Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Trader Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: German Unemployment (Jun), US PCE (May), US University of Michigan Final (Jun)

Earnings: N/A

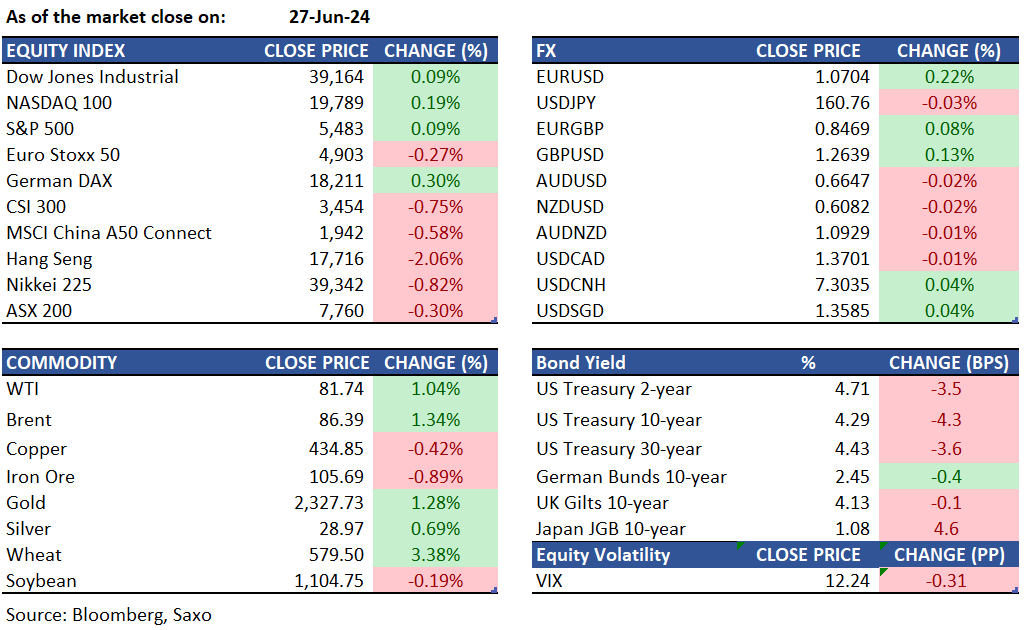

Equities: U.S. equities concluded the session mixed, with the Russell 2000 gaining 1% and outperforming due to a decline in Treasury yields, ahead of tomorrow’s crucial PCE inflation data. The Nasdaq remained strong, driven by a dynamic rotation among tech leaders. After a substantial rally, NVDA has cooled off, while AAPL led over the past two weeks. Recently, AMZN, TSLA, and GOOGL have taken the lead, sustaining the Nasdaq's upward momentum.Gross domestic product (GDP) grew at a revised annualized rate of 1.4% for Q1, although this marks a slowdown from the 3.4% rate observed in Q4 2023. In addition, U.S. data is showing some signs of slowing, with core capital goods orders falling by 0.6% in May, the goods trade deficit expanding by 2.7%, and retail inventories rising.

Fixed income: Foreign central bank usage of a key Federal Reserve facility surged to a new record high, signaling that policymakers globally are continuing to bolster their cash reserves. The yield on 10-year Treasury note declined 4 basis points to 4.29% on Thursday, as data suggested that the Fed’s tight monetary policy is hampering growth. Australian bonds rose in tandem with Treasuries after Reserve Bank Deputy Governor Andrew Hauser downplayed a hotter-than-expected May inflation report. Treasury bond futures remained steady ahead of key U.S. inflation data due on Friday. Australia’s 3-year note yield dropped 8 basis points to 4.09%, while the 10-year debt yield fell 7 basis points to 4.34%. A seven-year note auction produced a yield below the when-issued level. Futures of Japanese 10-year government notes ended the overnight session 17 ticks higher at 142.85, signaling a yield decline of nearly 2 basis points. Japan’s benchmark yield rose 4 basis points to 1.070% on Thursday.

Commodities: Gold rebounded to above $2,300 per ounce on Thursday after hitting a nearly three-month low. Markets reacted to key data suggesting the Federal Reserve may cut rates in September, making gold more attractive. Lower global interest rates also supported precious metals. Brent crude rose to $86.3 per barrel, nearing a two-month high, as Middle East supply concerns outweighed a surprise increase in US stockpiles. Iron ore prices with 62% iron content rose slightly to $106.56 per tonne in late June after Beijing relaxed homebuying curbs, potentially boosting the property market and steel demand for housing construction.

FX: The US dollar ended the day marginally lower ahead of Friday’s core PCE, but immediate focus is on the Biden/Trump debate which is set to begin at 2100 ET. EURUSD took over 1.07 again, with ECB rate cuts hinting that market expectations of about two rate cuts this year seem to be about right. Weekend French elections in focus, and volatility is likely to pick up. Japanese yen remained pegged near recent lows despite intervention threats, with USDJPY at 160.70, AUDJPY testing a break above 107, and GBPJPY rising to 203.40. Swedish krona underperformed as Riksbank signaled three more rate cuts for this year despite other major central banks turning more cautious about further rate cuts this year. USDSEK rose above 200-day moving average at 10.59.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.