Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Chief Investment Strategist

For years, the U.S. has been the undisputed leader of global markets, fueled by aggressive fiscal spending, tech dominance, and a strong consumer. But cracks are starting to show. Investors are increasingly looking overseas as concerns mount over U.S. stock valuations, monetary policy, and economic uncertainty.

Recent data points suggest the U.S. economy may be losing momentum:

Meanwhile, retail giant Walmart warned about cautious consumer behavior, reinforcing concerns about a slowdown in discretionary spending.

2. Fiscal spending: From turbocharged to tapering

For much of the past few years, U.S. economic growth has been supercharged by government spending. Whether it was pandemic stimulus, infrastructure projects, or incentives for green energy and semiconductors, fiscal expansion helped keep the economy strong.Despite market hopes for aggressive rate cuts, the Federal Reserve is staying cautious. Inflation is still sticky, and policymakers don’t want to risk cutting too soon, reigniting price pressures.

This has major implications:

For the past two years, AI enthusiasm has driven massive gains in U.S. tech stocks, sending the S&P 500 and Nasdaq to record highs. But could the AI boom be shifting overseas?

China’s DeepSeek, a rising AI startup, has gained investor attention, signaling that U.S. tech may not have a monopoly on AI innovation. At the same time, European regulators are scrutinizing U.S. tech giants more aggressively, raising concerns about fines, restrictions, and potential business model disruptions.

If global investors start questioning the extreme valuations of the “Magnificent Seven” (Apple, Microsoft, Nvidia, Amazon, Meta, Google, Tesla), they may rotate into cheaper markets. And that’s exactly what seems to be happening.

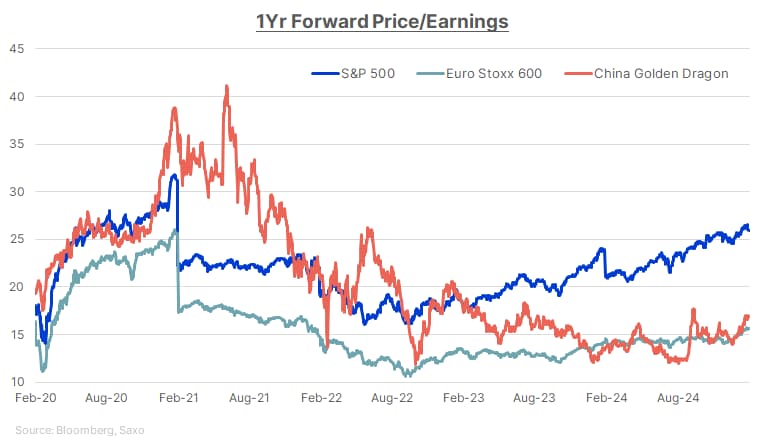

The U.S. market has enjoyed a massive run-up, but that’s also made it expensive. The S&P 500 now trades at a forward price-to-earnings (P/E) ratio of 22x, well above its historical average of 16x. In contrast:

The valuation gap is driving money flows. Investors are increasingly looking for opportunities in international markets where stocks have lagged in recent years but now look relatively attractive.

U.S. exceptionalism isn’t dead, but it’s facing serious challenges.

With fiscal spending slowing, tech leadership being questioned, high stock valuations, and cautious economic signals, investors are looking elsewhere. Europe and China are emerging as viable alternatives, benefiting from lower valuations, policy shifts, and a fresh wave of optimism.

For investors, the key takeaway is diversification. Staying too concentrated in U.S. stocks could be riskier than in past years. It may be time to look beyond the U.S. and explore global opportunities.