Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Swiss CPI (Aug), Swiss GDP (Q2), US ISM Manufacturing PMI (Aug), Final S&P Manufacturing PMI (Aug)

Earnings: ZScaler, GitLab, Asana, HealthEquity, OneStream

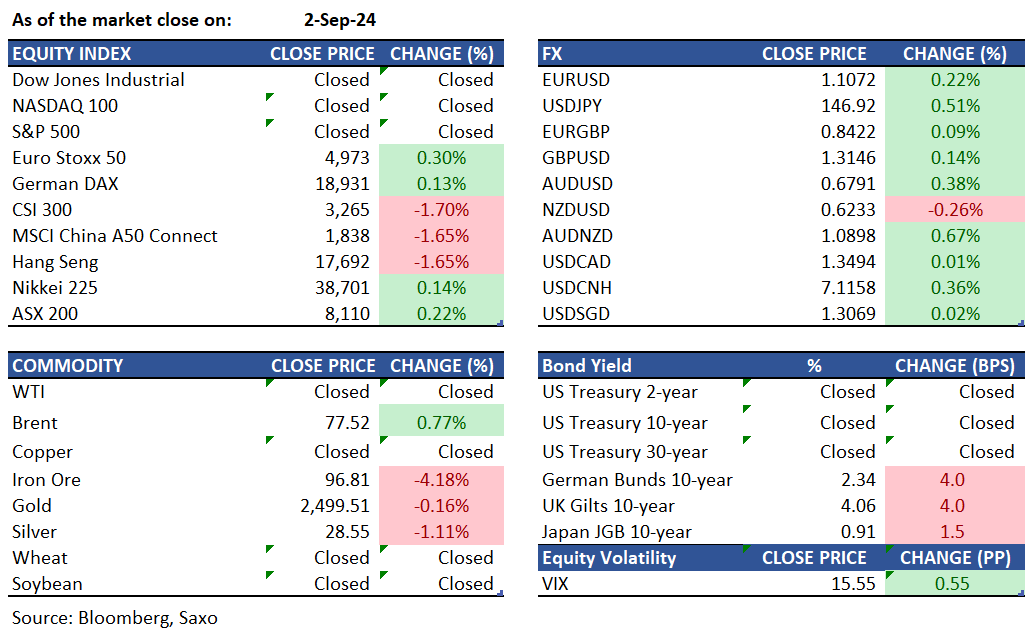

Equities: European stocks bounced back from early losses to close positively on Monday, maintaining the strong momentum seen in August. Investors are closely watching the economic situation for clues on future credit costs and corporate earnings. The Eurozone’s Stoxx 50 rose 0.3% to 4,972, its highest level since mid-July, while the pan-European Stoxx 600 recovered from early setbacks to finish flat at 525, matching the last session’s record high. The tech sector led the intraday recovery, following gains in US markets on Friday. Investors are hopeful that robust results from this week’s ISM PMIs and Friday’s jobs report will support the Fed in achieving a soft landing. ASML and SAP each gained nearly 1%, while Volkswagen rebounded to close 1.4% higher after early losses, outshining other auto manufacturers by announcing new cost-cutting measures and hinting at possible plant closures in Germany.

Fixed income: Treasury futures are declining as cash trading resumes following a three-day weekend. Futures indicate a drop in Japan’s 10-year notes ahead of an auction for this maturity. The Ministry of Finance plans to auction ¥2.6 trillion of June 2034 notes. Japan’s 10-year yield has risen to 0.915%, the highest level since August 6. German Bunds have fallen for a third consecutive day, marking their longest losing streak in over three weeks, while swap spreads tighten as investors absorb €2 billion of 10-year ESM debt and prepare for upcoming bond offerings from Austria and Germany. Money markets have reduced ECB rate-cut expectations by up to 4 basis points, now pricing in 23 basis points of easing this month, 59 basis points by year-end, and 154 basis points by the end of 2025. The yield on Australia’s 3-year note has increased by 1 basis point to 3.62%, while the yield on 10-year debt has risen by 1 basis point to 4.02%.

Commodities: Gold fell below $2,500, continuing its decline from last week’s record highs due to a stronger dollar and rising bond yields. Silver dropped 1.11% to $28.55. Brent crude rose to around $77.5, despite extending the previous session's decline. The market was impacted by OPEC’s plan to increase production by 180,000 bpd starting in October, partially reversing recent cuts while maintaining other reductions until late 2025. Demand concerns grew as China’s factory activity hit a six-month low in August, raising fears of missed growth targets. EIA data showed US oil consumption in June slowed to its lowest seasonal levels since the 2020 pandemic. Additionally, Libya's Sarir, Messla, and Nafoura oilfields were instructed to resume operations after a political standoff. Iron ore prices with 62% iron content remained below $100 in early September, pressured by weak economic data from China and rising inventories. Copper futures fell to around $4.12 per pound amid rising inventories and soft Chinese demand, with LME warehouse inventories recently increasing by 8,700 tons.

FX: Thin trading session with US and Canada closed for Labour day on Monday saw US dollar trading sideways. The Japanese yen underperformed, slipping over 0.5% against the US dollar and 0.9% against the Australian dollar as focus remains on US labor data this week, starting with the ISM manufacturing print today that comes with an employment sub-index. The Australian dollar continued to outperform among the major currencies, despite a slump in iron ore prices as China’s Caixin manufacturing PMI offset some of the headwinds from softer official PMI. The New Zealand dollar, however, could not catch a bid from Australian dollar’s gains. The euro was slightly higher and ECB’s Nagel will be on the wires today. His comments from last week highlighted that he is not in favour of ECB reducing rates too quickly as 2% inflation goal is not yet reached. Swiss CPI and GDP are also on the radar today, and the weakness in franc could remain short-lived given that it is a haven currency needed for diversification in portfolios amid the recent uncertainties. To read more about what’s key in the macro and FX space this week, read our Weekly FX Chartbook.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.