Global Market Quick Take: Asia – July 25, 2024

APAC Research

Key points:

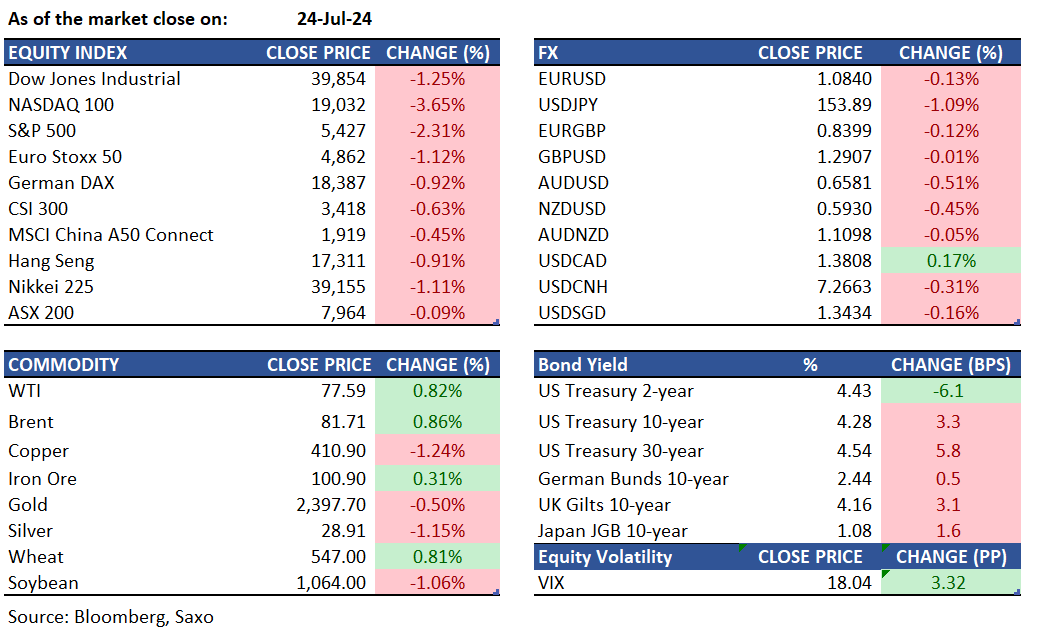

- Equities: US stocks plunged due to a broad tech sell-off

- FX: Yen gains further while commodity currencies slip.

- Commodities: Copper slides for eighth straight session

- Fixed income: 5-30 yield curve steepest since May 2023

- Economic data: US advance Q2 GDP, German Ifo

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

- Stock Market Today: S&P500 in biggest slump since 2022 as Alphabet, Tesla nosedive (Investing)

- Nvidia supplier SK Hynix posts highest profit in 6 years on AI boom (Investing)

- Chipotle Mexican Grill tops analyst expectations; shares rally (Investing)

- 'Fear gauge' hits three-month high as US stocks sell off (Yahoo)

- Stock Market News: Nasdaq Falls 3.6% (Barron’s)

Macro:

- US flash PMIs for July were mixed. Manufacturing fell to a 7-month low, and back into contractionary territory, of 49.5 (exp. 51.7, prev. 51.6), while Services rising to a 28-month high of 56.0 (exp. 55.0, prev. 55.3). Price metrics eased, signalling that a Goldilocks scenario remained in place at the start of Q3.

- European PMIs were also weaker on manufacturing, but services remained in expansion, although weakening from June levels. Headline reading dropped to 50.1 in July from 50.9.

- UK PMIs held up strongly with the manufacturing PMI coming in higher at 51.8 from 50.9 previously and 51.0 expected and services PMI at 52.4 from 52.1 previously but a notch lower than 52.5 expected.

