Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US PCE, University of Michigan survey

Earnings: 3M, Charter Communications, Bristol Myers Squibb, Booz Allen Hamilton, Centene Corporation

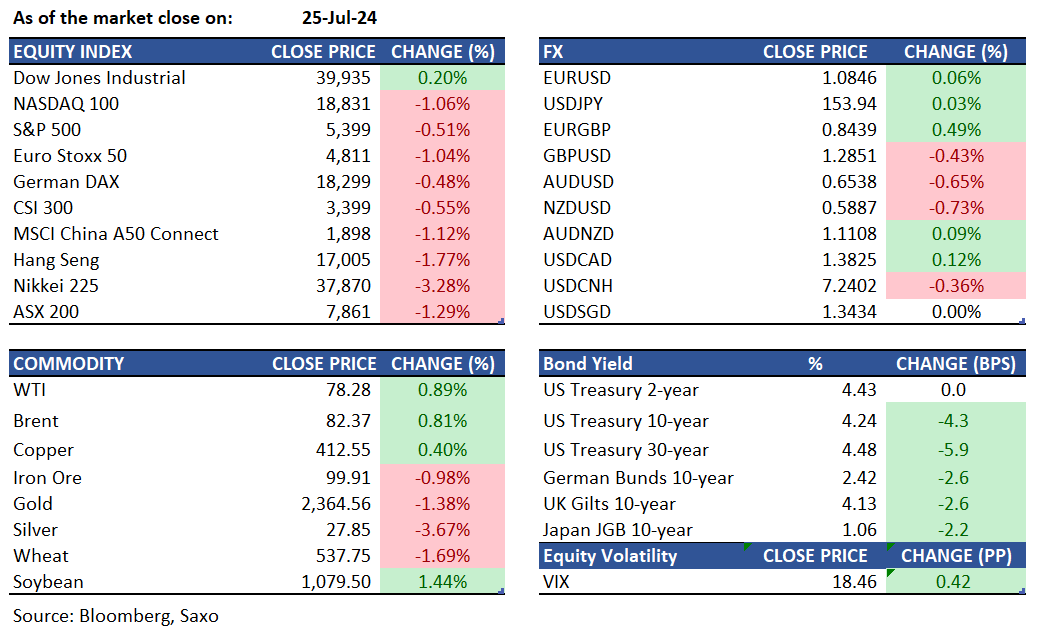

Equities: U.S. equities closed mixed on Thursday after facing their worst sessions since 2022. Investors continued to sell off this year's top tech stocks, casting doubts on the sustainability of the AI-driven rally. The S&P 500 ended 0.5% lower, the Nasdaq 100 slipped 1%, while the Dow gained 81 points. Earlier gains, bolstered by a better-than-expected 2.8% growth in Q2 U.S. GDP, were trimmed, reinforcing the view that the Federal Reserve can curb inflation without harming the economy. Energy and Industrials sectors led the gains, while Communication Services and Technology were the biggest laggards. Among megacaps, Microsoft and Alphabet fell by 2.5% and 3.1%, respectively, and AMD dropped 4.3%. On the earnings front, AbbVie surged 3.4%, and IBM climbed 3.9% after posting strong earnings results. In contrast, Ford Motor plunged 18.3% after missing second-quarter estimates, marking its worst decline since May 2009.

Fixed income: Treasuries ended with mixed results and a flatter yield curve, as the week's steepening trend paused after reaching year-to-date highs. Treasury 2-year yields edged up to 4.44% after hitting a six-month low earlier, while the 10-year yield fell three basis points to 4.25%. A stronger-than-expected initial estimate of 2Q GDP strengthened the case for the Federal Reserve to delay rate cuts until at least September, reducing pressure on short-term yields. Meanwhile, the 7-year note auction saw strong demand despite the day's gains lowering its yield by over 4 basis points. Additionally, foreign central bank usage of a key Federal Reserve facility hit a new record, indicating that policymakers globally continue to build cash reserves.

Commodities: August gold futures fell by $62.20, or -2.57%, to settle at $2,353.50, marking a two-week low and closing just above the intraday low. Weakness was due to profit-taking after last week's all-time highs. Stronger-than-expected GDP data added pressure as investors reassessed the likelihood of Fed rate cuts moving into the Fall. Concerns about China’s economic health further weighed on prices amid a recent Chinese rate cut. WTI crude oil futures settled at $78.28 per barrel on Thursday, rebounding from earlier losses. Strong US GDP growth at 2.8% and a decline in crude inventories by 3.7 million barrels supported prices. EIA data showed a 5.6 million barrel drop in gasoline stocks, indicating increased demand. However, oil prices remain near six-week lows due to China's sluggish economic growth.

FX: The US dollar traded mixed despite a hot Q2 GDP report questioning the market’s stance on Fed delivering rate cuts. Attention turns to June PCE print today, where an upside surprise could pushback the September rate cut that is priced in. Safe havens continued to gain, but Swiss franc outperformed as Japanese yen’s gain slowed. Read this article to know more about yen’s carry unwind and what risks it may bring. New Zealand dollar led the declines in G10 FX space, and Australian dollar followed. Sterling’s resilience also cam under scrutiny as the British pound fell.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.