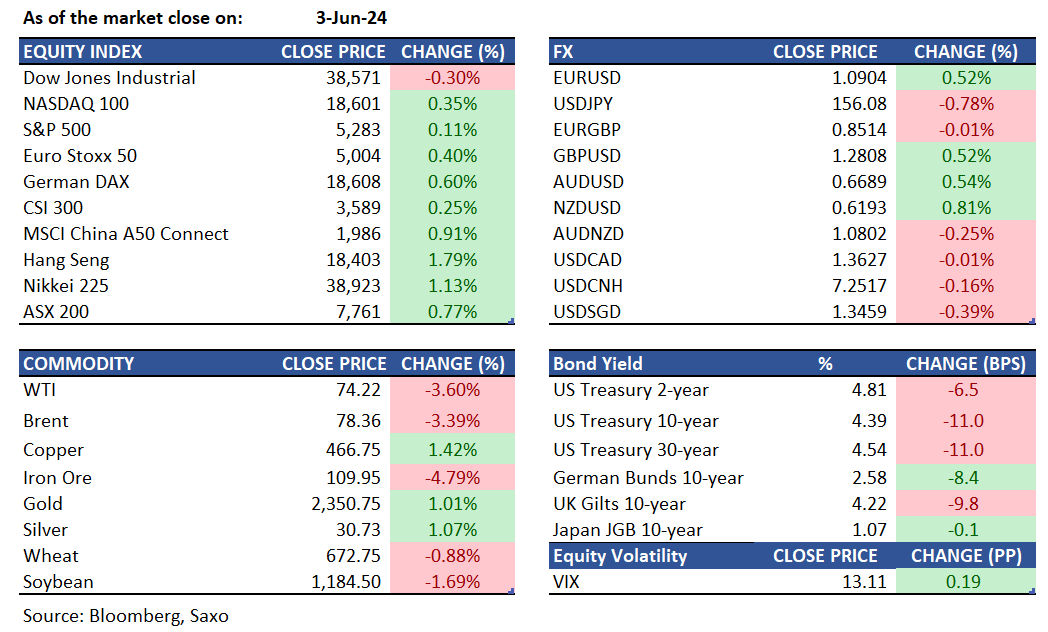

Equities: Stocks ended mixed, with the Nasdaq up and the Dow and Russell 2000 down, retracting after a positive opening that followed Friday's rally. The S&P 500 notably rebounded from its prior lift-off level. Despite initial steep drops—the Dow over 300 points and the Nasdaq by 250 points—both significantly recovered from their daily lows in a session marked by volatility. Energy stocks led losses in the S&P due to falling oil prices after OPEC+ extended output cuts. Tech and Communications sectors lost early gains while Materials, Industrials, and Financials also declined. Upcoming job data (JOLTs, ADP, Nonfarm Payroll) take the spotlight this week but ISM manufacturing data last night showed a decline with falling new goods orders, easing input inflation, and U.S. construction spending dropping for the second month. Meme stock frenzy continues with Gamestop rising as high as 90% in the premarket before ending the session up 21%.

FX: The US dollar plummeted lower at the start of the week as weakness in ISM manufacturing took Treasury yields lower. NZDUSD outperformed, breaking above 0.6150 to highest levels since March and looking to attempt a break of the 0.62 handle in early Asian trading hours. Japanese yen also got a sigh of relief, and USDJPY slipped all the way to test the 156 handle. Swiss franc in focus today as Swiss CPI is reported and SNB Jordan sounded concerned about weak franc last week. USDCHF slumped to break below 0.90 and was last seen around 0.8950, its lowest levels since the SNB rate cut on March 21. EURUSD rallied above 1.09 ahead of the expected ECB rate cut this week, and GBPUSD is above 1.28. CAD underperformed, as we noted in Monday’s macro and FX podcast, with USDCAD wobbling around 1.3620 ahead of the likely BOC rate cut on Wednesday. For more on our tactical G10 FX views, read the Weekly FX Chartbook.

Commodities: Oil prices remained near their lowest levels in nearly four months as concerns about oversupply arose following OPEC+'s plan to increase production. WTI crude fell 3.6% while Brent Crude was down 3.39%. Natural gas saw a nearly 7% increase, continuing May's strong performance, as summer heat began to impact the U.S. Gold rose just over 1% to $2,369.30 an ounce due to a drop in the dollar and yields. Iron ore futures declined by 4.79%, while cocoa futures surged to trade around $9,800 per tonne.

Fixed income: Japanese 10-year bond futures climbed for a consecutive day, following the lead of U.S. Treasuries, which gained on Monday. The upswing in U.S. bonds came after lackluster U.S. ISM manufacturing figures prompted traders to heighten their expectations for a Federal Reserve rate reduction. Treasuries advanced along the maturity spectrum on Monday, buoyed by reports of accelerated contraction in factory activity and near-stagnant output, which pushed 10-year yields down by 11 basis points to 4.39%. In early Tuesday dealings, Australia's comparable yields dropped by seven basis points, while New Zealand's yields declined by nine. Swap contracts linked to forthcoming Federal Reserve gatherings are still forecasting a quarter-point interest rate decrease in December, while the likelihood of a cut occurring as early as September has crept up to approximately 50%, with November also being assigned strong probabilities.

Macro:

Macro events: Swiss CPI (May), German Unemployment (May), US Durable Goods (Apr), US Factory Orders (Apr), US JOLTS Job Openings (Apr).

Earnings: BBWI, Ferguson, Donaldson, Core&Main, Designer Brands, CrowdStrike, Hewlett Packard, PVH, Stitch Fix, GuideWire, Sportman’s Warehouse, Verint, Lakeland

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.