Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Chief Investment Strategist

For years, the U.S. has been the undisputed leader of global markets, fueled by aggressive fiscal spending, tech dominance, and a strong consumer. But cracks are starting to show. Investors are increasingly looking overseas as concerns mount over U.S. stock valuations, monetary policy, and economic uncertainty.

Recent data points suggest the U.S. economy may be losing momentum:

Meanwhile, retail giant Walmart warned about cautious consumer behavior, reinforcing concerns about a slowdown in discretionary spending.

2. Fiscal spending: From turbocharged to tapering

For much of the past few years, U.S. economic growth has been supercharged by government spending. Whether it was pandemic stimulus, infrastructure projects, or incentives for green energy and semiconductors, fiscal expansion helped keep the economy strong.Despite market hopes for aggressive rate cuts, the Federal Reserve is staying cautious. Inflation is still sticky, and policymakers don’t want to risk cutting too soon, reigniting price pressures.

This has major implications:

For the past two years, AI enthusiasm has driven massive gains in U.S. tech stocks, sending the S&P 500 and Nasdaq to record highs. But could the AI boom be shifting overseas?

China’s DeepSeek, a rising AI startup, has gained investor attention, signaling that U.S. tech may not have a monopoly on AI innovation. At the same time, European regulators are scrutinizing U.S. tech giants more aggressively, raising concerns about fines, restrictions, and potential business model disruptions.

If global investors start questioning the extreme valuations of the “Magnificent Seven” (Apple, Microsoft, Nvidia, Amazon, Meta, Google, Tesla), they may rotate into cheaper markets. And that’s exactly what seems to be happening.

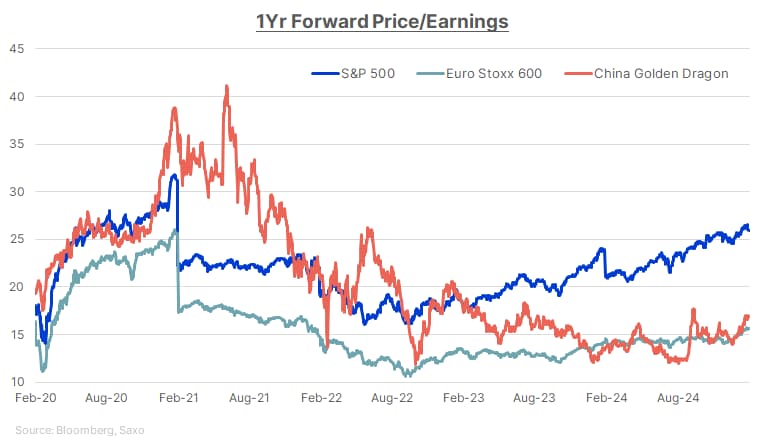

The U.S. market has enjoyed a massive run-up, but that’s also made it expensive. The S&P 500 now trades at a forward price-to-earnings (P/E) ratio of 22x, well above its historical average of 16x. In contrast:

The valuation gap is driving money flows. Investors are increasingly looking for opportunities in international markets where stocks have lagged in recent years but now look relatively attractive.

U.S. exceptionalism isn’t dead, but it’s facing serious challenges.

With fiscal spending slowing, tech leadership being questioned, high stock valuations, and cautious economic signals, investors are looking elsewhere. Europe and China are emerging as viable alternatives, benefiting from lower valuations, policy shifts, and a fresh wave of optimism.

For investors, the key takeaway is diversification. Staying too concentrated in U.S. stocks could be riskier than in past years. It may be time to look beyond the U.S. and explore global opportunities.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)