Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: Japan Household Spending (Jul), German Industrial Output (Jul), EZ Revised GDP (Q2), US NFP (Aug) – preview here, Canadian Unemployment/Wages (Aug)

Earnings: BigLots, ABM, Brady, Genesco, BRP

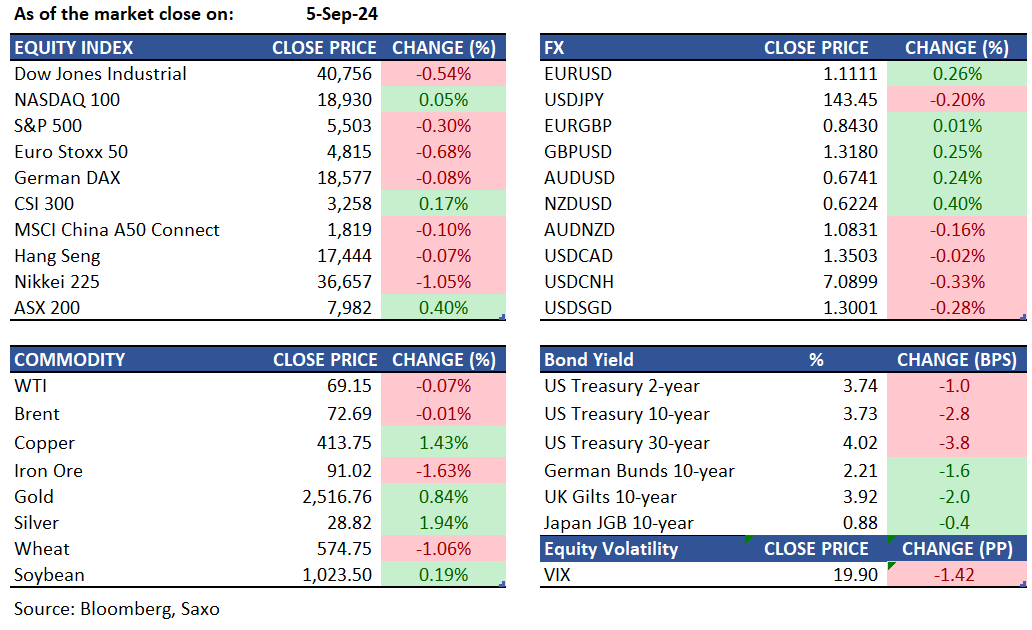

Equities: US stocks ended a volatile session mixed on Thursday as investors repositioned ahead of Friday’s crucial labor report. The S&P 500 and the Dow Jones fell by 0.3% and 0.5%, respectively, while the Nasdaq 100 managed gains after initially rising over 1%. New labor market data offered mixed signals about the U.S. economy's health with ADP private payroll growth for August coming in at 99,000 jobs, the weakest since January 2021 and significantly below expectations. However, weekly unemployment claims declined, providing some relief. The conflicting data, including a drop in job openings on Wednesday, fueled concerns about a potential recession and the pace of the Federal Reserve's rate-cuts. Health sector stocks led the declines, with Eli Lilly down 3.5% and UnitedHealth falling 1.5%. In contrast, the consumer discretionary sector performed best, bolstered by Amazon's 2.6% rise and Tesla's 4.9% increase. Following a 99% increase in revenue and impressive Q2 deliveries, Nio saw its stock surge by 14.3% in today’s session. Conversely, Broadcom, which reported earnings after the market closed and exceeded expectations on both revenue and earnings, saw its shares decline by 6.7%.

Fixed income: Treasuries peaked after ADP data missed expectations. However, gains were trimmed at the front end of the curve due to an unexpected rise in the prices paid component of the August ISM services report. This led to a flattening of the curve, partially reversing Wednesday’s steepening trend, with long-end yields ending the day richer by about 4 basis points compared to the previous day's close. Yields were richer by 1 to 4 basis points across the curve, with the 2s10s and 5s30s spreads flattening by 2 and 2.5 basis points, respectively. The 10-year yields ended around 3.725%, down approximately 3 basis points on the day, outperforming both bunds and gilts. Investors continued to pour money into US money-market funds for the fifth consecutive week, indicating strong demand despite anticipated Federal Reserve interest-rate cuts. About $37 billion was added to these funds in the week ending September 4, bringing total inflows over this period to approximately $165 billion. Buyers eagerly participated in Treasury’s four- and eight-week auctions to lock in yields above 5%, anticipating that the Federal Reserve will cut interest rates later this month. The Treasury sold $80 billion of four-week bills at 5.08% and $80 billion of eight-week bills at 5.04%.

Commodities: WTI crude futures settled at $69.1, close to a 14-month low, due to concerns over slowing demand in the U.S. and China, and potential increased supply from Libya, despite a larger-than-expected 6.9 million barrel drop in U.S. crude inventories reported by the U.S. Energy Information Administration for the week ending August 30. OPEC+ postponed planned production hikes for October and November. In Libya, tankers resumed loading crude despite political tensions. U.S. gasoline futures fell toward $1.9 per gallon in September, the lowest since February 2021, amid a broader slump in the oil market driven by reduced fuel demand. Gold prices increased by 0.65% to $2,516.

FX: The US dollar slipped further lower on Thursday amid mixed economic data continuing to put the focus on Fed’s rate cuts. However, markets still remain divided between whether the US economy will achieve a soft landing or a hard landing, the two scenarios we discussed in this article. Earlier this week, it seemed that a hard landing scenario was being priced in, but yesterday’s price action of Kiwi dollar outperforming among major currencies is reflective of soft landing expectations. Gains in other activity currencies like British pound and Australian dollar also outpaced gains in the Japanese yen, a safe-haven. The Norwegian krone, however, closed in the red as oil prices failed to sustain a bid despite OPEC+ pushing back its supply hike timeline.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.