Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Powell at Fed's Jackson Hole Economic Policy Symposium, BoJ Governor Ueda’s Testimony, Canada Retail Sales (Jun), ECB Wages

Earnings: Gold Fields, Hafnia

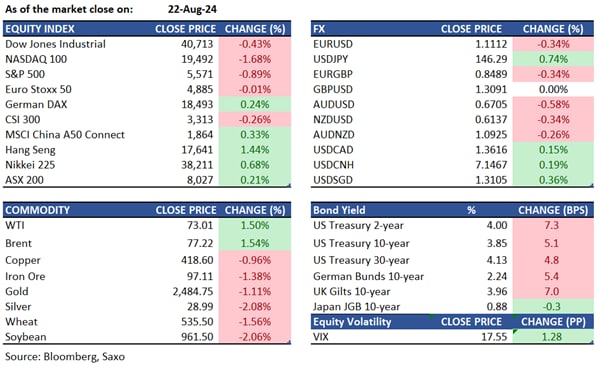

Equities: US stocks pulled back on Thursday as rising yields led to caution ahead of Fed Chair Jerome Powell's speech at the Jackson Hole symposium on Friday. The S&P 500 fell 0.9%, the Nasdaq 100 declined 1.7% with a significant drop in tech shares, and the Dow Jones lost 177 points. New data showed that initial jobless claims rose slightly more than expected in mid-August, increasing concerns about a slowing labor market in the US, following an 818,000 downward revision to nonfarm payrolls for the year ending in March. Meanwhile, S&P PMI data indicated that the US private economy grew significantly in August, driven solely by service providers. The tech sector led the declines, with Nvidia shares falling nearly 2% ahead of their earnings report next week. This report is expected to influence the momentum of tech stocks globally and provide new insights into the sustainability of the AI-driven equity rally that has boosted stocks this year.

Fixed income: Treasuries declined on Thursday after Kansas City Fed President Jeffrey Schmid emphasized the need for more economic data before supporting rate cuts. Contributing factors included a rebound in crude oil prices from their January lows and mixed results from S&P Global US PMIs, with services and composite components exceeding expectations. Strong European PMIs earlier in the day had already pressured Treasuries downward. The Treasury curve bear-flattened, with the two-year yield rising by 7 basis points. Yields had increased by 5 to 7 basis points, flattening the curve; the 2s10s and 5s30s spreads tightened by over 1 basis point. The 10-year yield ended at around 3.855%, up more than 5 basis points, compared to a 7 basis point rise for the UK 10-year yield. Schmid’s comments affected the short end of the curve, initiating the flattening trend. By the session's end, swaps priced in about 29 basis points of easing for September, down from 32 basis points on Wednesday, and 95 basis points for the year, down from 102 basis points. In SOFR options, notable activity included over 100,000 September 2024 call spreads, targeting a half-point Fed rate cut for the September policy meeting. Japan’s 10-year note futures ended down 30 ticks at 144.58, indicating a 3 basis point rise in yields.

Commodities: WTI crude oil futures up by $1.08 (1.50%) to $73.01 per barrel, and Brent Crude futures up by $1.17 (1.54%) to $77.22 per barrel. NYMEX natural gas prices fell by 5.70%, closing at $2.0530. Gold prices dropped from their record highs, with December gold decreasing by $30.80 (1.2%) to $2,516.70 an ounce. Earlier, gold prices ranged between $2,506.40 and $2,551.40 an ounce, down from this week's high of $2,570.40 an ounce. The drop in precious metals happened after the dollar and Treasury yields bounced back.

FX: The US dollar snapped four days of losses to reverse higher as US economic data continued to rule out the case for a larger rate cut from the Fed to kickstart the easing cycle in September. Focus is very much on Chair Powell’s speech today at the Jackson Hole but with more data such as August jobs report and CPI due ahead of the Fed’s September meeting, it may remain hard for him to signal rate cuts that match the market’s pricing. The stronger US dollar weighed on other currencies, but British pound remained the most resilient. The euro faltered but held the support at 1.11 against the US dollar. The Japanese yen saw a steady decline before turning sideways and BOJ’s Ueda will be on watch today.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.