口座開設は無料。オンラインで簡単にお申し込みいただけます。

最短3分で入力完了!

債券戦略責任者

サマリー: - FOMCの前には、3年物、10年物、30年物の入札に向けたCPIデータが注目される。火曜日には、ディスインフレ傾向の中でのデュレーションに対する需要が試される。

- 金利は5.25~5.5%に据え置かれる可能性が高い。それでも、米連邦準備制度理事会(FRB)の経済予測サマリー(SEP)とドット・プロットの修正が重要な焦点となる。

- ディスインフレ傾向の加速により成長率が上方修正されれば、ソフトランディングへの思惑がさらに強まる可能性があるが、2024年に5回の利下げを実施するという市場の予想も揺らぐことになる。

- ドットプロットが下方修正され、予想インフレ率も低下すれば、最近の債券ラリーは固まるだろう。

- 今後数カ月、連邦準備制度理事会(FRB)は現在の債券の将来バリュエーションを正当化するため、利下げに向けて迅速に動く必要があるが、それが実現する可能性は低く、利回りに上昇圧力がかかるだろう。

- 財政支出が下支えされるなか、大幅な先制利下げは考えにくいと思われる。

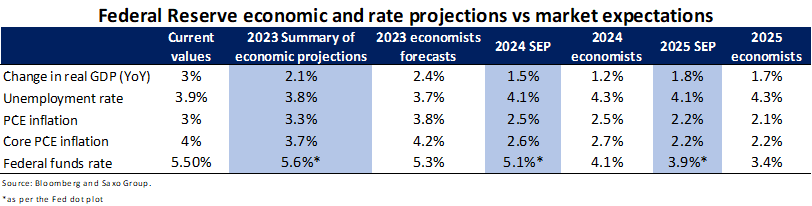

Markets are pricing 125 basis points rate cuts by the end of next year as investors are fast to claim that inflation is dead. However, the FOMC September dot plot shows that policymakers expect to cut rates only twice next year, making the divergence between markets and the Federal Reserve's projections the perfect volatility cocktail.

Despite such a dramatic divergence in rate cut expectations, economists are somewhat aligned with the FOMC summary of economic projections (SEP) for the next few years. Indeed, core PCE is expected by the end of next year at 2.7% by economists surveyed by Bloomberg and at 2.6% by the SEP. Similarly, real growth and the unemployment rate are expected at 1.5% and 4.1% according to SEP and around 1.2% and 4.3% by economists.

Yet, the Fed might be looking to update some of those projections. In October, the core PCE price index was up 3.5% YoY, well below the 3.7% the Fed estimated to end the year with. At the same time, the October unemployment rate has risen to 3.9%, well above the unemployment rate expected by the central bank at the end of 2023.

That should lead the Fed to revise inflation down and unemployment up, agreeing with markets' view that there is no reason to hike any further, fueling discussions concerning when interest rate cuts will begin and by how much.

Yet, it’s uncertain what the SEP will show in terms of real growth projections. Seeing a faster disinflationary trend than anticipated might lead to an upward revision in growth, fueling speculations of a soft landing. That might be enough to put at odds market expectations of five rate cuts next year, besides the dot plot.

The FOMC dot plot will be the market's big focus. The median rate cuts expected for next year and 2025 will likely shift further down. However, considering that in September, only five members were showing a rate of 4.625% or below by Q4 2024, it is unlikely that we are going to see other members lowering their expectations below that threshold, making the Q4 2024 median rate more likely to remain between 4.8% to 5%.

Although the gap between policymakers and bond future markets' expectations of rate cuts will remain wide, a lower dot plot combined with lower projected price pressures will likely consolidate the recent bond rally.

The real challenge for bond markets will come in the next couple of months when central banks need to move towards cuts quickly to justify current bond future valuations.

Central banks are unlikely to deliver aggressive rate cuts pre-emptively for the following reasons:

That’s why, as central banks have fought to significantly tighten the economy amid a dangerously high wave of inflation, they will only move once they have the certainty of having fixed this problem. Otherwise, they risk entering stagflation, a period of high inflation and high unemployment, which is a much more challenging scenario to deal with, especially during an election year.

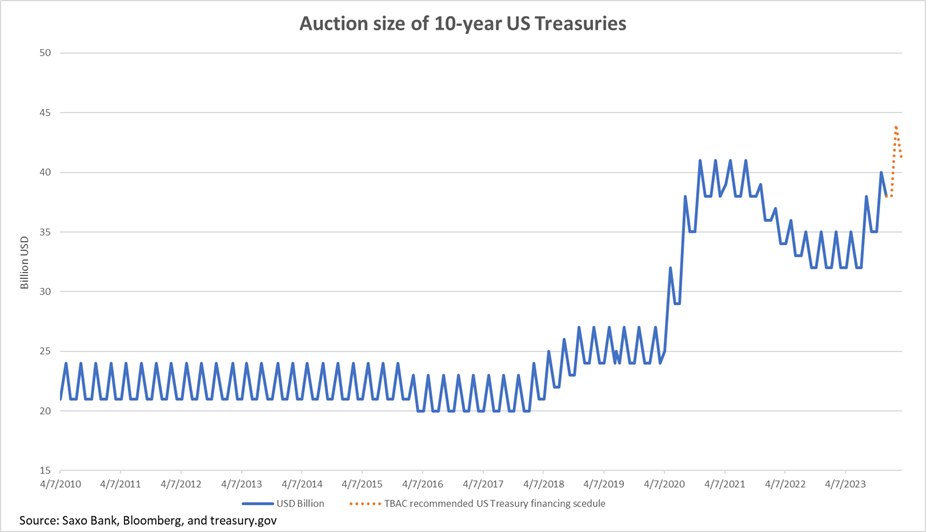

Next week is not going to be all about the Fed. Markets will have to weather a double auction on Monday, with the US Treasury selling three- and ten-year US Treasury, a thirty-year auction, and CPI numbers on Tuesday.

The 10- and 30-year US Treasury auctions will be the main focus, as after the dramatic drop in yields, buying longer-term bonds has become most expensive since September. After witnessing an ugly 30-year US Treasury auction last month with primary dealers taking 24.7% of the issue, the largest share since November 2021, the question is whether investors will step in this time when the yield on the 30-year tenor is roughly 50bps lower than last month. Weak bidding metrics in the 30-year tenor might reignite the bear steepening of the yield curve.

To set the grounds ahead of the 30-year auction is a new set of US CPI data. While the headline CPI is expected to have dropped to 3.1% YoY in November from 3.2% in October, Core CPI is expected to have remained flat at 4%. While it is true that if numbers show a faster disinflationary trend that would be bullish for bonds, it's key to bear in mind that it is more likely for an auction to tail if a considerable drop in yields precedes it. Yet, the magnitude of such a tail will dictate whether investors see it or not as a sign of fiscal dominance, as well as the constraints that the US Treasury has in raising additional new debt in markets. Let's remember that the US Treasury was meant to sell $38 billion in 10-year notes and $22 billion in 30-year bonds next week, according to suggestions from the Treasury Borrowing Advisory Committee TBAC. Yet, due to weaker bidding metrics, the Treasury has decided to play it safe and sell $1 billion less than what was suggested.

Suppose the US Treasury happens to follow the suggested increases in US Treasury notes and bond issuance in the first quarter of 2024. In that case, the auction size will rise to a record high, even above what markets used to absorb amid the COVID pandemic when quantitative easing (QE) was a supportive force for markets.