Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: FOMC Announcement (preview here), BoJ Announcement and Outlook Report (preview here), China NBS PMI (Jul), Australia CPI (Q2/Jun), German Retail Sales (Jun), French CPI Prelim. (Jul), EZ Flash HICP (Jul), Italian CPI Prelim. (Jul), US ADP (Jul), Pending Home Sales (Jul), Chicago PMI (Jul)

Earnings: Boeing, Mastercard, Meta, Arm, Qualcomm, Lam Research

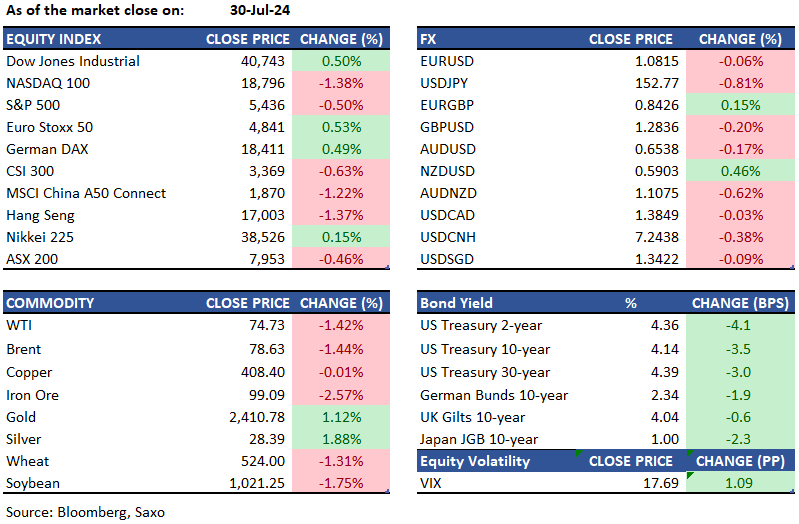

Equities: US stocks erased early gains as declines in heavyweight chip companies pressured tech-exposed equity indices, while markets assessed recent data and geared up for the Federal Reserve’s policy decision tomorrow. The Nasdaq 100 closed 1.3% lower, reaching its lowest level in nearly two months, while the S&P 500 fell 0.5%. Nvidia dropped 7%, triggering widespread selling pressure on other semiconductor giants and extending the sector's period of weakness as investors question the sustainability of the AI rally, shifting their focus to more traditional sectors of the US economy. Microsoft fell as much as 3% post-market after reporting a miss on cloud revenue, while AMD rallied 7.6% after reporting earnings that surpassed expectations and issued a strong Q3 forecast. On the other hand, Apple, Alphabet, and Meta experienced muted activity ahead of their reports later in the week. Merck sank 9.8%, and Procter & Gamble plunged 4.8% following their respective results. Still, the Dow gained 205 points, extending its outperformance over tech-heavy counterparts, supported by banks and insurers.

Fixed income: Treasuries closed Tuesday with lower yields and a slightly steeper curve, reaching session lows in the US afternoon amid a haven rally following Israel's strike in Lebanon targeting a Hezbollah commander. Five- and 10-year yields dropped to their lowest levels since March. Earlier, the market faced a brief setback when June JOLTS job openings and July consumer confidence exceeded economist expectations. Yields decreased by 3 to 5 basis points. Balances at the Federal Reserve’s overnight reverse repurchase agreement facility fell to their lowest level in over six weeks, as repo rates remained above the program's offering yield. Japanese bond futures tumbled overnight after media reports suggested that the nation's central bank might consider raising the policy interest rate. About 30% of BOJ watchers anticipate a rate hike, while over 90% acknowledge the risk of such a move. The benchmark yield dropped 3 basis points to 0.995%.

Commodities: Gold increased by 1.12%, closing at $2,410, while silver up 1.88% to $28.39 on Tuesday, close to 12-week lows, as investors anticipated upcoming monetary policy decisions from major central banks. WTI crude dropped by 1.42% to $74.73 per barrel, marking a 9% decline in July and reaching its lowest level since early June. Brent crude futures also fell 1.44% to $78.63 per barrel due to easing geopolitical risks and concerns over Chinese demand. Copper futures continued their decline, reaching $4 per pound, the lowest in four months, amid growing demand concerns from China.

FX: The Japanese yen rallied sharply overnight amid reports from Japanese media about a potential rate from the Bank of Japan at the announcement today. The Swiss franc also gained this morning in Asia amid escalating Mideast tensions fueling safe-haven flows. Meanwhile, the US dollar also remained supported despite the 1% gain in Japanese yen. The resilience of the British pound is coming under scrutiny as the Bank of England decision draws closer and an August rate cut remains a coin toss. The Australian dollar has also been on a backfoot ahead of the quarterly inflation report out today, where a hot print can continue to fuel speculation about a potential rate hike from the Reserve Bank of Australia.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.