大胆予測

キャリートレードの巻き戻しでUSD/JPYが100を下回り、日本に次なる資産バブルが到来

チャル・チャナナ

チーフ・インベストメント・ストラテジスト

債券戦略責任者

サマリー: 連邦準備制度理事会(FRB)が当面、積極的な利下げを行う必要がないと市場に信じ込ませることができる限り、長期利回りの高騰は続くだろう。とはいえ、最近の利回り上昇の激しさは、週明けの政府閉鎖に伴う調整を求めている。その前に、木曜日に行われる7年物入札に注目したい。7年物は一般的に投資家に嫌われる年限であるため、債券売りが加速する可能性があるが、投資家の需要が強いことが証明されれば、利回り上昇に一時的に歯止めがかかる可能性もある。債券が暴落を続ける中、米国債ベンチマークは、景気後退のリスクから守りながら、過去10年以上で最も高い利回りを支払っており、より魅力的になっている。超長期債も魅力的なリスク・リワード・レシオを提供するが、デュレーションについては引き続き慎重であり、イールド・カーブの前部を選好する。

年債、5年債、7年債の入札額は1,340億ドルに達し、長期国債に対する圧力が取り除かれるか、あるいは一段と強まる可能性がある。

長期債の入札規模が拡大する中で、需要が引き続き底堅いかどうかを見極めることが重要である。2022年の16.8%に比べ、2023年は13.4%しか間接入札が行われず、外国人投資家の需要が大幅に減少しているため、20年債とともに最も好まれない年限の一つである7年債に対する投資家の意欲が特に重要になる。8月の7年物入札では、失望した外国人入札者の需要を国内バイヤーが救った。とはいえ、国内需要も減退すれば、投資家はイールド・カーブのさらなるベア・スティープニングに備え、より高いターム・プレミアムを要求していることになるかもしれない。逆に、イールドカーブ中央への物色意欲が高まれば、先週のFOMC後に起きた債券売りに一時的な終止符が打たれ、投資家がブル・スティープニングのポジションを取り始めていることを意味するかもしれない。

政府機関の閉鎖が経済成長の足を引っ張り、失業率を押し上げるのは必至だ。シャットダウンが長引けば長引くほど、経済の深刻度は増す。経済情勢が急速に悪化すれば、11月1日の連邦準備制度理事会(FRB)の会合に向けて不透明な経済環境が生まれ、政策決定者は再利上げを実施するのではなく、金利を据え置くことを余儀なくされるかもしれない。というのも、中央銀行が利上げサイクルを最終的に終了したことを示唆し、イールドカーブのブル・スティープニングを誘発するからだ。

同時に、S&Pとフィッチがすでに安全資産としてAA+の格付けを付与していることを考えると、ムーディーズの格下げは市場によってすぐに受け入れられるかもしれない。AaaからAa1への格下げは、他の2つの格付け会社の評価を強めるだろう。

長期債をどれくらいの期間保有したいかは、あなたの市場観による。長期投資家であれば、利回りがピークに達するにつれてデュレーション・エクスポージャーを徐々に増やしていくことが理にかなっているかもしれない。10年物米国債(US91282CHT18)の修正デュレーションは約8%である。しかし、これらの証券を1年間保有し、利回りが100bps上昇した場合、このポジションの総損失は-2.5%になる。利益が100bps下がれば、トータル・リターンは12%となる。金利がピークに達しようとしていると仮定すれば、利回りが上昇するにつれて、安全資産のリスク・リターンはより魅力的になります。

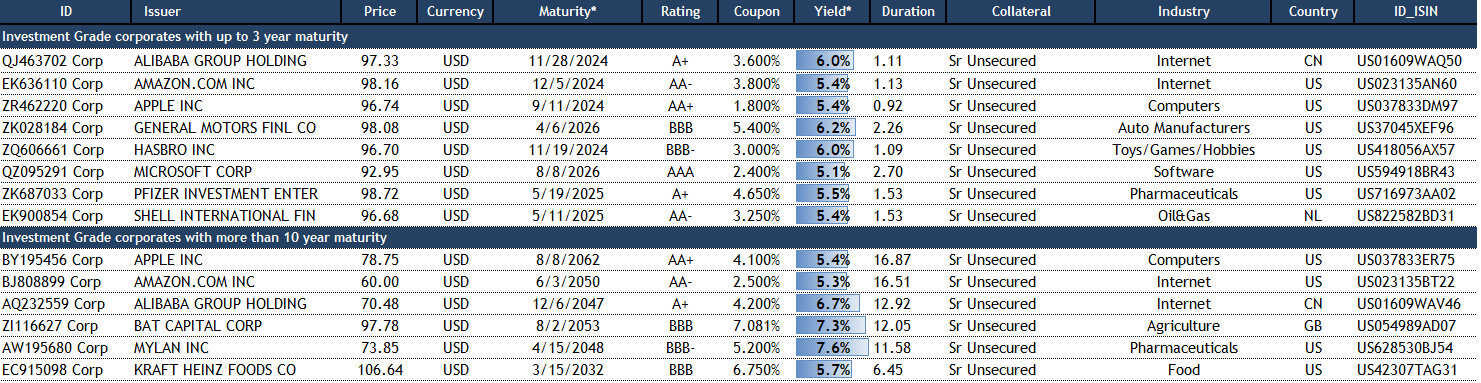

社債を見るなら、ハイ・イールド債よりも優良債を選ぼう。投資適格社債で最も利回りが高いのは、イールド・カーブの前部と延長部分であるため、投資家はバーベルを作るとよいだろう。以下は、格付けの高い短期および長期の米ドル社債の例である。

