Is U.S. exceptionalism fading? The warning signs investors can’t ignore

Charu Chanana

Chief Investment Strategist

Key points:

- U.S. growth drivers are weakening: Fiscal spending is tightening, the AI boom faces competition from China, and the Fed is hesitant to cut rates aggressively, all of which could slow U.S. economic momentum.

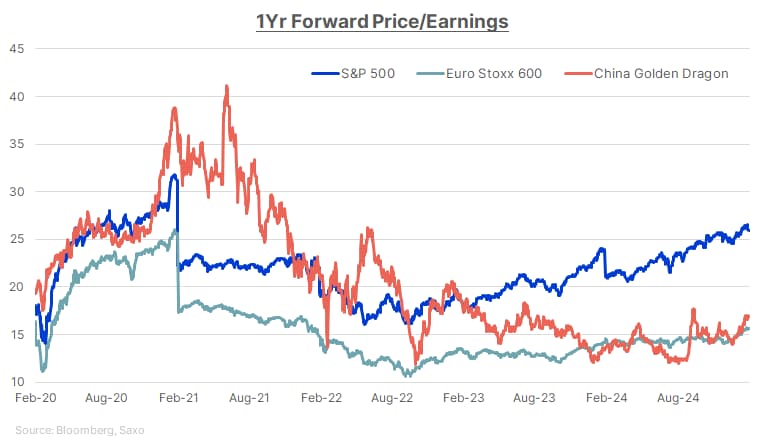

- U.S. stock valuations look stretched: The S&P 500 trades at a 22x P/E, far higher than Europe (15x) and China (17x), leading investors to rotate into cheaper international markets with growth potential.

- Global markets are gaining appeal: Investors are diversifying away from the U.S. Europe benefits from expected fiscal spending and rate cuts, while China is attracting interest due to AI innovation and government stimulus.

For years, the U.S. has been the undisputed leader of global markets, fueled by aggressive fiscal spending, tech dominance, and a strong consumer. But cracks are starting to show. Investors are increasingly looking overseas as concerns mount over U.S. stock valuations, monetary policy, and economic uncertainty.

1. Economic data is flashing caution

Recent data points suggest the U.S. economy may be losing momentum:

- Business activity reported by S&P Global on Friday was at a 17-month low, as firms worry about tariffs and federal spending cuts. This was the latest in a string of surveys suggesting that businesses and consumers were becoming increasingly rattled by the Trump administration's policies.

- Consumer sentiment has dropped sharply, with the University of Michigan’s index hitting its lowest level since November 2023.

- Long-term inflation expectations have surged to 3.5%, the highest since 1995, suggesting that the Fed may remain cautious on further easing despite activity indicators starting to signal a weak outlook.

Meanwhile, retail giant Walmart warned about cautious consumer behavior, reinforcing concerns about a slowdown in discretionary spending.

2. Fiscal spending: From turbocharged to tapering

For much of the past few years, U.S. economic growth has been supercharged by government spending. Whether it was pandemic stimulus, infrastructure projects, or incentives for green energy and semiconductors, fiscal expansion helped keep the economy strong.Now, the tide is turning. With the budget deficit ballooning, Washington is under pressure to rein in spending. Proposals to slash federal expenditures by up to $2 trillion could weigh on economic growth, with sectors reliant on government contracts and subsidies, such as defense, healthcare, and green energy feeling the pinch.

And while tax cuts could help consumers, it’s not clear they’ll fully offset the pullback in government outlays. The risk is that less fiscal support could slow GDP growth and corporate earnings momentum.

3. The Fed: Not rushing to cut

Despite market hopes for aggressive rate cuts, the Federal Reserve is staying cautious. Inflation is still sticky, and policymakers don’t want to risk cutting too soon, reigniting price pressures.

This has major implications:

- Higher for longer rates could put pressure on high-growth, high-valuation tech stocks, which thrive in low-rate environments.

- Slower consumer spending could emerge as borrowing remains expensive, affecting housing, autos, and discretionary sectors.

4. Big tech: The AI trade faces competition

For the past two years, AI enthusiasm has driven massive gains in U.S. tech stocks, sending the S&P 500 and Nasdaq to record highs. But could the AI boom be shifting overseas?

China’s DeepSeek, a rising AI startup, has gained investor attention, signaling that U.S. tech may not have a monopoly on AI innovation. At the same time, European regulators are scrutinizing U.S. tech giants more aggressively, raising concerns about fines, restrictions, and potential business model disruptions.

If global investors start questioning the extreme valuations of the “Magnificent Seven” (Apple, Microsoft, Nvidia, Amazon, Meta, Google, Tesla), they may rotate into cheaper markets. And that’s exactly what seems to be happening.

5. U.S. stock valuations: Too pricey?

The U.S. market has enjoyed a massive run-up, but that’s also made it expensive. The S&P 500 now trades at a forward price-to-earnings (P/E) ratio of 22x, well above its historical average of 16x. In contrast:

- Europe’s Stoxx 600 trades at just 15x earnings, making it significantly cheaper.

- China’s Golden Dragon Index (which tracks U.S.-listed Chinese firms) has a P/E ratio of 17x, still lower than the S&P 500.

The valuation gap is driving money flows. Investors are increasingly looking for opportunities in international markets where stocks have lagged in recent years but now look relatively attractive.

6. Europe & China: Where the money is going

With the U.S. market feeling stretched, investors are diversifying. Here’s what’s driving international interest:

Europe: Valuations, fiscal spending & rate cuts

- Stocks remain relatively cheap, offering better value than U.S. equities.

- The European Central Bank (ECB) is expected to be more aggressive in easing than the Fed, which could support economic growth.

- A potential Ukraine ceasefire could boost sentiment, particularly for European defense and energy companies.

- Germany’s Feb 23 election has resulted in the opposition bloc CDU/CSU getting about 29% of votes, and they should be able to find partners to form a coalition. This would likely bring scope for Germany, the largest economy in the Eurozone, to ditch its fiscal conservatism and boost spending on key sectors such as defence, infrastructure and rebuilding of Ukraine.

China: AI & policy support

- The Chinese government is ramping up stimulus to boost growth.

- DeepSeek’s AI emergence has drawn investor attention, suggesting China is still a player in the AI race. DeepSeek’s open-source model opens up the scope for faster AI monetization by Chinese companies.

- Valuations are still attractive, and the market is in the early stages of rebounding from a multi-year downturn.

The Bottom Line

U.S. exceptionalism isn’t dead, but it’s facing serious challenges.

With fiscal spending slowing, tech leadership being questioned, high stock valuations, and cautious economic signals, investors are looking elsewhere. Europe and China are emerging as viable alternatives, benefiting from lower valuations, policy shifts, and a fresh wave of optimism.

For investors, the key takeaway is diversification. Staying too concentrated in U.S. stocks could be riskier than in past years. It may be time to look beyond the U.S. and explore global opportunities.