Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro: European Parliamentary elections results came as a surprise, with far-right parties gaining significant traction. French President Emmanuel Macron called a snap parliamentary election for June 30 after he received a drubbing at the hands of his far-right rival Marine Le Pen. His German counterpart Olaf Scholz didn’t fare much better, with his Social Democrats suffering their worst performance in an EU election in history, while Prime Minister Giorgia Meloni right-wing party appeared to be the winner in Italy. Overall, however the three centrist groups -- EPP, the Socialists and the liberals -- will hold a comfortable majority, despite the far-right gaining seats, while the Greens suffered losses, and with European Commission President Ursula Von der Leyen’s center-right EPP grouping projected to cement its place as the biggest group in parliament, she is well placed to win a second term.

Macro events: EIA STEO, OPEC MOMR, UK Jobs Report (Apr)

Earnings: Academy, MPA, Lilium, Oracle, Casey’s, PetMeds, Rubrik, VistaGen, Mama’s Creations

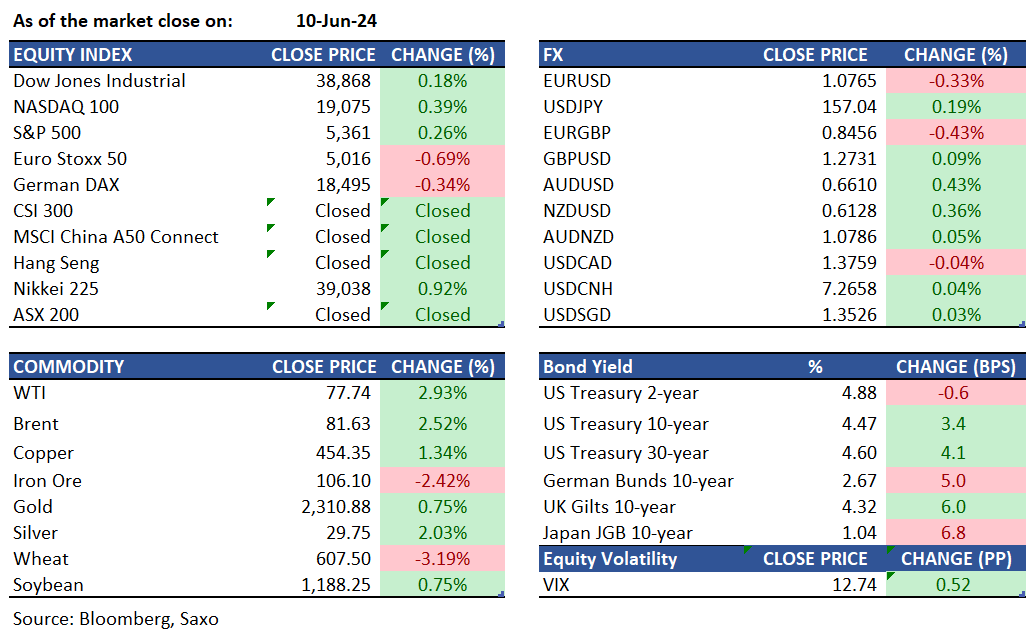

Equities: Following a downturn at the end of last week, US equity futures showed modest declines in pre-market trading, devoid of significant economic data to sway investor sentiment. With the Federal Reserve meeting scheduled for Wednesday, the market appears poised for a period of stagnation in the coming days. Current market probabilities indicate a mere 1% likelihood of a rate cut, with an implied 99% expectation of no action. Small caps underperformed early, with the Russell 2000 index declining by 0.4%, compared to the Nasdaq 100's 0.1% drop and the SPX 500's 0.08% decrease. As the day ended, US equities retraced from peaks but maintained gains. Notably, the Russell 2000 Index outperformed, showing a 0.33% increase, surpassing the Nasdaq 100 and SPX 500. In terms of data, the NY Fed Survey of Consumer Expectations for May revealed that one-year ahead expected inflation stood at 3.2%, slightly lower than April's 3.3%, while three-year ahead expected inflation remained unchanged at 2.8%. Additionally, five-year ahead expected inflation for May increased to 3% from April's 2.8%.

Fixed income: The Treasury market experienced minimal shifts as a lackluster $58 billion three-year auction dampened sentiment ahead of Tuesday's $39 billion 10-year sale. Australian bonds declined in response to their US counterparts after a three-day weekend. The yield on Australia's 3-year note rose by 10 basis points from Friday's close to 3.99%, while the yield on 10-year debt increased by 12 basis points to 4.34%. French debt widened the yield premium over its German counterpart to the highest level in six months following President Emmanuel Macron's announcement of a snap election after his party's disappointing performance in a European vote. Futures of Japan's 10-year notes concluded the overnight session with a 3-tick increase at 143.51. The yield curve displayed a significant bear-steepening on Monday, with the 30-year tenor rising by 9 basis points to 2.180%.

Commodities: Oil rose amid expected summer demand surges. Goldman Sachs predicts a price range for Brent between $75 and $90. Market focus is on the Fed's rate decision and US inflation data. Gold recovered to $2,305 an ounce after a major drop, with upcoming US economic indicators likely to influence Fed’s rate moves. Political uncertainty in Europe grows with election shifts. US natural gas futures hit $3/MMBtu, driven by hotter weather forecasts and earlier production cuts. The reduction in surplus eases storage concerns, but there's an increased risk of energy shortages in several North American regions if temperatures exceed normal levels.

FX: The US dollar strengthened due to a strong job report on Friday and political issues in the EU, which resulted in the euro dropping to a 1-month low of 1.0733 before stabilizing, as discussed in this article. Key events to watch are US inflation data and the Fed's announcement on Wednesday. The euro faces pressure from an ECB rate cut and upcoming French elections, with a key technical level at 1.0721. The euro also hit a 21-month low against the British pound (GBP). The USDJPY remains around 157, with potential intervention from Japan's central bank likely capping its rise ahead of the Bank of Japan's Friday announcement. The Australian dollar rebounded from its 50-day moving average, trading just above 0.66. The British pound remains close to 1.27 ahead of UK jobs data to be released today.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.