Summary: Long-term yields are likely to continue to soar for as long as the Federal Reserve can convince markets it won't need to cut rates aggressively in the foreseeable future. Yet, the intensity of the recent rise in yields calls for a correction, which may come with a government shutdown at the end of the week. Before that, our focus is on the seven-year auction on Thursday, a tenor typically disliked by investors, which could accelerate the bond selloff but may also temporarily halt the rise in yields if investors' demand proves strong. As bonds continue to tumble, the US Treasury benchmark becomes more appealing, paying the highest yield in over a decade while protecting against the risk of a recession. While ultra-long bonds also provide an attractive risk-reward ratio, we remain cautious about duration and prefer the front part of the yield curve.

The intense selloff in long-term US Treasuries comes on the back of last week's FOMC meeting. The market realizes that the "higher-for-longer" message sets a reference point for the whole US Treasury yield curve. Suppose the Fed's economic projections are correct in showing that the economy will remain resilient, unemployment will stay well below the 2010/20-decade average, and inflation will gradually decrease. In that case, there is no reason for the Fed to cut rates aggressively as the market would expect amid a recession. Hence, the 10-year yields will need to price over a much higher expected Fed fund rate.

After the SVB debacle in March, 3-months SOFR futures were pricing rates to fall to 2.7% by the end of 2024. Investors now see the Fed cutting rates only to 4% in the next three years, building a much higher floor for 10-year US Treasury yields, which need to provide a premium above this level. Therefore, the recent move of 10-year yields breaking above 4.5% is justified. The question is whether yields will rise to test 5% and break further up or stabilize below, trading rangebound for a while. Although it's impossible to answer this question accurately, we can look at technical analysis to gauge the intensity of the current momentum to understand better how long it may last. The RSI has been slightly declining while the 10-year yield uptrend continued, indicating that the uptrend is weakening and a slight correction might be due. Therefore, it's fair to expect yields to test support at 4.42% in the short term before resuming their rise and setting above 4.5%, trading rangebound for some time. How high yields can rise above this level depends on how long the economy allows the Fed to keep its hawkish posture. If the signs of a shallow recession don't appear before the end of the year, yields might continue to rise towards 5%. Yet, if economic data get increasingly mixed, it would be fair to see yields trading rangebound well below this level.

The $134 billion auction of two, five, and seven-year notes may remove or apply further pressure on long-term Treasuries.

Understanding whether demand remains resilient as auction sizes have increased across longer tenors will be critical. Investors’ appetite for the 7-year notes, one of the least liked tenors together with the 20-year, will be particularly important as foreign investor demand has dropped significantly this year, with indirect bidders taking only 13.4% of the issue in 2023 compared to 16.8% in 2022. At the August 7-year auction, domestic buyers came to the rescue of disappointing foreign bidders' demand. Still, if domestic demand wanes too, it may mean that investors are positioning for a further bear-steepening of the yield curve, demanding a higher term premium. On the contrary, if the appetite for the belly of the yield curve increases, it may imply that investors are beginning to position for a bull-steepening, putting a temporary ending to the bond selloff that has taken place after last week's FOMC meeting.

Contrary to what many believe, a potential government shutdown and downgrade from Moody's may cause US Treasuries to rally rather than plunge.

A government shutdown will inevitably be a drag on economic growth and will push the unemployment rate up. The longer the shutdown, the greater the severity on the economy. A quick deterioration of the economic backdrop might create an uncertain economic environment for the Federal Reserve’s November 1st meeting, forcing the hand of policymakers to hold rates steady rather than delivering another hike. That will send a positive signal to the bond market as another pause implies that the central bank is finally done with its hiking cycle, provoking a bull steepening of the yield curve.

At the same time, considering that S&P and Fitch have already assigned an AA+ rating to the safe-haven, a downgrade from Moody's might be shrugged off by markets reasonably quickly. A downgrade from Aaa to Aa1 would reinforce the valuations of the other two rating agencies.

It depends on your market view and how long you want to hold these securities. If you are a long-term investor, it may make sense to increase duration exposure gradually as yields peak. The modified duration of 10-year US Treasuries (US91282CHT18) is around 8%. Yet, if these securities are held for a year, and meanwhile yields rise by 100bps, the total loss of this position would be -2.5%. If yields drop by 100bps, the total return would be 12%. Assuming that rates are about to peak, the risk-reward profile of the safe haven becomes more appealing as yields soar.

When looking at corporate bonds, we prefer quality over junk. As the highest yields in the investment grade corporate bond space are paid in the front and long part of the yield curve, investors might be interested in creating a barbell. Below is an example of well-rated short and long-term USD corporate bonds.