Quarterly Outlook

Equity outlook: The high cost of global fragmentation for US portfolios

Charu Chanana

Chief Investment Strategist

Key points:

------------------------------------------------------------------

Disclaimer: Past performance does not indicate future performance.

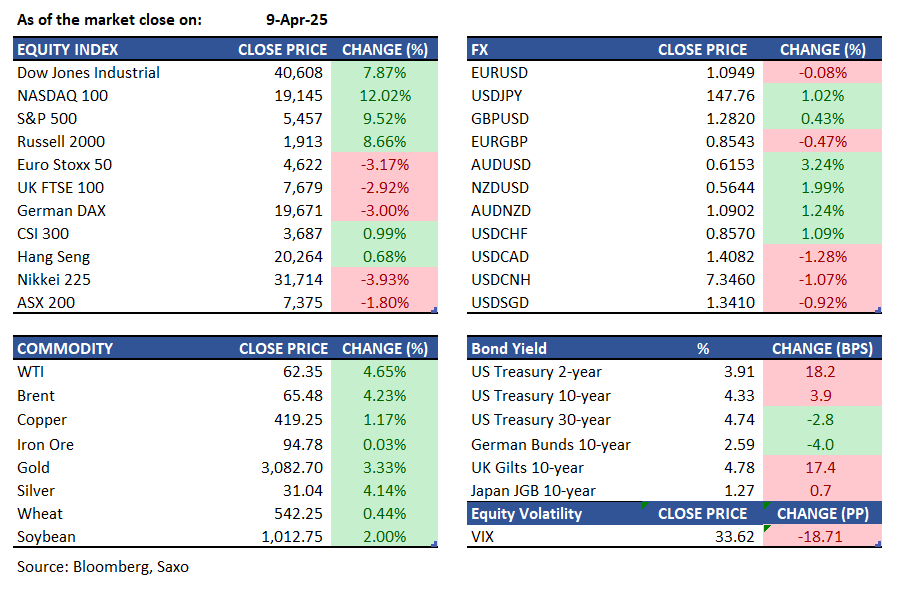

Macro:

Equities:

Earnings this week:

Thursday: CarMax (KMX)

Friday: JPMorgan Chase (JPM), Morgan Stanley (MS), Wells Fargo (WFC), Bank of New York Mellon (BK), BlackRock (BLK)

FX:

Commodities:

Fixed income:

For a global look at markets – go to Inspiration.