Quarterly Outlook

Macro Outlook: The US rate cut cycle has begun

Peter Garnry

Chief Investment Strategist

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: China CPI (Aug), EZ Sentix Index (Sep), US Employment Trends (Aug)

Earnings: Oracle, Rubrik, Limoneira, BioStem, Calavo

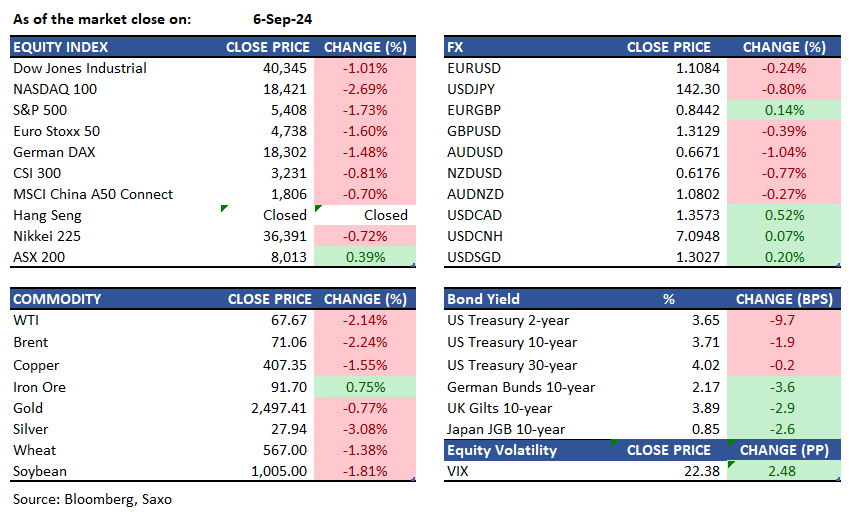

Equities: U.S. stocks declined on Friday due to concerns over a slowing labor market and a tech selloff. The S&P 500 fell 1.7%, the Dow dropped 409 points, and the Nasdaq decreased by 2.5%. Major tech companies, including Amazon (-3.6%), Alphabet (-4%), and Meta (-3.2%), experienced significant losses, while chipmakers like Broadcom (-10.3%) and Nvidia (-4.1%) also saw sharp declines. Broadcom shares fell despite strong Q3 results due to lower FQ4 margin guidance. It projected Q4 revenue of $14.0B, below the $14.13B consensus, causing the SOX index to drop over 4.5%. The August jobs report and Fed Governor Waller's comments on labor market risks and a potential larger rate cut added to market anxiety. For the week, the S&P 500 lost about 4%, marking its worst week since March 2023. The Nasdaq fell 5.6%, recording its worst start to September since 2001. The Dow slipped 2.5%, posting its steepest early-September decline since 2008.

Fixed income: On Friday, Treasury futures experienced notable volatility following the release of the jobs report and comments from Federal Reserve Governor Christopher Waller. The softer-than-expected data likely triggered some profit-taking, pushing yields higher. Traders were evaluating this information to make informed bets on the anticipated size of the Fed's interest rate cut in September. The yield curve had steepened significantly; the front-end retained the day's gains while the long-end remained relatively unchanged. Fed-dated Overnight Index Swaps (OIS) were pricing in about a 30 basis point rate cut for this month's policy meeting, amid record volumes in fed funds futures. U.S. yields had risen by 1 to 8 basis points across the curve. The 2s10s and 5s30s spreads had steepened by 7 and 4 basis points, respectively, with 10-year yields closing at approximately 3.715%, near the midpoint of the day's trading range of 3.644% to 3.759%. According to Commodity Futures Trading Commission data, asset managers increased their net futures positioning in the week leading up to September 3, following a couple of weeks of significant de-leveraging and liquidation of long positions. Meanwhile, hedge funds increased their net duration short by approximately 167,000 10-year futures equivalents.

Commodities: WTI crude oil futures down 2.14% to $67.67, marking their lowest level since June 2023 and an 8% decline for the week. Brent crude futures also fell 2.24% to $71.06, their lowest since June 2023. OPEC+ postponed a planned production increase of 180,000 barrels per day until December, which would have added about 2.2 million barrels per day through the end of next year. Weak economic data from China and the U.S. raised concerns about declining demand, while potential increases in oil supply from Libya added further pressure. Despite an unexpected large drawdown in U.S. crude inventories of 6.9 million barrels, far exceeding the anticipated 1.1 million barrel draw, WTI oil prices experienced their worst week since October. Natural gas for October delivery gained 6.96% to $2.2750 per million British thermal units. Gold prices dropped 0.77% to $2,297, and silver declined 3.08% to below $28, amid uncertainty over the Federal Reserve's interest rate cuts following weak U.S. labor market data.

FX: The US dollar ended last week in a choppy fashion with the jobs report unable to break the debate about the pace of Fed’s easing. The weakness in the Australian dollar on the back of the slide in commodity prices, especially iron ore, was offset by further gains in the Japanese yen as front-end Treasury yields fell further. Other commodity currencies such as New Zealand dollar, Norwegian krone and Canadian dollar also underperformed, while other safe-havens such as Swiss franc closed in gains for the week. The Loonie was also weighed down by underwhelming Canadian jobs data where unemployment rose more than expected. The euro closed the week higher despite losses on Friday, and ECB meeting will be the key event to watch this week.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.