- Bank of Canada: The Bank of Canada cut rates by 25bps taking its policy rate to 4.50%, as was expected by the majority of analysts. Within the statement, the BoC noted that risks to the inflation outlook are balanced, whilst removing language that referred to the BoC being more concerned about upside risks. Looking ahead, the BoC said decisions will be guided by incoming information and their assessment of their implications for the inflation outlook. The MPR saw the BoC revise down its Q2 24 CPI forecast to 2.7% from 2.9%, with Q3 CPI seen at 2.3%. The BoC doesn't see CPI returning to the midpoint of their target range until 2026 however, with 2025 CPI projections raised to 2.4% from 2.2% in April.

Macro events: US Durable Goods Orders, US Jobless Claims, US Q2 Advance GDP, German Ifo

Earnings: American Airlines, AbbVie, Honeywell, Raytheon Technologies, Southwest Airlines

Equities: US stocks plunged on Wednesday due to a broad tech sell-off after underwhelming megacap earnings raised doubts about the AI-driven bull market. The S&P 500 sank 2.3%, marking its worst day since December 2022, while the Nasdaq 100 fell 3.6%, its worst since October 2022. The Dow tumbled 503 points. Alphabet dropped 5% on higher-than-expected AI spending and disappointing YouTube ad revenue. Tesla shares plummeted 12.3% after reporting a 7% drop in auto revenue, a profit miss, and delays in the Robotaxi project. Visa fell 3.9% due to decreased payments volume. Chip stocks also suffered, with Nvidia sinking 6.8%, Broadcom losing 7.6%, and Arm falling 8.1%. The CAC 40 fell 1.1% to close at 7,514, driven by disappointing earnings from luxury giant LVMH. Shares of LVMH plummeted 4.5% after reporting a 1% year-on-year increase in quarterly sales to EUR 20.98 billion, missing expectations. Other luxury stocks also faced losses. IBM reports earnings later today.

Fixed income: Treasury yields ended Wednesday mixed, with the yield curve steepening sharply on expectations of further Fed easing this year. The yield on newly auctioned 2-year notes fell below 4.40%, its lowest since February, partly due to former New York Fed President William Dudley's call for rate cuts this month. Long-term yields rose in the afternoon amid heavy futures trading, pushing curve spreads to their widest levels of the year. The 2-year/10-year spread ended around -14 basis points, nearing its least inverted level since July 2022, while the 5-year/30-year spread steepened to nearly 39 basis points, a level last seen in May 2023.

Commodities: Oil prices stabilized after their first gain in four sessions, supported by a drop in US crude inventories and Russia's pledge for additional production cuts. Brent crude stayed above $81 a barrel, while West Texas Intermediate hovered near $77. US crude inventories fell by 3.74 million barrels, marking the fourth consecutive weekly drop. Gold prices held steady as traders awaited key data that could signal when the Federal Reserve might lower interest rates. Bullion remained around $2,400 an ounce in early Asian trading, following a 0.5% decline on Wednesday. The upcoming personal consumption expenditures data is expected to show easing price pressures, potentially increasing bets on rate cuts. Copper futures recorded their longest daily losing streak in over four years, settling at their lowest price in more than three months on Wednesday. The metal is down over 20% from its May highs, driven by concerns over weakening demand amid China's economic slowdown. Copper prices fell for an eighth consecutive session, the longest streak since February 2020.

FX: The US dollar had a mixed session on Wednesday as it plunged earlier amid continued gains in the Japanese yen but recovered later amid a risk-off sentiment driven by a plunge in US equities. The risk-off sentiment also drove other safe-havens like the Japanese yen and Swiss franc higher, and the British pound also remained resilient with the UK PMIs coming in stronger than Europe and even the US. Meanwhile, commodity currencies Australian dollar and kiwi dollar continued to plunge as commodity prices retreated as a result of China’s gloomy economy. The Canadian dollar also weakened after the Bank of Canada’s dovish rate cut. The move in Japanese yen is key to watch, with markets expecting the Fed to tilt dovish next week in contrast to the Bank of Japan likely announcing a rate hike. We discussed the Powell Put and its implication in this article yesterday.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.