Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

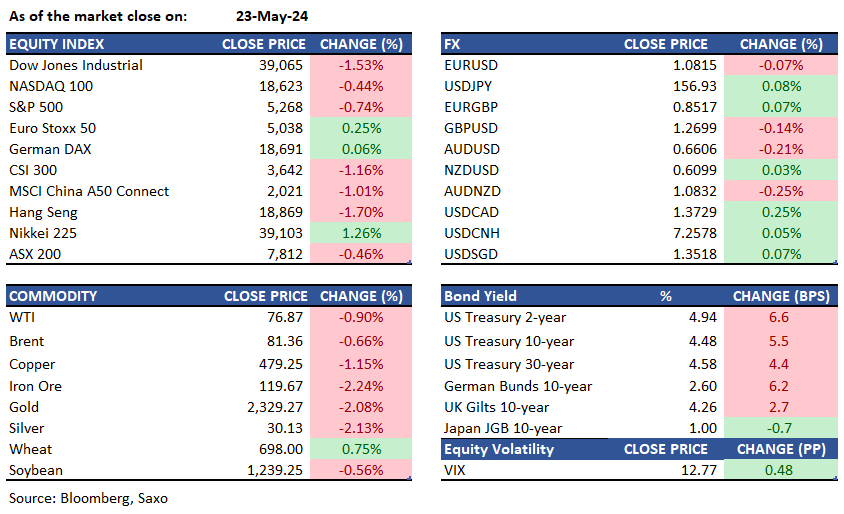

Equities: U.S. stock markets kicked off the trading session with the S&P 500 and the Nasdaq hitting new intraday highs, primarily propelled by Nvidia's impressive earnings report, which surpassed market forecasts and uplifted the tech industry. This surge took the Nasdaq to the brink of 17,000, while the SOX index reached an all-time high of 5,255.63. The initial upswing, however, didn’t last as investors began cashing in profits after a string of US data showed strong economic momentum (S&P Global PMIs), further delaying the prospect of Fed rate cuts this year. The market is now pricing a possible cut only in November 2024. Following that, the Nasdaq fell to under 16,700, and the S&P 500 dropped below 5,260. The downward trend saw Nvidia's shares pulling back from their highs, as the breadth of the market indicated a shift with S&P 500 declines eclipsing advances. Across the board, every S&P sector experienced notable declines, with sectors like REITs, Utilities, Healthcare, and Financials undergoing pronounced dips, which along with a significant downturn in Boeing's stock price, resulted in a drop of over 600 points for the Dow. Amidst these market movements, after Nvidia's earnings, the wider market sentiment turned cautious with a clear "sell on the news" reaction that dented the overall performance for May. This cautious tone was mirrored in small-cap stocks as the Russell 2000 significantly lagged. Comments from market analysts like Jeff Gundlach, alerting about recession probabilities and growing U.S. debt burdens, added to the wary outlook.

FX: The US dollar continued its upward trend for the fourth day in a row, bolstered by higher Treasury yields in response to a report indicating a faster-than-expected expansion in the US economy and increasing price measures. The Bloomberg Dollar Spot Index initially declined by 0.2% before rebounding to a 0.2% increase, and the dollar gained ground against most G-10 peers during midday trading due to model purchases. The euro experienced a 0.2% decline to 1.0806 against the dollar, with its losses initially tempered by higher European bond yields. The USDJPY pair climbed by up to 0.3% to 157.20, marking a three-week high before moderating its gains. The pound decreased by 0.2% to 1.2687 as a result of reduced long positions following US PMI data and a UK composite PMI that fell short of expectations. Despite a decrease in oil prices, the Norwegian krone advanced against other G-10 and commodity currencies, while the Kiwi, Aussie, and the Loonie saw minimal movement during the session.

Commodities: Gold fell more than 2% to $2,329 an ounce and Silver declined 2.13% to $30.13 an ounce. The decline was attributed to a rebound in the dollar and Treasury yields, as well as profit taking following a recent surge in commodity prices. The release of minutes from the prior FOMC meeting, indicating that interest rates would remain elevated for an extended period, further contributed to the downward pressure on gold prices. Despite the recent pullback, gold prices are still up approximately 14% year-to-date. Meanwhile, Bitcoin prices dipped by 2% to just below $68,000, and oil prices also retreated, with WTI crude dropped 0.9% to $76.87 per barrel and Brent Crude futures fell 0.66% to $81.36 per barrel. Concerns over the potential impact of higher U.S. interest rates on demand growth added to the market unease surrounding commodity prices. Cocoa futures rallied by 10.8% and Natural gas slipped by 6.4%.

Fixed income: Treasury bond futures are on track for their largest weekly decline in five weeks, as robust US economic data prompts traders to scale back their expectations for a Federal Reserve interest rate cut. Market attention is focused on bond auctions in Japan and Australia. On Thursday, the Treasury 10-year note yield increased by 6 basis points to 4.48% following the release of a composite PMI for US manufacturing and services that exceeded economists' forecasts, while the 2-year yield climbed by six basis points to 4.93%. Overnight indexed swap (OIS) prices indicate the likelihood of a 25 basis point Fed rate cut in December. German 2-year yields rose by eight basis points after German PMI data surpassed analyst expectations. Japanese 10-year bond futures concluded the overnight session with a 16-tick decline at 143.57, and the benchmark yield decreased by 0.5 basis points to 0.995% on Thursday. Meanwhile, the yield on Australia's 3-year note advanced by 5 basis points to 3.98%, and the yield on 10-year debt rose by 5 basis points to 4.31%.

Macro:

Macro events: Malaysia April CPI, Singapore April Industrial Output, Japan April Dept. Store Sales, Japan April CPI, UK April Retail sales, Germany 1Q Final GDPx, Canada March retail sales, US April Durable goods orders, US May University of Michigan consumer sentiment index

Earnings: MayBank, Booz Allen, Buckle, Sunlands Tech

News:

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.